Gold And Silver – Cognitive Disconnect Between Physical And Paper

Commodities / Gold and Silver 2013 Nov 09, 2013 - 12:56 PM GMTBy: Michael_Noonan

When one understands the widely pervasive but narrowly understood phenomenon of cognitive dissonance that permeates most of the Western world, it is not so difficult to put into context the disparity between demand for physical gold and silver and supply for the faux paper market. There is a growing sense for many that everything in the financial world is out of line, and way out of line for many others.

When one understands the widely pervasive but narrowly understood phenomenon of cognitive dissonance that permeates most of the Western world, it is not so difficult to put into context the disparity between demand for physical gold and silver and supply for the faux paper market. There is a growing sense for many that everything in the financial world is out of line, and way out of line for many others.

Cognitive dissonance: an inner need to maintain harmony in one's attitudes and beliefs while avoiding disharmony, [dissonance]. When a conflict arises that produces a sense of inner discomfort about one's beliefs or attitudes over something that promotes an alteration of those same beliefs and attitudes, there is a driving need to restore the inner balance or calm. In other words, it is easier to go along in order to get along.

This inability to reconcile gross inequities brought about by the world's central bankers; outright theft from events like MF Global, "bail-ins" for bank account holders being held [hostage] responsible for the failed financial activities of the bankers themselves, which is just another form of theft; and the most insidious form of theft, confiscation of wealth via fiat-issued currencies, creating inflation and destroying capital.

Despite this recent and brazen form of theft from people's bank accounts, the money on deposit in banks continues to rise, begging to be stolen by the bankers, [and they will steal it, count on it]. It would seem these kinds of situations would cause people to close out brokerage accounts and bank accounts, but it is not happening.

Detroit's pensioners may be lucky to receive 16 cents for the dollar of what they expected to collect, and every state is grossly underfunded for public pensions. When pensioners get hit across the country, it will be viewed like a Black Swan event: "Who could have seen it coming?" Thank the politicians who keep raising the debt ceiling, allowing government to shut down, and then raise the [nonexistent] "ceiling" and resume spending with abandon.

There is the blatant manipulation of the gold and silver markets themselves, with so many PMs experts calling for higher prices that refuse to show up, for a reason. The cognitive dissonance aspect to gold and silver and their disconnect between demand for the physical and supply for the paper, with paper prices prevailing, is the refusal for those outside the banking system, [governments being a puppet subset of the central bankers], to recognize central banking for the criminal enterprise that it is.

How can the insatiable appetite for the physical metal be subservient to the corrupt LBMA and COMEX? There is a war going on, one that has already been lost by the West to a yet to be declared victorious East/BRICS. The Western central banking system is choking on the fiat of its own making, force-feeding their same fiat down the debt-ridden throats of lesser countries like Cyprus, Greece, Ireland, et al.

Then there has been the theft of gold from Libya, once Gaddafi was disposed of, and from Somalia, to help satisfy Germany's demand for the return of its gold. There are reports of allocated gold accounts that no longer have the gold, stolen from the account holders who fear going public for a variety of reasons.

The Obama regime, led by a Nobel Peace Prize recipient, the leading advocate for war for any [false] reason, was stopped cold by Russia, and in the process, the US was abandoned by its partner in crime, UK. This happened, most likely, because Russia reminded the UK from where its source for winter heating fuel comes.

The West is in a relentless state of decline matched by the increasing rise in status and power of the East/BRICS nations, with gold being the ultimate trump card. China is by far the largest buyer of gold on the market. Do you think it has any interest in seeing the price of gold go to $2,000, or higher? As a huge buyer, China has a vested interest in seeing the price of gold where it is, not caring if it continues lower, which is even better.

If gold were to go higher, it exposes the largest Ponzi scheme ever, conducted by the world's central bankers who are left with empty gold vaults, and who would have to accept the collapse of Western fiat currencies. Evidence of this comes from the sale of J P Morgan's Morgan Guarantee Company building, housing the world's largest gold vault, able to withstand an earthquake, for a relatively cheap $725 million. The buyer? China. The reality and symbolism are rich in irony.

All the news announcements of which country has increased their gold buying, how many tonnes of gold does China actually own, record sales for gold and silver coins, empty or nearly empty COMEX gold holdings, all validate why the price of gold and silver will eventually go much higher. However, it has little to no bearing on the price of gold, and no impact on Western central bankers and all the unelected organizations that rule the Western financial world and governments, [Basel, BIS, IMF].

This is a behind the scenes change of players, literally, on the world's stage, and the New World Order elite are doing what they can to fight off the inevitable, steal as much as possible before the end arrives, and jockey for position, if possible, even as a bit player lording over the ashes of another fallen empire, as it were. It will be RIP USA. The American people do not see this coming.

Until that day of reckoning, there are forces not fully understood that still exert influence and control on the gold/silver market. For how much longer can it last? It is unlikely that it will be measured in months, a lower probability factor, but more likely still in years, fewer than more, but it is anyone's guess. This Ponzi scheme will go on, and on, because it is the largest holders in the Western world who maintain control, and they are unopposed in their control.

All the bullish news that has been reported, month after month, for the past few years has done nothing to change the recent down trend. None of the bullish news that will come out next week or next month will have any effect, either. People are looking at the wrong measures for a turnaround.

The best advice always has been and always will be, "Follow the money." The Western "money" is imaginary, but few are willing to see the financial emperor "is wearing no clothes." Cognitive dissonance works in favor of the money changers, and they rely on it. Those who choose to hold the fiat will end up with the value of all fiats, ultimately.

Those who choose to follow the true money will continue to buy gold and silver. We each are captains of our own ship. Those in control of the helm are the buyers and holders of real money. Everyone else is sailing on a ship of fools.

It may be fool-hardy to look at charts of an increasingly minor factor on the gold/silver landscape, but we have no way of charting what is unseen. If the arrival of the end game creates an overnight several hundred-dollar gap up in gold, those who own and continue to buy the physical will be immediate beneficiaries, rewarded for their patience and willingness to not get caught in the eventual maelstrom of reality coming to the fore.

It may also be possible to be positioned in futures for a turn in market trend before any such upheaval occurs. No one knows how any of this will play out, so for now, best to play whatever opportunity may be available from reading current market activity.

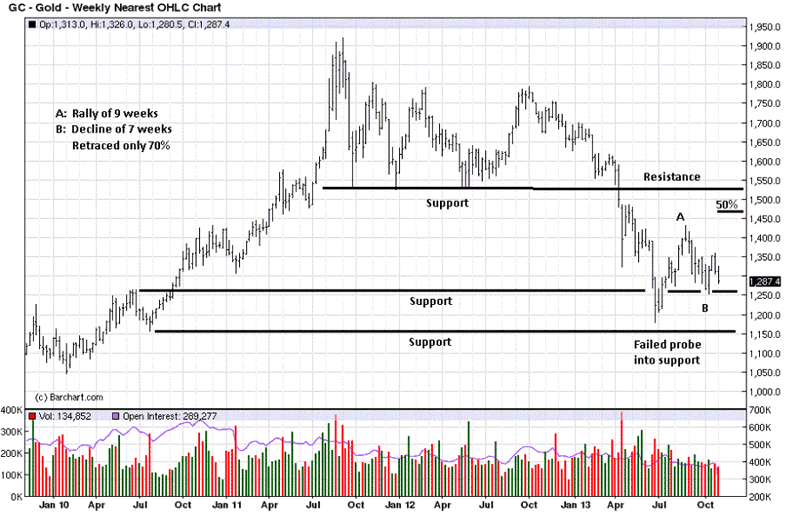

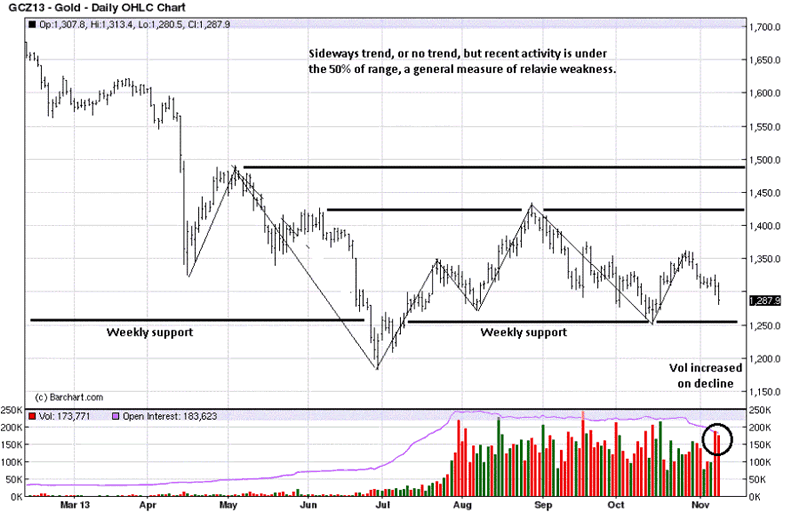

The trend is down, and price continues to show bouts of strong selling. That said, the last two weeks had some sizeable daily sell-offs, but the net effect has been minimal against the gains of the two-week preceding. It takes time for any market to base, in preparation for a sustained reversal of trend, and gold may be in that process.

Price is holding at a band of support. What is absent is ongoing buying that can lift price above the swing high at "A."

There was a sharp increase in the level of volume for the last two days on the chart. The closes are on the lower end of the range, and this says sellers are in control. What sellers need now is continuation lower to take advantage of what appears to be a weakened market.

How price reacts next week will provide an important clue.

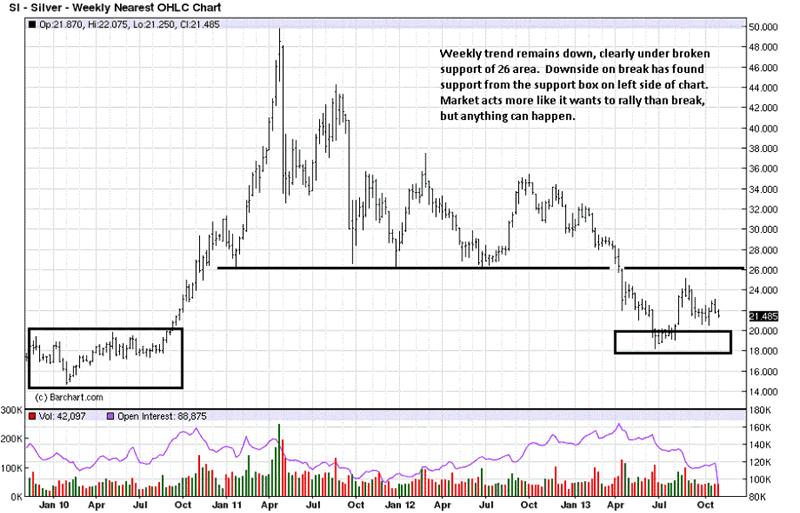

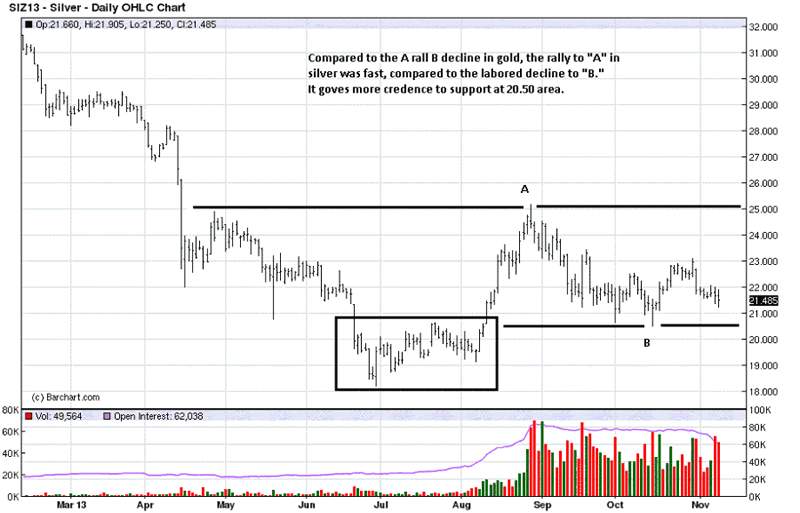

Silver looks relatively more promising because the decline is holding better than gold's.

The character of the silver daily is better than that of daily gold. The decline from 23 was fast, but the extent of the downside has been somewhat muted, by comparison. There is no reason to buy silver, or gold futures, at current levels, for additional downside cannot be ruled out.

By Michael Noonan

Michael Noonan, mn@edgetraderplus.com, is a Chicago-based trader with over 30 years in the business. His sole approach to analysis is derived from developing market pattern behavior, found in the form of Price, Volume, and Time, and it is generated from the best source possible, the market itself.

© 2013 Copyright Michael Noonan - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Michael Noonan Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.