Gold Stocks are the Greatest Investment Opportunity in 30 Years

Commodities / Gold and Silver Stocks 2013 Nov 20, 2013 - 05:58 PM GMTBy: Jeff_Clark

I caught myself daydreaming last week…

I caught myself daydreaming last week…

It's October 27, 2008, and Silver Wheaton (SLW) just hit $3 per share. I buy 10,000 shares, more than I've ever devoted to any one stock. I sell half when it hits $33 per share and pocket $150,000 after a 1,000% gain. I pay off the mortgage, and my wife quits work—and I still have 5,000 shares…

Not a bad daydream, eh? I don't know how many investors actually had the intestinal fortitude to plunk down a big lump of cash on a stock at that time—but Silver Wheaton did indeed offer that 1,000% return, and more.

When you look back at the investments that have made the most money over the past few decades, they've always been assets that had reached an extreme—an extreme low or an extreme high. Buying gold at $250 per ounce in 2001… buying tech stocks in the early '90s or Apple Computer at $8 per share in 2003… shorting real estate in 2007 or the stock market in 2008… the list goes on.

Each of those speculations led to massive returns only because the price of the respective asset was either dramatically undervalued and poised to take off or, in the case of the short sales, a bubble ready to pop.

Paradoxically, such opportunities aren't that hard to find—the truth is, they sprout up all the time. What is hard to find is the type of investor who has the guts to take advantage of those opportunities.

Fact is, most people run from assets that are at an all-time low… and happily buy into stocks that are reaching their peak. As legendary resource investor Rick Rule likes to say, "You're either a contrarian or you're a victim."

When you think about it, the strategy for getting rich—a strategy regularly applied by the Doug Caseys and Rick Rules of the world—is deceptively simple:

- Find an asset at an extreme (low or high) and determine if it's headed in the other direction anytime soon;

- Take a significant position and hold the fort while market forces play out.

That's all. The difficult part is to muster the courage to hold on when all your senses are screaming that it's a huge mistake, that your investment will never pan out, that today's fool (you) is tomorrow's loser.

If, on the other hand, you don't mind going where others fear to tread, opportunities practically jump into your outstretched hands.

Here's the best one I know of right now: gold stocks.

Actually, to say they're a "good opportunity" is a laughable understatement: Gold stocks are at an extreme low we haven't seen in over 30 years in this industry.

Let me prove it to you.

An effective way to measure the true value of gold stocks is to compare them to the gold price. Other things being equal, a gold producer selling for $20 per share at a $1,500 gold price is a heck of a lot cheaper than when gold's at $1,000. (When the price of a product is higher, the stock is more valuable, and vice versa.)

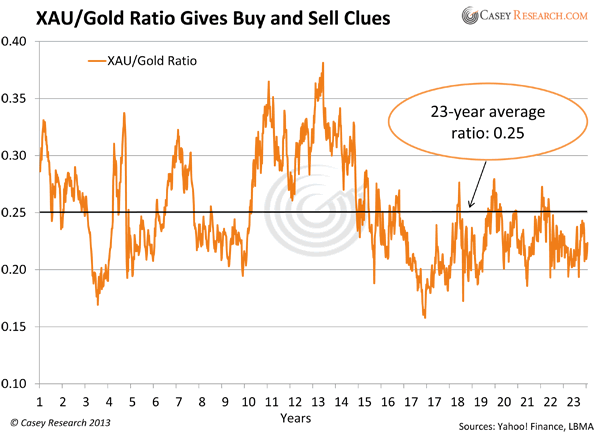

The XAU (Philadelphia Gold and Silver Index) consists of 30 gold and silver stocks and began trading in December 1983. Here are the first 23 years of the Index's ratio to gold.

Any time the ratio reached 0.20 or below, gold stocks were undervalued in relation to gold, and investors who bought at those inflection points made a profit. Conversely, once the ratio reached 0.34 or above, stocks were overvalued and due for a pullback.

For 23 years, from its inception through 2007, the XAU/gold ratio provided fairly reliable feedback for investors.

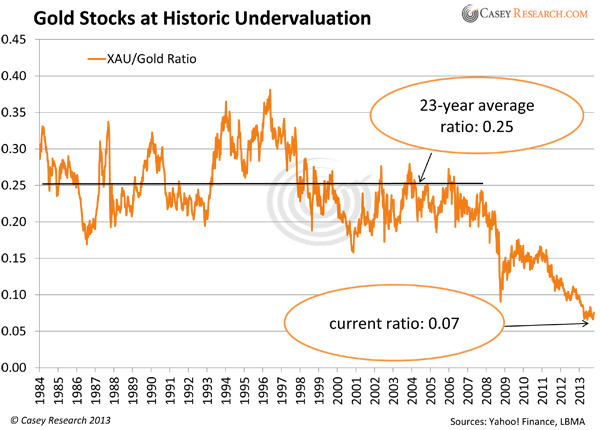

Now let's add the rest of the data.

Today, the XAU/gold ratio is at a historic low of 0.07.

To fully appreciate what this means, look at these former lows for comparison:

- It's lower than the 2008 gold stock selloff;

- It's lower than the "nuclear winter" of the mid-'90s;

- It's lower than the very beginning of the gold bull market in 2001.

Right now, gold stocks are like a rubber band that's being stretched to an extreme. As all rubber bands do, it will snap back. And not just that; based on how extreme the undervaluation has become, they're bound to be among the most profitable investments of this generation.

A year ago, I pointed out how cheap gold stocks were—and yes, they managed to get cheaper still. But that fact only underscores how vast this opportunity really is.

Current sentiment in the precious metals sector, especially the stocks, is beyond dreary: it's pitiful. At the Toronto Stock Exchange, where most mining stocks are traded, security guards are now doubling as suicide watchmen. (OK, I made that up.)

What I didn't make up is that your chances of following in Doug Casey's or Rick Rule's footsteps—and making similar breathtaking returns—have never been higher. Upside is at its greatest when even the cab driver laughs at the thought of buying a gold stock.

As conditions return to normal, huge profits will be made… by those who didn't listen to the investing herd and its mouthpieces in the mainstream financial media.

Is there a guarantee gold stocks will rebound and deliver life-changing profits? I'm sure you've heard the "death and taxes" thing, so I don't have to answer that question.

And there are some scenarios that could conceivably prevent gold and silver from rebounding—possibly killing off the miners for a generation:

- If billions of Chinese, Indians, and other Asians finally realize that unbacked paper currencies are much more desirable to hold than physical gold and silver…

- If Ben Bernanke vows never to print another bloody greenback again, and neither does his successor…

- If Congress unanimously agrees to lower, instead of raise, the debt ceiling and drastically cut all but core spending, for the health of the country and its citizens (I know, don't make me laugh)…

- If solar panel manufacturers and dozens of other industries find a valid replacement for silver in their products…

- If the insane amount of $700 trillion in derivatives circling the world like a cloud of toxic particles suddenly evaporates…

- If Beijing calls a press conference and proclaims they were mistaken and now feel no need to diversify out of the US dollar, that it's the one and only reserve currency the world will ever need…

… then we might see that happen. But I'm not holding my breath on any of these. (A phrase about snowballs and hot places comes to mind.)

In the meantime, I bought another gold Eagle last month.

Gold investing comes in many forms—bullion coins, paper proxies like gold ETFs, gold accumulation programs, large- and small-cap gold stocks. Find out which one is right for you, in my 2014 Gold Investor's Guide that you can read free of charge by clicking here.

Learn when is the best time to buy gold and where to get it… the 3 best ways to invest… and how to pick the right gold stocks. Click here to get your free report now.

© 2013 Copyright Casey Research - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Casey Research Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.