This Forgotten Metal Could Double in Price

Commodities / Metals & Mining Nov 05, 2013 - 02:48 PM GMTBy: Money_Morning

Peter Krauth writes: We looked at aluminum last time, where the profit potential remains unusually high. But now it's time to look at the other "forgotten" metal.

Peter Krauth writes: We looked at aluminum last time, where the profit potential remains unusually high. But now it's time to look at the other "forgotten" metal.

This one, as you'll see, is already the most-used metal in the world.

And shares of its best producer could double...

A $500 Million Bet on Iron Ore

Remember, Mick Davis doesn't just know commodities. He bets on them. Big. And he wins.

And now he's at it again...

As you'll recall from last time, his X2 Resources has raised $1 billion to acquire attractive commodity assets.

Half of that sum is coming from Noble Group Limited (SGX: N21). Noble is positioning itself as the preferred marketer and provider of supply chain management and logistics services to X2.

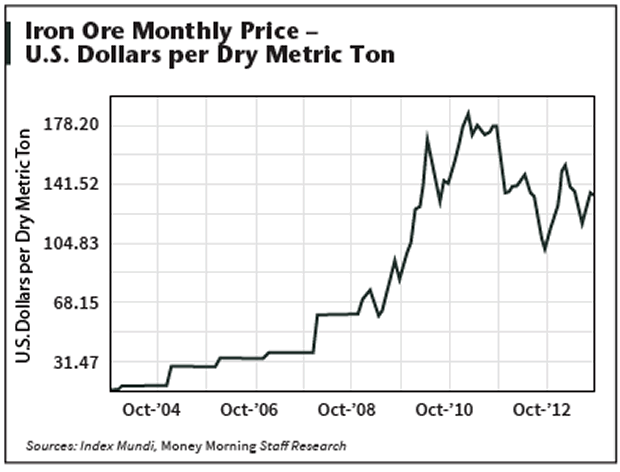

Iron ore is also one of Noble's core commodities. That puts it directly in Mick Davis' sights - and ours. Take a look at this chart...

Iron ore prices have struggled since peaking in early 2011.

But that may be changing.

Last month, Australia, the largest iron ore exporter, upped its estimated prices, citing swelling Chinese demand for the raw material. Prices for 62% iron ore delivered to the Chinese port of Tianjin are up 19% from their May lows.

What's more, Australia's Bureau of Resources and Energy Economics forecasts 16% higher iron ore exports this year over last, and an average 8% annual growth from 2014 to 2018.

Chinese ore production has seen declining grades and output, forcing the world's largest producer to increasingly rely on imports as they strive to enhance the quality of their production.

China is just the tip of the iceberg.

The supply and demand dynamics of iron ore are about to shift dramatically... in demand's favor.

Red Tape Is Choking Supply

While McKinsey & Company expects Chinese growth to top 7% through 2015, the supply-demand dynamics in this market are not all about China. Recent events in India could be foreshadowing ballooning demand there as well.

India's federal government has investigated illegal and unreported iron ore mining over the four years spanning 2006 to 2010. Thanks to the investigations, numerous high-ranking officials have been jailed after more than 110 billion short tons of iron ore may have been mined without permits or paying royalties.

Since then, the Supreme Court of India has banned mining in some of the involved areas, with the Federation of Indian Mineral Industries indicating that iron ore exports have fallen 70% since the ban in Karnataka and Goa states.

The bottom line is that losses in the last fiscal year alone are estimated at $10 billion worth of iron ore exports. And it's expected that India will soon become a net importer of the material.

Meanwhile a few continents away, other problems are brewing.

Tiny Uruguay holds outsized quantities of iron ore - as much as 275 billion short tons.

But here's where it gets really interesting: Should these resources be mined, they could turn Uruguay into the eighth-largest iron ore producer.

A single project, the Valentines, being advanced by London-based Zamin Ferrous Limited, could see as much as $3 billion invested, the largest foreign direct investment in the country's history. The Valentines would produce nearly 20 short tons of iron ore annually and generate $1.4 billion per year in exports over 20 years.

Lawmakers passed a law aimed at regulating large-scale mining, but that hasn't assuaged the locals.

Last month, 2,000 people, including environmentalists, descended on the capital, Montevideo, to protest against the large-scale mining projects likely to break ground soon.

One area, Lavalleja, even passed its own law to ban open-pit mineral extraction in the department. Along with protestors, authorities here see foreign mining as a threat to Uruguay's own mining industry.

Challenges like these put a big question mark on foreign-funded Uruguayan iron ore mining. That it will proceed smoothly - or even proceed at all - seems to be anyone's guess right now.

And that puts even more iron ore production in doubt, just as demand is on the mend - potentially in a big way, given India's and China's own production difficulties.

Rio Tinto plc (ADR) (NYSE: RIO) projects 771 million short tons of iron ore will be required to meet demand over the next seven years. But lower grades and rising capital expenditures have upped costs, creating further challenges to supply.

The lowdown of all this is that iron ore prices will have to go up, so that production costs and demand can meet in a happy place.

And that points to better times ahead for iron ore producers.

My Favorite Iron Investment Could Double

I prefer to go right to the source, to the world's largest producer of iron ore.

Vale SA (ADR) (NYSE: VALE) is headquartered in Brazil and operates in more than 30 countries. It's an $85 billion company that derives 50% of its revenues from Asia. Sixty-nine percent of its worldwide revenue comes from iron ore and pellets.

Other resources Vale produces are copper, coal, fertilizers, and manganese, but altogether they only contribute about 30% of revenues.

Shares peaked above $35 in early 2011 and then started on a sustained downtrend. The price gave back nearly two-thirds from its high, bottoming at around $12 in July. But shares are up 33% already since then, and I think there's a lot more to come.

With a trailing P/E at 36, shares look pricey, but that's like driving by looking only in the rearview mirror. Consensus estimates put the full-year 2014 P/E at 8, implying much higher earnings over the course of next year.

As we know, earnings ultimately drive stock prices, so with this kind of deep value, I don't expect Vale to stay this cheap for long.

The next move is yours.

Source :http://moneymorning.com/2013/11/05/the-other-forgotten-metal-could-double-too/

Money Morning/The Money Map Report

©2013 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Money Morning Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.