It's Bubble Time in Britain, A Tragic Story

Politics / UK Politics Nov 06, 2013 - 04:29 PM GMTBy: BATR

Some things are simply so funny that they can't help showing us hidden truths. As anyone who's ever read Mark Twain or heard Groucho Marx, among many many other voices, will gladly confirm, funny things can make you think, and even reveal tragedy. Not necessarily thigh slapping stuff, just funny things. Fumbling through the Guardian's webpages on Tuesday, I found what I find is a fine example of just that. Plus, in the very same edition, a bunch of articles that provide an equally fine perspective.

Some things are simply so funny that they can't help showing us hidden truths. As anyone who's ever read Mark Twain or heard Groucho Marx, among many many other voices, will gladly confirm, funny things can make you think, and even reveal tragedy. Not necessarily thigh slapping stuff, just funny things. Fumbling through the Guardian's webpages on Tuesday, I found what I find is a fine example of just that. Plus, in the very same edition, a bunch of articles that provide an equally fine perspective.

Let's start with that perspective. You may have noticed that the domestic and international press have recently published some remarkably positive numbers for the UK economy. On the other hand, you may also have read my October series on Britain's energy position, which is not so positive: in fact, it's outright desperate. Moreover, the current leadership manages to come up with all the wrong answers, so Brits will be forced to learn what lies beyond desperate.

But not today. Today is bubble time, in credit and in confidence.

The Wall Street Journal quotes the European Commission:

EU More Than Doubles U.K.'s 2013 Growth Forecast

The European Commission said Tuesday the U.K. will be the fastest-growing of the major European economies this year and next, and a separate survey showed activity in the country's services sector grew at its fastest rate in 16 years in October. The forecast and survey bode well for the U.K.'s economic prospects, indicating the recovery that began earlier this year is picking up speed.

In its autumn forecast, the European Union's executive arm said the economy of the U.K. the largest non-euro-zone country in the EU would grow 1.3% in 2013, considerably higher than the 0.6% growth it projected in May.

"The expectation is for consumers to dip into their savings and continue spending with the outlook for real wage growth to turn positive at the end of 2014 and into 2015," the commission said. "However, the debt burden of households remains a distinct risk to private consumption."

Where "The expectation is for consumers to dip into their savings ... " = confidence bubble, and "the debt burden of households remains a distinct risk to private consumption" = credit bubble.

While the Guardian quotes Britain's National Institute of Economic and Social Research:

UK growth to pick up in 2014 – NIESR

UK growth will pick up next year but the economy will remain over-dependent on squeezed consumers, a leading thinktank has warned. The National Institute of Economic and Social Research (NIESR) forecasts growth will come in at 1.4% this year and quicken to 2% next year. Both those forecasts are up by 0.2 percentage points since NIESR's last outlook was published in August.

[..] But NIESR argued growth was not built on solid foundations. "After two years of stagnation, economic growth has returned, underpinned by an increase in consumer spending," the thinktank said. "Consumer spending growth is necessary for an economic recovery in the UK, but a consumer-driven recovery will not be 'balanced', let alone one reflecting the required long-term 'rebalancing' towards an economy with greater net national saving."

Did you catch that? They (both government and thinktank) are actually looking for some sort of growth that leaves the British people (in their role as consumers) standing on the sideline, squeezed and all. I think you just got to, like me, be wondering A) if that's possible, and B) what purpose that would serve in the first place. The idea, if I understand it well and put it in somewhat stark terms, seems to be to establish an economy that grows while the people become disposable. If they're not needed for economic growth, than what use are they, right?

Not that they're going to say it out loud; you can bet that the architects of this brilliant scheme will repeat ad infinitum that they do it to provide the people with a better future (a claim which all by itself should be funny enough to make you understand what they are really about). But it is of course implied when you say an economy must "wean itself off dependency on consumer spending".

And don't worry, I know that the idea is to earn money by making the economy "healthier" through increasing exports. But there's a problem or two with the idea. First of all, every country wants to achieve that same goal. Because every country has consumers that are both to deep in debt AND don't spend enough, to keep the party lights on. And in that context, even if you would win that battle, which is by no means a given, that means other countries must fail, and then who are you going to export your products to? Exactly, other countries with squeezed consumers, that's who. How on earth is that a winning strategy?

And besides, what does the UK have to export anyway?

Services are booming but is this the wrong sort of economic growth?

It conjures up those blissful, carefree days when Things Could Only Get Better, and the name Lehman Brothers meant nothing to anyone in Britain outside a tiny cadre of City workers: according to the latest survey of the services sector, its companies are now more optimistic than at any time since 1997.

If this latest survey is to be believed, the services sector – long the engine of our out-of-kilter economy – is booming. Whether it has been the Funding for Lending scheme prising open the banks' purse strings; the housing recovery helping to tempt shoppers back into the spending habit; or the halt to doom-laden headlines about the imminent collapse of the eurozone, confidence appears to have flooded back.

Looks like exporting services is the UK's only hope. To countries that themselves already have services sectors that are as bloated as the British one. Which makes up some 77% of GDP. And while there are increasing calls throughout the western world to increase manufacturing again after decades of these nonsensical claims about building service economies or knowledge economies as the ultimate sign of being truly developed, rebuilding your manufacturing base back once you've lost it is very hard, and at the very least takes a lot of time.

Britain's industrial production today accounts for just 22% of GDP. That's all that's left. Less than a third of the services sector. That paints the picture of a country that has squandered its independence, that is dependent on imports to a huge extent. Typical for all rich nations, US, Japan, western Europe, true, Britain is by no means alone, but still.

So making your own "things" (consumer goods, if you will) is not going to happen. And neither is producing your own food. Agriculture accounts for less than 1% of British GDP... When the food from 1000s of miles away stops coming, the United Kingdom will be royally screwed.

Personally, I simply can't understand how a nation, a people, can let things come this far. They must attach no value whatsoever to their independence, or I can't explain this. It all does go a ways towards explaining the prevailing blind faith in growth, though: there's nothing else left. But faith and hope and tragedy.

Let's get to the funny part now. The OECD came out recently with another of its reports on the quality of life in its member countries. These reports are so useless, worthless and valueless that I feel kind of embarrassed paying any attention to them, but, fortunately, that's not really the point. Here's the Guardian's coverage of the report:

UK a great place to live and work, says OECD

The UK is one of best places to live and work, according to the Organisation for Economic Co-operation and Development, although income inequality has risen by more than in other countries since the global financial crisis struck in 2007.

The Paris-based thinktank has been seeking to measure wellbeing for the 34 nations of the OECD, based on aspects of life such as incomes, education, housing and security. It says the UK ranks above the OECD country average on environmental quality, personal security, jobs and earnings and housing among other measures. It is close to average for work-life balance, but below in education and skills.

That puts the UK alongside Switzerland, Australia, Nordic European countries, Canada and New Zealand in a clutch of highest-performing countries on the latest work for the OECD's Better Life Index.

Looking at the UK, the OECD says that over 2007 to 2011 there was a cumulative increase in real household disposable income of around 1%, while in the euro area, income dropped by 2%. The report adds: "In the OECD as a whole, the poor employment situation had a major impact on life satisfaction. This trend is not visible in the United Kingdom where, from 2007 to 2012, the percentage of British people declaring being very satisfied with their lives increased from 63% to 64%."

A great place to live. "... the percentage of British people declaring being very satisfied with their lives increased from 63% to 64%.".

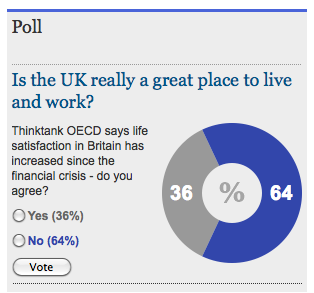

Well, maybe that depends on who you ask. Because that same 64% number also appears in a poll that the Guardian ran on its homepage. Just a bit different:

OECD Better Life Index: is the UK really a great place to live and work?

Thinktank says life satisfaction in Britain has increased since the financial crisis - do you agree?

Ha ha ha. How funny is that? The entire confidence bubble shattered in one chart. Guess a lot of Brits didn't get the program in time. What do you mean you're not happy, you sod? The OECD says you are! Get in line!

Again still on the same page, the Guardian tops it off with this:

'I can't believe it': German expat's reaction to UK's 'superior' quality of life

The OECD claim that Britain now ranks above Germany on a number of quality of life measures took at least one German expatriate by surprise. Susann Schmiede's first reaction was to laugh.

"It's really surprising, I can't believe it," she said. Schmiede is office manager for the German Deli, which sells Westphalian pumpernickel loaves and Thuringer bratwurst sausages online and at Borough market in London.

I know that many people will not believe things are as bad as I make them out to be. Many people in Britain simply don't want to believe it, and those elsewhere will think: but it's different here. What I think is that the way we've built our societies contains fundamental flaws, most of all where it comes to making ourselves depend on other, far-away, people, and on transport systems, to provide us with what we could easily have produced ourselves. While it may at least temporarily seem cheaper to have others do our work for us, in the end it's inevitable that we will pay a hefty price for it. Sure, let someone else make your iPads and your flatscreen TVs for you, but never your basic necessities. That will come back to haunt you. There's nothing that has the intrinsic value of what you can make with your own hands and grow in your own garden. But who still knows how to make or grow anything at all?

And I don't want to keep beating on Britain, it's a wonderful country, but it keeps on providing all these great stories about where and how things go wrong (and it seems to be making a great effort to do everything wrong), and these are stories that I think everybody all over the world should learn from. Because if we don't learn the lesson this can teach us, and fast, and make no mistake, we face dizzyingly steep learning curves, then we will go blind into that good night, and it won't be so gentle.

By Raul Ilargi Meijer

Website: http://theautomaticearth.com (provides unique analysis of economics, finance, politics and social dynamics in the context of Complexity Theory)

© 2013 Copyright Raul I Meijer - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Raul Ilargi Meijer Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.