These Gold Charts Will Make Your Heart Beat Faster

Commodities / Gold and Silver 2014 Feb 20, 2014 - 04:54 AM GMTBy: Frank_Holmes

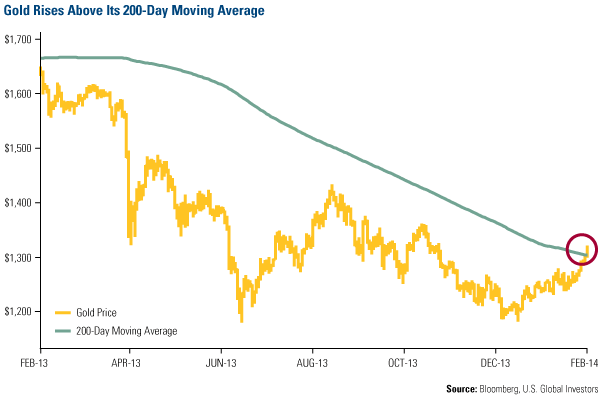

Gold lovers' hearts beat faster last week, as the metal rose above $1,300 an ounce for the first time since November. The precious metal also climbed above its 200-day moving average, which hasn't happened in about a year.

Gold lovers' hearts beat faster last week, as the metal rose above $1,300 an ounce for the first time since November. The precious metal also climbed above its 200-day moving average, which hasn't happened in about a year.

ISI's John Mendelson noted that the generic gold future "rallied off its mid-December low and has decisively broken out above its downtrend line connecting the descending tops from late August, a near-term positive." The next price he's targeting is $1,350, the price gold was at in late October.

So while gold may correct over the next several months as the metal enters its seasonally weak period of the year, this looks promising for gold investors.

Here are a few more gold charts that just might have your heart beating faster:

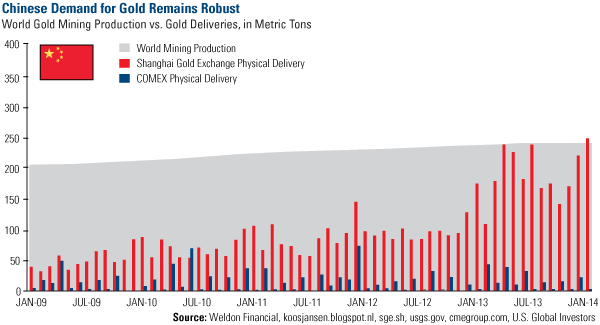

1. The Love Trade Endures in the East

In January, 246 tons of gold were withdrawn from the Shanghai Gold Exchange, as China continues expressing its love for the precious metal. This marks a record level of gold deliveries on the exchange as well as a significant increase over the same time last year.

In addition, you can see on the chart below that January's total also exceeds world mining production for the month.

As Ralph Aldis likes to say, "Once the metal moves from the West and goes into China, we won't get that gold back very easily."

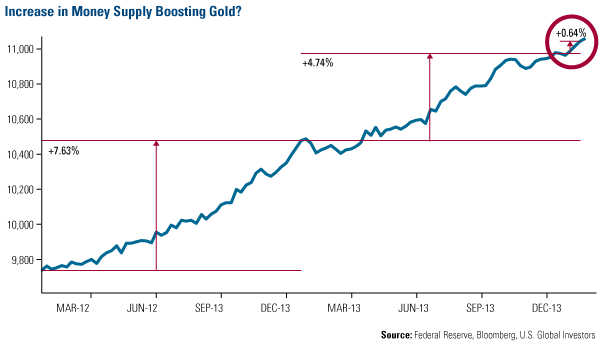

2. Money Supply Grew Faster in January

In the first month of 2014, the M2 money supply, which is a measure of money supply that includes cash, savings and checking deposits, grew faster than the previous two years. In 2012, M2 grew 7.6 percent and in 2013, money supply rose 4.7 percent; at an annualized rate, January's money supply growth "reached an annualized rate of increase of 8.75 percent," according to Bloomberg's Precious Metal Mining team.

This may mean "the U.S. Federal Reserve is trying to resurrect inflation, thus increasing the appeal of gold, the supply of which can only increase about 1.5 percent to 2.5 percent annually," says Bloomberg.

Last year, gold started to take it on the chin when the real rate of return went from a negative 0.62 percent in March to a positive 0.54 percent by December. Like I told Jim Goddard from HoweStreet, a positive real rate of return is typically a major headwind for gold.

Between March and December of 2013, two things happened: 1) Yields rose in anticipation that the Federal Reserve would begin tapering its bond purchases, and 2) the consumer price index declined. However, going forward, I anticipate that CPI will increase, and, given the modest economic growth we've been seeing in the U.S. economy, interest rates won't be able to rise too quickly.

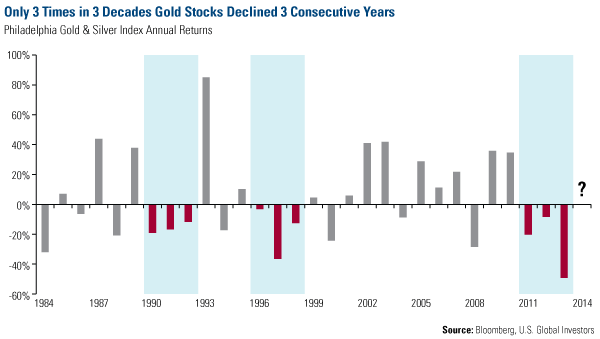

3. Gold Stocks Poised to Rebound After Rare 3-Year Loss

What I think is tremendously powerful for gold stock investors is this chart. At the beginning of January, we took a look back at the annual returns for the Philadelphia Gold & Silver Index. In three decades, there were only three times that gold stocks only saw a consecutive 3-year loss.

These aren't the only gold charts to love. See more in my latest presentation from the World Money Show.

Want to receive more commentaries like this one? Sign up to receive email updates from Frank Holmes and the rest of the U.S. Global Investors team, follow us on Twitter or like us on Facebook.

By Frank Holmes

CEO and Chief Investment Officer

U.S. Global Investors

U.S. Global Investors, Inc. is an investment management firm specializing in gold, natural resources, emerging markets and global infrastructure opportunities around the world. The company, headquartered in San Antonio, Texas, manages 13 no-load mutual funds in the U.S. Global Investors fund family, as well as funds for international clients.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.Standard deviation is a measure of the dispersion of a set of data from its mean. The more spread apart the data, the higher the deviation. Standard deviation is also known as historical volatility. All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies. The NYSE Arca Gold BUGS (Basket of Unhedged Gold Stocks) Index (HUI) is a modified equal dollar weighted index of companies involved in gold mining. The HUI Index was designed to provide significant exposure to near term movements in gold prices by including companies that do not hedge their gold production beyond 1.5 years. The MSCI Emerging Markets Index is a free float-adjusted market capitalization index that is designed to measure equity market performance in the global emerging markets. The U.S. Trade Weighted Dollar Index provides a general indication of the international value of the U.S. dollar.

Frank Holmes Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.