A World of Manipulated Markets

Stock-Markets / Market Manipulation Feb 24, 2014 - 12:18 PM GMTBy: James_Turk

“There are no markets anymore, just interventions.” — Chris Powell, Gold Anti-Trust Action Committee

“There are no markets anymore, just interventions.” — Chris Powell, Gold Anti-Trust Action Committee

Once upon a time, a handful of countries sometimes described as “capitalist” claimed to operate on the principal that consenting adults should be free to buy, sell, build and consume what they wanted, with little interference or guidance from the authorities. The idea, derived from Adam Smith’s 1776 classic Wealth of Nations, was that all of these self-interested actions would in the aggregate form an “invisible hand” capable of guiding society towards the greatest good for the greatest number of people. Coincidentally, the political framework for such a society was envisioned the same year on the other side of the Atlantic, when Thomas Jefferson penned in the American Declaration of Independence that in addition to life and liberty, there was a third inalienable right for every individual – the pursuit of happiness. The resulting “market-based” societies were messy but brilliant, producing more progress in two centuries than in the previous 50.

But those days are long gone. After four decades of unrestrained borrowing, the developed world is in a constant state of near-collapse and governments everywhere feel compelled (or perhaps liberated) to tinker with markets, sometimes overtly and sometimes secretly, but of late with an increasingly heavy hand. The system that is evolving does not yet have a modern name but certainly looks like the central planning that failed so miserably for the Soviet Union and Social Democratic Europe in decades past. What follows is a brief overview of the manipulations that now dominate the global economy.

Artificially-low interest rates. Interest rates are, in effect, the price of money and as such they’re a crucial signal to virtually everyone in every market. When rates are high, that’s an incentive to save, because the resulting yield is attractive. Low rates, meanwhile, are a signal that money is cheap and borrowing is potentially more profitable than saving.

Prior to the World War II interest rates were set mostly by supply and demand. When there were lots of productive uses for a limited supply of money, demand for it went up and interest rates rose, and vice versa. Market participants had a fair idea of what the economy was asking for and government generally let them respond to these signals. (The term “laissez faire,” French for “let [them] do,” is aptly used to describe this version of capitalism.)

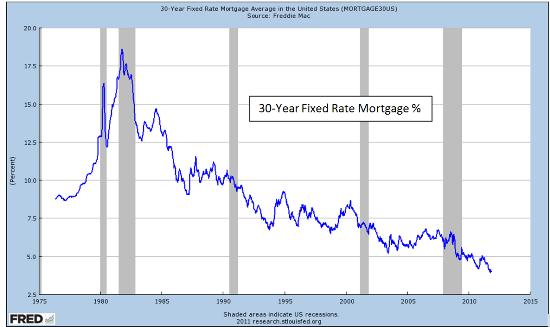

When the Fed began playing a bigger role in the economy in the 1950s and 60s, it chose as its main policy tool the Fed Funds Rate, the rate at which it lent short-term money to banks. Long-term interest rates (i.e., the bond market) remained free to fluctuate according to the supply and demand for loans. But following the crisis of 2008 the Fed and other central banks expanded their focus from short-term rates to all rates, including long-term. Today, the Fed intervenes aggressively “across the yield curve,” pushing short rates down to zero and buying enough bonds to push long-term rates down to historically-low levels.

These interventions have preempted the market’s price-signaling mechanism, encouraging borrowing and speculation and discouraging saving…

Dishonest interest rates. While governments have been actively depressing rates, the world’s major banks have been manipulating the London Interbank Offered Rate (Libor) for their own ends. Libor is the reference rate for trillions of dollars of loans world-wide. And in a scandal that is still escalating as this is written in late 2013, it has been revealed that the banks responsible for setting this rate have been arbitrarily moving it around and then trading on the advance knowledge of the movement, enhancing their profits and yearend bonuses. Other banks lied about the rates at which they were borrowing to make them appear less fragile during the 2008 financial crisis, misleading market participants as well as government regulators. Meanwhile, many of the loans based on sham Libor rates disadvantaged the entity on one side of the transaction, costing, in the aggregate, hundreds of billions of dollars.

Artificially-high stock prices. Until very recently share prices, by general consensus, were set purely by market forces (though they were influenced somewhat by the Fed’s control of short term-interest rates and government tax and spending laws). Whether the market went up or down was not generally seen as a pressing policy matter for the federal government or central bank. Then in 1988 – presumably in response to the previous year’s flash-crash that had sliced about 30 percent from US stock prices in a single month – the Reagan Administration created the Working Group on Financial Markets to either prevent or manage such events in the future.

This shadowy organization came to be known as “Plunge Protection Team (PPT),” and is now thought by many to funnel government money into the market to boost share prices when it perceives the need. The origin of this idea goes back to 1989 when former Federal Reserve Board member Robert Heller told the Wall Street Journal that, “Instead of flooding the entire economy with liquidity, and thereby increasing the danger of inflation, the Fed could support the stock market directly by buying market averages in the futures market, thereby stabilizing the market as a whole.” In August 2005, Canadian hedge fund Sprott Asset Management released a report arguing that the PPT was indeed manipulating stock prices.

Cheap mortgages, inflated home prices. For most of the 20th century, homes were bought with either cash or 30-year, fixed-rate mortgages. And because long-term interest rates were not set by the Fed, the price of money with which to buy a house was determined by the market. But after the 2008 financial crisis, when the Fed began forcing down long-term rates, cheap mortgages and rising home prices became government policy objectives. The Fed now buys mortgage backed bonds in addition to government bonds, which both lowers mortgage rates and funnels money into the mortgage market, generally making home loans easier to obtain. Here again, rising home prices are just a means to a positive wealth effect, which it is hoped will induce more borrowing and spending. And individuals are signaled by the market to buy the biggest house possible using the most aggressive mortgage possible.

Suppressed gold price. We cover gold in much greater detail in Section IV, but for now suffice it to say that because the metal is a competing form of money, when it rises in dollar terms it makes the dollar and the dollar’s managers look bad. So for nearly two decades the US, along with several other governments and their central banks, has been systematically intervening in the gold market to push down its exchange rate to the dollar. They do this by covertly dumping central bank gold onto the market and instructing large commercial banks to sell huge numbers of gold futures contracts into thinly traded markets. Together, these secret machinations have held gold’s exchange rate far below where a free market would have taken it. Gold’s ability to signal market participants that inflation is rising and/or national currencies are being mismanaged is being short-circuited. As a result, market participants who might otherwise be converting those currencies into hard assets are not doing so.

All of the above. The Exchange Stabilization Fund (ESF) was established in 1934 to enable carte blanche market intervention by the federal government, outside of Congressional oversight. As Dr. Anna J. Schwartz, at the time a Distinguished Fellow of the American Economic Association, explained in a 1998 speech, “The ESF was conceived to operate in secrecy under the exclusive control of the Secretary of the Treasury, with the approval of the President, [quoting here from the 1934 legislation] ‘whose decisions shall be final and not subject to review by any other officer of the United States’.”

The ESF now functions as a “slush fund” available to the Treasury Department for wide-ranging, frequently-secret market interventions. It provides “stabilization” loans to foreign governments. It influences currency exchange rates – including that of gold. It was used to offer insurance to money market funds. Most recently it was drained to provide the government some breathing room during the late 2013 debt ceiling impasse. As for the stock market, well, why not? Perhaps the ESF is the real – or at least another – Plunge Protection Team.

Distorted Signals and Lost Trust What happens when market signals are distorted by the government? In a word, “malinvestment.” Factories are built that produce the wrong things, houses are bought that cost more than their owners can afford, bank CDs are cashed in to buy stocks just before a market correction, gold and other hard assets are converted to paper currency when they should be accumulated and held long-term. The market, in short, stops directing capital to its most productive uses and wealth creation grinds to a halt.

Along the way, people begin to notice that the markets they thought were more-or-less honest are being secretly manipulated for the benefit of others, and trust begins to erode. The next chapter explains what happens then.

This is excerpted from The Money Bubble, by James Turk and John Rubino

By James Turk

© 2014 Copyright James Turk- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.