Mon(k)ey Puzzle

Stock-Markets / Financial Markets 2013 Dec 11, 2013 - 04:26 PM GMTBy: John_Mauldin

By Grant Williams

By Grant Williams

Protruding from the sand a short distance to the south of the Pilot Pier, on the golden sands of Hartlepool in England's North East, is a vertical wooden mast.

The mast dates back to the Napoleonic Wars, when the Emperor Bonaparte's armies were marching through Europe, sweeping all before them as the aftermath of the French Revolution manifested itself in France's aggressive attempt to take what it deemed as its rightful place at the head of the European table.

The mast dates back to the Napoleonic Wars, when the Emperor Bonaparte's armies were marching through Europe, sweeping all before them as the aftermath of the French Revolution manifested itself in France's aggressive attempt to take what it deemed as its rightful place at the head of the European table.

Of course, with Napoleon's disastrous invasion of Russia in 1812, the French Army was to suffer one of the most comprehensive military defeats in history; but at the time of our story the battle was very much joined; and Britain, the mightiest naval power the world had ever seen, was locked in combat with her mortal enemy from across the English Channel.

Hartlepool, a small port in County Durham, was founded in the 7th century around Hartlepool Abbey, a Northumbrian monastery. The name originates from the Old English "heort-ieg" or "hart island," as stags were seen roaming the countryside in great abundance.

Around the time of the Napoleonic Wars, Hartlepool boasted a population of about 900 people — all of whom seemed to be obsessed with the possibility of attack by France.

Gun emplacements were established and defences constructed in order to repel any French aggression, and the Hartlepudlians (as the people of that region were known) stood ready to fight the first Frenchman who dared set foot upon their beloved sand.

One night, amidst a terrible storm, a French chasse-marée (fishmonger ship) that had been pressed into the service of the Emperor capsized and sank off the coast of North East England, leaving a somewhat unusual but most definitely solitary survivor — a monkey, who found himself washed ashore, exhausted, battered and bruised from his nautical tribulations but still clinging to the mast, which remains there to this day.

One can only imagine how glad he must have been to end up on the golden sands of Hartlepool's beach.

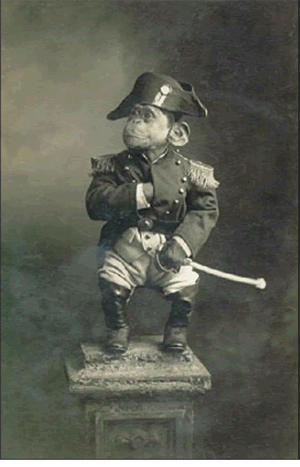

Unfortunately for him, he happened to be wearing a French naval uniform, which would, sadly, be the direct cause of his tragic demise a matter of hours after his miraculous escape from a watery grave.

The best guess that historians can posit is that the monkey was dressed in a sailor's uniform for the amusement of the ship's crew, but the Hartlepudlians were most definitely NOT amused; and upon finding him sprawled on the sand clad in a uniform with which they were unfamiliar, they immediately arrested him as a French spy and proceeded to force the confused monkey to stand trial right there on the beach.

The monkey was asked a series of questions designed to discover why he had come to Hartlepool; but with the monkey unable (or perhaps unwilling) to answer their questions, and with the locals uncertain as to what a Frenchman looked like, they reached the inevitable — but for the monkey somewhat unfortunate — conclusion that the monkey was a French sailor and therefore a spy.

The monkey was sentenced to death and hanged from the mast on the beach.

Music hall performer Ned Corvan immortalized the tale in "The Monkey Song," a popular ditty of the time that contains the wonderful lines:

The Fishermen hung the Monkey O! The Fishermen wi' courage high, Seized on the Monkey for a spy, "Hang him" says yen, says another,"He'll die!" They did, and they hung the Monkey O!. They tortor'd the Monkey till loud he did squeak Says yen, "That's French," says another "it's Greek" For the Fishermen had got drunky, O!

To this day, the citizens of Hartlepool are known, much to their chagrin, in England (and around the world) as "monkey hangers."

Now at this point in the proceedings, you are no doubt thinking to yourself, "He's finally lost the plot. Where is he going this time?" Well, as you have indulged me and my tales of monkeys swinging from yardarms, I'll tell you.

The people on that storm-tossed beach were confronted with something they didn't recognize, and though logic dictated that they ought to investigate further before they took any action, the animal spirits of a group of excitable people ensured that they forgot about clear-headed analysis and did something that their descendants still regret over two centuries later.

Right now, today, investors all over the world are confronted by markets that have been dressed up for the amusement of the crew in charge of the ship, and nobody seems to recognize what they are looking at.

Sure, they look like markets, but at the same time there is an unfamiliarity that is extremely unnerving to at least a few in the gathering crowd.

The majority of the mob, however, have decided that they look enough like markets to charge in blindly in the expectation that all will be as it should.

Things are not as they should be. Far from it.

Everywhere one looks are signs that the markets are just monkeys dressed up in fancy costumes.

To continue reading this article from Things That Make You Go Hmmm… – a free weekly newsletter by Grant Williams, a highly respected financial expert and current portfolio and strategy advisor at Vulpes Investment Management in Singapore – please click here.

Like Outside the Box?

Sign up today and get each new issue delivered free to your inbox.

It's your opportunity to get the news John Mauldin thinks matters most to your finances.

© 2013 Mauldin Economics. All Rights Reserved.

Outside the Box is a free weekly economic e-letter by best-selling author and renowned financial expert, John Mauldin. You can learn more and get your free subscription by visiting www.MauldinEconomics.com.

Please write to subscribers@mauldineconomics.com to inform us of any reproductions, including when and where copy will be reproduced. You must keep the letter intact, from introduction to disclaimers. If you would like to quote brief portions only, please reference www.MauldinEconomics.com.

To subscribe to John Mauldin's e-letter, please click here: http://www.mauldineconomics.com/subscribe

To change your email address, please click here: http://www.mauldineconomics.com/change-address

Outside the Box and MauldinEconomics.com is not an offering for any investment. It represents only the opinions of John Mauldin and those that he interviews. Any views expressed are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest and is not in any way a testimony of, or associated with, Mauldin's other firms. John Mauldin is the Chairman of Mauldin Economics, LLC. He also is the President of Millennium Wave Advisors, LLC (MWA) which is an investment advisory firm registered with multiple states, President and registered representative of Millennium Wave Securities, LLC, (MWS) member FINRA, SIPC, through which securities may be offered . MWS is also a Commodity Pool Operator (CPO) and a Commodity Trading Advisor (CTA) registered with the CFTC, as well as an Introducing Broker (IB) and NFA Member. Millennium Wave Investments is a dba of MWA LLC and MWS LLC. This message may contain information that is confidential or privileged and is intended only for the individual or entity named above and does not constitute an offer for or advice about any alternative investment product. Such advice can only be made when accompanied by a prospectus or similar offering document. Past performance is not indicative of future performance. Please make sure to review important disclosures at the end of each article. Mauldin companies may have a marketing relationship with products and services mentioned in this letter for a fee.

Note: Joining The Mauldin Circle is not an offering for any investment. It represents only the opinions of John Mauldin and Millennium Wave Investments. It is intended solely for investors who have registered with Millennium Wave Investments and its partners at http://www.MauldinCircle.com (formerly AccreditedInvestor.ws) or directly related websites. The Mauldin Circle may send out material that is provided on a confidential basis, and subscribers to the Mauldin Circle are not to send this letter to anyone other than their professional investment counselors. Investors should discuss any investment with their personal investment counsel. You are advised to discuss with your financial advisers your investment options and whether any investment is suitable for your specific needs prior to making any investments. John Mauldin is the President of Millennium Wave Advisors, LLC (MWA), which is an investment advisory firm registered with multiple states. John Mauldin is a registered representative of Millennium Wave Securities, LLC, (MWS), an FINRA registered broker-dealer. MWS is also a Commodity Pool Operator (CPO) and a Commodity Trading Advisor (CTA) registered with the CFTC, as well as an Introducing Broker (IB). Millennium Wave Investments is a dba of MWA LLC and MWS LLC. Millennium Wave Investments cooperates in the consulting on and marketing of private and non-private investment offerings with other independent firms such as Altegris Investments; Capital Management Group; Absolute Return Partners, LLP; Fynn Capital; Nicola Wealth Management; and Plexus Asset Management. Investment offerings recommended by Mauldin may pay a portion of their fees to these independent firms, who will share 1/3 of those fees with MWS and thus with Mauldin. Any views expressed herein are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest with any CTA, fund, or program mentioned here or elsewhere. Before seeking any advisor's services or making an investment in a fund, investors must read and examine thoroughly the respective disclosure document or offering memorandum. Since these firms and Mauldin receive fees from the funds they recommend/market, they only recommend/market products with which they have been able to negotiate fee arrangements.

PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING IN MANAGED FUNDS. WHEN CONSIDERING ALTERNATIVE INVESTMENTS, INCLUDING HEDGE FUNDS, YOU SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS: OFTEN ENGAGE IN LEVERAGING AND OTHER SPECULATIVE INVESTMENT PRACTICES THAT MAY INCREASE THE RISK OF INVESTMENT LOSS, CAN BE ILLIQUID, ARE NOT REQUIRED TO PROVIDE PERIODIC PRICING OR VALUATION INFORMATION TO INVESTORS, MAY INVOLVE COMPLEX TAX STRUCTURES AND DELAYS IN DISTRIBUTING IMPORTANT TAX INFORMATION, ARE NOT SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER. Alternative investment performance can be volatile. An investor could lose all or a substantial amount of his or her investment. Often, alternative investment fund and account managers have total trading authority over their funds or accounts; the use of a single advisor applying generally similar trading programs could mean lack of diversification and, consequently, higher risk. There is often no secondary market for an investor’s interest in alternative investments, and none is expected to develop.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.