Relaxing U.S. Crude Oil Exports Ban is Bad News for Consumers

Commodities / Crude Oil Dec 26, 2013 - 10:11 AM GMTBy: EconMatters

US Energy Boom

US Energy Boom

The US is producing much more energy domestically the last decade in all forms from natural gas to crude oil with a myriad of boutique products along the way, and so it is natural for producers to want to maximize profits by expanding their marketplace.

Free Markets haven`t been Free for a long time

This would be the free market response, and that would be a great principle in theory, but nothing has been ‘free market’ in this country, and the world we live in for decades; that nostalgic business ideology has been replaced with corporate cronyism, powerful lobbying, state sponsored agendas, and closed door deal-making.

Petroleum Products versus Natural Gas

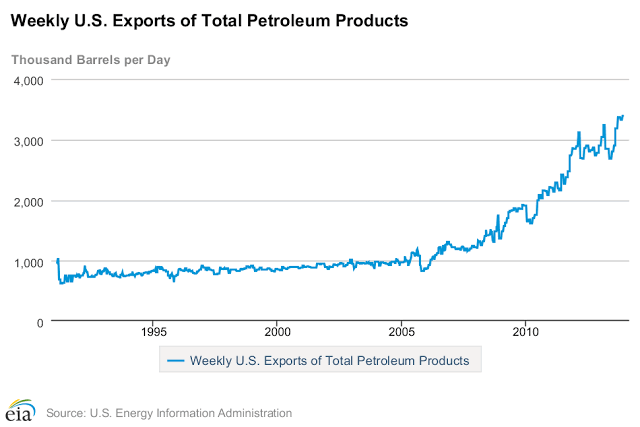

We have seen the inevitable outcome of any lifting of this ban by looking at the products markets, namely gasoline. There is an abundance of cheap domestic oil (would be a lot cheaper without excessive QE Stimulus & Artificial Demand created by refinery Exports of Products) but still domestic oil production, and oil production in North America is at multi-decade highs, and yet gasoline prices are at record highs for this time of the year, and this is after coming down considerably from earlier highs in 2013.

An Abundance of Natural Gas & Oil Subsidizing Gulf Coast Refiners

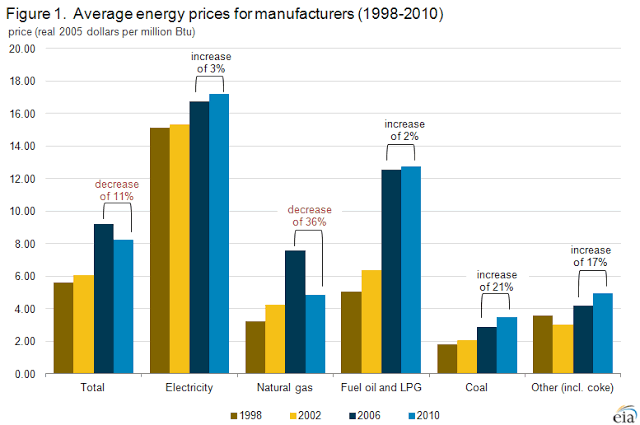

Why is this the case? It is because the highly profitable export market for end products like gasoline where refiners along the gulf coast have expanded capacity to take advantage of cheaper North American oil, and low natural gas prices that enabled lower petro manufacturing costs.

These cheaper input costs made US fuel and other derivative petroleum products very competitive on a global price basis which had the effect of higher prices for US consumers as supply markets were much tighter than they would have otherwise been without a robust export market during the last five years of this US Energy resurgence.

Lower Prices Good for US Economy

Natural Gas is the energy market that has helped domestic businesses and consumers with lower prices which has benefited the overall US economy, while the domestic oil market which should be helping US consumers and businesses more, is being pegged higher due to the exporting of products. This gets even worse for US Consumers and businesses if the Oil Export Ban is relaxed.

Somebody Wins, Somebody Loses

In effect, this results in the following scenario: US Consumers & Businesses pay higher prices, US Domestic Oil becomes more expensive due to widening the marketplace for exports, and Global Oil becomes cheaper for international consumers. This process just becomes a giant wealth transfer, another tax, a business subsidy from the US Consumer & Businesses that utilize domestic energy to foreigners and companies exporting said products to these international consumers.

Let`s just be consistent: Lift all Exporting Bans

While the government is at it let us just lift any Natural Gas bans on exporting, and just raise costs all along the energy input continuum for 2014. I am sure Dow Chemical will love this outcome and open up more manufacturing capacity here in the United States. Profits will be great for those who benefit from the aforementioned changes to energy export bans. But those business interests who rely on energy input for operations will be hurt from this legislative change, and so will US Consumers.

I am sure these same gulf coast petro-refiners will have no problem with also lifting the export bans on any natural gas products so that their manufacturing and operational costs will rise along with higher natural gas prices which will eat into their operating margins and thus transfer this wealth to the natural gas industry players.

Market Correlations & Paradigm Shifts

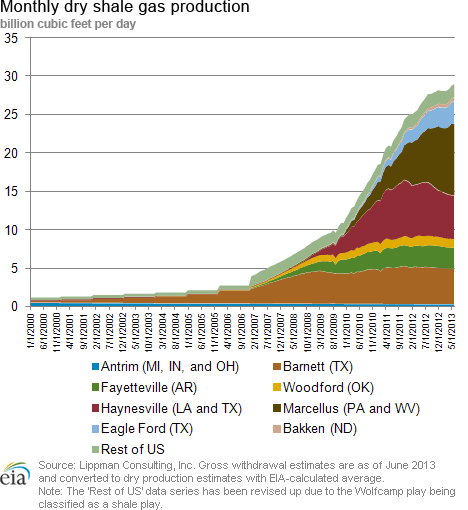

One can see the positive correlations in the charts between the increased production of domestic natural gas, thus leading to much lower input prices for refiners; and the takeoff in petroleum products exports from a pretty stable baseline previously , starting to gain steam around the 2005 to 2006 timeframe.

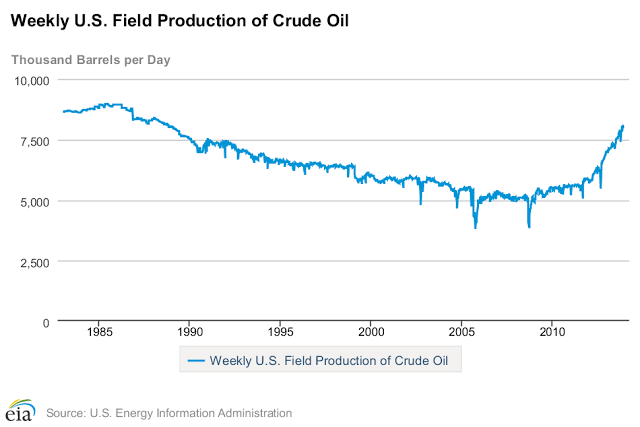

This export dynamic for petroleum products along with high oil prices relative to the economy due to QE Stimulus liquidity and potential Middle-East instability inflated commodities and oil specifically thus further incentivizing US Domestic Oil Production along with new and cheaper technological drilling techniques in the energy industry activating the rebound around 2010 for the increased Domestic Oil part of the equation.

This led to the Gulf Coast refiners expanding capacity and seeking cheaper transportation methods of this increased North American and Domestic Oil via pipelines, rail, and barges. The US domestic Oil production was the definite laggard in this US energy boom renaissance.

It will be interesting to see how this all plays out from a market standpoint, i.e., will US Domestic Oil production continue to trend higher without a robust export market like Natural Gas or will the recent trend reverse itself with production shutdowns in domestic Oil production projects?

Another interesting dynamic to watch is what price is needed for the marginal cost of production for these domestic oil producers? Some refiners close to the fields are currently paying $25 below the WTI price for Oil – this is telling in how inefficient and costly our oil transportation system currently is, and that the actual market price needed for oil projects is much lower than the rhetoric thrown around in the media.

When you factor in alternative opportunities for capital use, the oil industry has been quite attractive for investment over the last decade at these prices; that ought to tell you something given the contraction in most other industries.

Consequently what happens when the Oil production market gets too frothy relative to demand, and what happens if there is a major pullback in oil prices which has been built into many market intelligence scenarios at the big oil companies?

Moreover, would cheaper oil prices be all bad as this could lead to an improved economy both domestically and globally causing demand for consumption to rise thus soaking up some of these increased production gains of the last three years.

The energy markets will be fascinating to watch over the next ten years as the big players fight for production share and lucrative revenue streams on a global scale from Iran and Venezuela to the United States and Canada.

Self-Interests Problem & Power

If this comes down to a self-interest problem which it usually does then one would think that the vote would fall along the lines of a 2-1 constituency vote against lifting the export ban on these domestic energy resources, but US Consumers haven`t had a vote at the table for a long time.

It probably will come down to which corporate lobby is stronger, and has more sway with the politicians in the decision making process. If past history is any indication, consumers usually get taxed with higher prices in the end, so the exports ban probably has a bunch of complicated and opaque loopholes added that provide enough cover for the politicians, and increased profits for the oil exporters.

But the lobbyists better get going and influence the politicians on this issue ASAP because once the next presidential election comes around higher gas prices seem to matter a whole bunch to these same politicians - see Barack Obama during the last election cycle.

By EconMatters

The theory of quantum mechanics and Einstein’s theory of relativity (E=mc2) have taught us that matter (yin) and energy (yang) are inter-related and interdependent. This interconnectness of all things is the essense of the concept “yin-yang”, and Einstein’s fundamental equation: matter equals energy. The same theories may be applied to equities and commodity markets.

All things within the markets and macro-economy undergo constant change and transformation, and everything is interconnected. That’s why here at Economic Forecasts & Opinions, we focus on identifying the fundamental theories of cause and effect in the markets to help you achieve a great continuum of portfolio yin-yang equilibrium.

That's why, with a team of analysts, we at EconMatters focus on identifying the fundamental theories of cause and effect in the financial markets that matters to your portfolio.

© 2013 Copyright EconMatters - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

EconMatters Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.