Has the Long-term Kress Cycle Bottomed Early?

Stock-Markets / Cycles Analysis Dec 12, 2013 - 05:24 AM GMTBy: Clif_Droke

A reader asks, "I was wondering if it's possible that the long cycles, such as the 60-year cycle, have already bottomed early. Is that even a possibility within the scope of the cycles? It appears that the Fed has complete control of the markets right now. One cannot help but wonder how high they will drive the stock market, and how low they will drive the gold miners. It would seem that the imbalances are beginning to look a little conspicuous."

A reader asks, "I was wondering if it's possible that the long cycles, such as the 60-year cycle, have already bottomed early. Is that even a possibility within the scope of the cycles? It appears that the Fed has complete control of the markets right now. One cannot help but wonder how high they will drive the stock market, and how low they will drive the gold miners. It would seem that the imbalances are beginning to look a little conspicuous."

This is a question many investors are asking themselves right now, so let's delve into it.

It's important to note that the 60-year cycle that was referenced above is "fixed" as opposed to dynamic. This means that its bottom is absolute and can't be moved beyond its standard deviation of roughly 1-2 months. Therefore it hasn't bottomed yet and won't bottom until later next year, as per the norm of a yearly Kress cycle.

Now is it possible that the Fed's extraordinary stimulus efforts in recent years have mitigated the cycle? Yes it is. Historically the last 60-year bottom of 1954 saw a similar situation wherein the Great Depression of the preceding decades - and the U.S. government's response to it (namely war-time spending) - essentially ended the depression/bear market a few years before it normally would have ended under the Kress cycles.

It would be quite a stretch to assert the Fed has complete control of the market. Yes, it does exercise a rather large degree of control over equities through QE, but when you consider how historically "oversold" the market was in the wake of the 2008 crash the subsequent rally isn't surprising. A greater feat would be if the Fed could prevent another market "melt-up" from occurring. It's doubtful the central bank has the prescience to do this, so we may yet see a final sell-off before the 60-year cycle bottoms next year.

Just how bad is the economy?

A common refrain heard among pundits is that the Fed's QE stimulus program has done little, if anything, to boost the economy.

No one denies the extent to which QE has sent stock prices soaring in the last five years, yet in that same amount of time the domestic economy has made but scant progress. Or so goes the cliché. There is good reason for believing, however, that the economy has seen more internal improvement than critics would like to admit.

So just how much as QE helped the economy? A recent report by the McKinsey Global Institute, as mentioned in the Momentum Strategies Report, estimated that "unconventional monetary policies" such as asset purchases and low interest rates have reduced the unemployment rate by at least 1 percent and have prevented a deflationary spiral in the U.S.

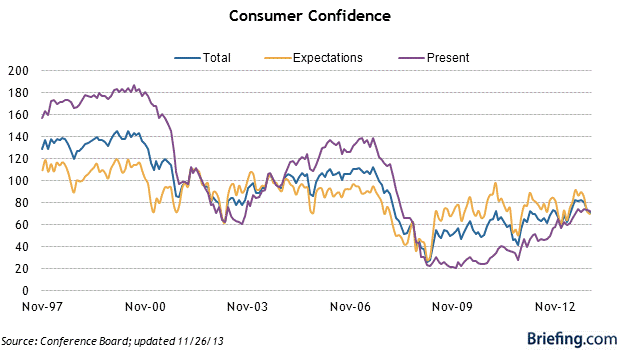

Consumer confidence, while certainly below the high levels of the pre-crisis years, has come a long way since the depths of 2009. It reflects a steady improvement in how consumers perceive their own economic prospects and is a testament of recovery.

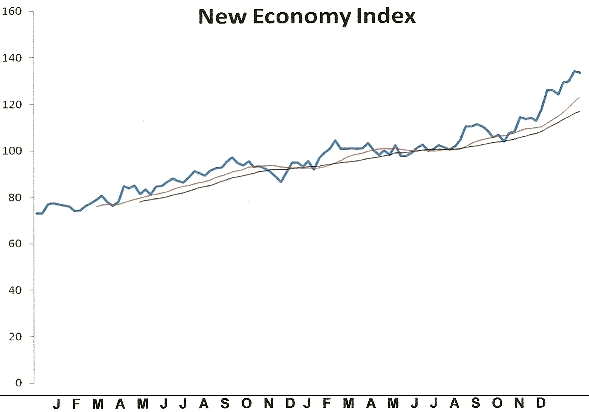

Another clear testament of economic recovery is the New Economy Index (NEI), a reflection of the real-time state of the U.S. retail economy. NEI recently hit a new all-time high and continues trending higher. As long-time readers of this column are aware, until NEI confirms a "sell" signal the overall trend of retail spending is considered to be up. The last time NEI gave a "sell" signal was in early 2010, which proved to be a temporary blip in the long-term recover that started in 2009.

There are many who wonder why, with untold billions in stimulus money, the economy hasn't recovered more than it has by now. There are three answers to this; the first answer is that given the severity of the 2008 credit crash it was only natural that recovery would be prolonged. After all, the previous Great Depression in the 1930s took over a decade to get the economy moving again. This time around the unprecedented scope and pace of the Fed's stimulus shortened the depth of the recession and improved the recovery time.

The second answer is that the 60year/120-year Kress cycle has been in its final "hard down" phase for the last few years. This has created a deflationary undercurrent in the U.S. economy; it partly explains why the Fed can get away with creating so much money every month without it leading to massive inflation, as it would normally.

A third and more revealing answer is that the consumer spending component of the recovery has actually done better than the statistics suggest. Raymond James economist Jeffrey Saut discussed this in a recent commentary, noting that "the majority of [consumer] transactions are taking place for cash, where sales are not as readily captured in the surface figure as are credit-card purchases. Indeed, not only are the foreigners transacting in cash, but many Americans are doing the same after having been burned by debt in the 2008-09 credit crisis." Saut's conclusion is that the economy is stronger than most believe.

This isn't the complete story, however. Most of the increased spending and subsequent economic strength is courtesy of upper-middle class and wealthy consumers. The middle class still hasn't fully recovered from the Great Recession, and there is some evidence that segments of the middle class are still experiencing something akin to a recession. The way a recovery normally progresses is that the wealthier segments of the population are the first to emerge from an economic contraction with increased spending. Then the classes beneath them slowly start spending again as the job market improves and with it their fortunes. It's clear that the U.S. middle class has yet to fully participate in the recovery, but their participation should be evident by 2015 once the deflationary undercurrents of the Kress cycle have been dissipated.

Kress Cycles

Cycle analysis is essential to successful long-term financial planning. While stock selection begins with fundamental analysis and technical analysis is crucial for short-term market timing, cycles provide the context for the market's intermediate- and longer-term trends.

While cycles are important, having the right set of cycles is absolutely critical to an investor's success. They can make all the difference between a winning year and a losing one. One of the best cycle methods for capturing stock market turning points is the set of weekly and yearly rhythms known as the Kress cycles. This series of weekly cycles has been used with excellent long-term results for over 20 years after having been perfected by the late Samuel J. Kress.

In my latest book "Kress Cycles," the third and final installment in the series, I explain the weekly cycles which are paramount to understanding Kress cycle methodology. Never before have the weekly cycles been revealed which Mr. Kress himself used to great effect in trading the SPX and OEX. If you have ever wanted to learn the Kress cycles in their entirety, now is your chance. The book is now available for sale at:

http://www.clifdroke.com/books/kresscycles.html

Order today to receive your autographed copy along with a free booklet on the best strategies for momentum trading. Also receive a FREE 1-month trial subscription to the Momentum Strategies Report newsletter.

By Clif Droke

www.clifdroke.com

Clif Droke is the editor of the daily Gold & Silver Stock Report. Published daily since 2002, the report provides forecasts and analysis of the leading gold, silver, uranium and energy stocks from a short-term technical standpoint. He is also the author of numerous books, including 'How to Read Chart Patterns for Greater Profits.' For more information visit www.clifdroke.com

Clif Droke Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.