The Deflationary Effects of the Crashing Stock Market Kress Cycle

Stock-Markets / Cycles Analysis Mar 06, 2014 - 06:44 PM GMTBy: Clif_Droke

Stocks came under selling pressure on Monday in the wake of renewed concerns over geopolitical instability in Eastern Europe. An escalation of tension between Russia and the Ukraine led to a plunge in Russia’s stock market, which in turn had a spillover effect on U.S. equities.

Stocks came under selling pressure on Monday in the wake of renewed concerns over geopolitical instability in Eastern Europe. An escalation of tension between Russia and the Ukraine led to a plunge in Russia’s stock market, which in turn had a spillover effect on U.S. equities.

Russia is currently the focus of Wall Street’s worries right now. One of the better proxies for Russia’s stock market is the Market Vectors Russia ETF Trust (RSX), which lost nearly 7% in value on Monday. RSX made a 4-year low today which underscores the political and economic troubles facing that region of the globe.

Aside from the potential spillover impact of Russia’s stock market decline, an even bigger concern as we head into spring is China’s stock market. The iShares China Large Cap ETF (FXI), our favorite China proxy, is struggling to get back above its 50-day moving average. It’s also dangerously close to its recent low from early February. A violation of the February low would almost certainly touch off another wave of investor concern over China’s economic outlook and could have spillover impact on U.S. equities later this year after the melt-up phase of the bull market is complete. There has been an historical correlation between FXI and the S&P in recent years, with China stock weakness leading to U.S. market weakness more often than not.

Meanwhile the rush into the safe havens continues unabated as investors are clearly concerned over the developing overseas market and political woes. The iShares 20+ Year Treasury Bond ETF (TLT), our bond proxy, continues trending higher and recently tested its previously high from Feb. 3 when investor fear was spiking. Gold meanwhile also continues its recent surge and made another new high for the year on Mar. 3, as seen in the SPDR Gold Trust ETF (GLD) below.

Both of these financial safe haven assets are proof of not only investor fears, but they also reflect to a certain degree the deflationary undercurrent that is accelerating between now and later this year when the long-term Kress cycles are scheduled to bottom. The Fed and other economists have convinced themselves that deflation has been defeated, yet the deflationary threat remains until the last of the cycles comprising the 120-year Kress cycle series bottoms in the coming months.

Russia’s crashing stock market is in many ways similar to the tumultuous events of the summer of 1998, which witnessed an outbreak of deflationary pressure in commodities. It began early that year with weakness in Asian economies and was accelerated by the Russian ruble crisis. By the summer of ’98 those troubles were brought to bear on the U.S. financial market. In only a matter of weeks, a record high in the Dow was transformed into the shortest bear market on record – a 22% plunge in the S&P over a period of just a few weeks. Of course the bear market bottomed in October and by year’s end the major U.S. indices were heading back toward their old highs. But the lesson learned in that event is that deflation-driven bear markets can occur swiftly and suddenly, even when everything looks rosy. Keep in mind also that the U.S. economy was experiencing a powerful bull market in its own right at that time, which reminds us that the state of the economy can’t be used as a leading indicator when it comes to the stock market.

The 1998 experience, and more recently the Russian crisis, also reminds us how swiftly deflationary undercurrents in the global economy can lead to major trouble. It pays to keep on your toes during the final year of the long-term deflationary cycle, and stock picking and market timing are absolutely essential. A good money management strategy (i.e. a stop-loss discipline) is also a must in the event of a rapid reversal of trend.

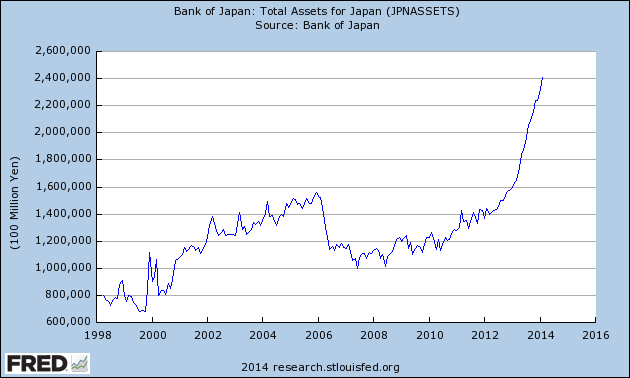

To give you another idea of just how potent the deflationary phase of the 120-year Kress cycle is, look no further than Japan.

Japan’s Nikkei stock index peaked in 1989 and the country entered a bear market and deflationary depression lasting some 20 years. Only in the last year or so has inflation finally shown signs of life after a record-breaking amount of liquidity created by the Bank of Japan. Shinzo Abe, the architect of Japan’s re-inflationary monetary policy, has thrown everything but the kitchen sink at the country’s economy in hopes of fighting deflation. As it stands the efforts have been only mildly successful by historical standards; indeed, Japan’s inflation rate is up only 1.4% from last year despite a 56% year-over-year increase in the monetary base.

As economist Ed Yardeni pointed out in a recent blog posting, Japan’s core Consumer Price Index (CPI) inflation rate has been positive for the past four months through January, when it was 0.6%. “That’s still awfully low,” he writes, “but it beats the 55 consecutive months of negative readings from January 2009 through July 2013.”

When it takes this much money creation (see chart below) just to put a floor on deflation, you know the deflationary cycles are still coming down hard.

Kress Cycles

Cycle analysis is essential to successful long-term financial planning. While stock selection begins with fundamental analysis and technical analysis is crucial for short-term market timing, cycles provide the context for the market’s intermediate- and longer-term trends.

While cycles are important, having the right set of cycles is absolutely critical to an investor’s success. They can make all the difference between a winning year and a losing one. One of the best cycle methods for capturing stock market turning points is the set of weekly and yearly rhythms known as the Kress cycles. This series of weekly cycles has been used with excellent long-term results for over 20 years after having been perfected by the late Samuel J. Kress.

In my latest book “Kress Cycles,” the third and final installment in the series, I explain the weekly cycles which are paramount to understanding Kress cycle methodology. Never before have the weekly cycles been revealed which Mr. Kress himself used to great effect in trading the SPX and OEX. If you have ever wanted to learn the Kress cycles in their entirety, now is your chance. The book is now available for sale at:

http://www.clifdroke.com/books/kresscycles.html

Order today to receive your autographed copy along with a free booklet on the best strategies for momentum trading. Also receive a FREE 1-month trial subscription to the Momentum Strategies Report newsletter.

By Clif Droke

www.clifdroke.com

Clif Droke is the editor of the daily Gold & Silver Stock Report. Published daily since 2002, the report provides forecasts and analysis of the leading gold, silver, uranium and energy stocks from a short-term technical standpoint. He is also the author of numerous books, including 'How to Read Chart Patterns for Greater Profits.' For more information visit www.clifdroke.com

Clif Droke Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.