Corporate Earnings Leadership Emerging in These Transport Stocks

Companies / Corporate Earnings Oct 28, 2013 - 09:15 AM GMTMitchell Clark, B.Comm writes: As more and more companies report, it’s apparent that quite a few are beating Wall Street consensus (usually either on revenues or earnings, rather than both), and it’s happening in industries where you want to see leadership.

What Wall Street consensus actually becomes is typically a well-managed dance between sell-side analysts and a company’s chief financial officer. Consensus estimates generally don’t mean very much in the way of real economic growth, which makes it all the more significant when you do see real growth.

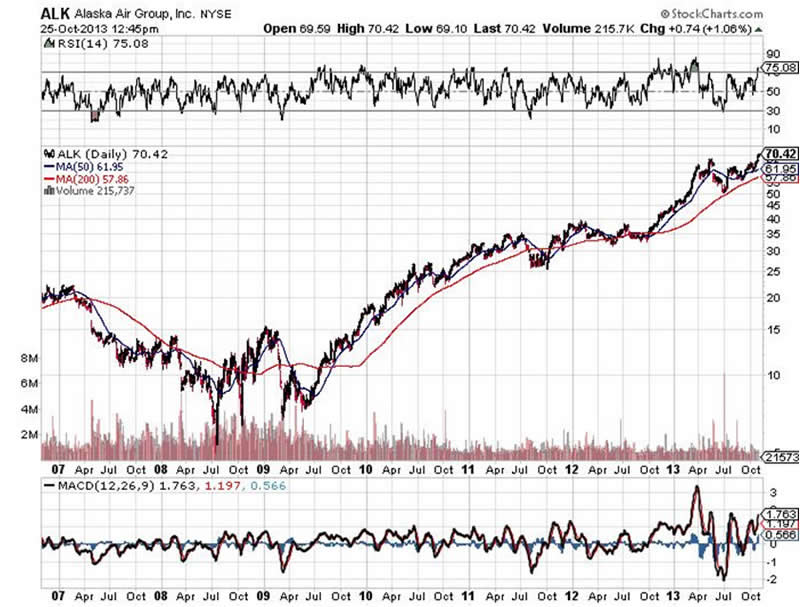

Alaska Air Group, Inc. (ALK) has been a hot stock over the last four years, and the last 12 months especially.

The company handedly beat Wall Street consensus, revealing a solid upturn in its airline business. The stock has gone up considerably but is not expensively priced, given current earnings. The company pays a dividend and is highly likely to get upgraded after such a strong quarter.

Total revenues including passenger, freight, and mail rose 22% during the third quarter of 2013 to $1.56 billion.

Along with this growth, the company was able to keep a handle on expenses with total operating costs rising only eight percent to $1.09 billion (aircraft maintenance costs dropped four percent to $54.0 million). This boosted total operating income 75% to $470 million. GAAP net income rose substantially to $289 million, or $4.08 per diluted share, way up from $163 million, or $2.27 per diluted share, in the third quarter of 2012.

Alaska Air Group purchased 1.45 million of its own shares this year for $83.0 million. The company has been paying down debt and holds the number-one spot in the U.S. Department of Transportation list of on-time performance.

It was a great quarter for the company, with a record earnings performance. This stock, in my view, is poised for more near-term gains and could move considerably higher as the company expects solid business conditions going into next year.

Chart courtesy of www.StockCharts.com

The position’s been in consolidation since May. It’s a stock market leader and a meaningful component of the Dow Jones Transportation Average.

This index, which I view to be an important leading indicator, recently broke through the 7,000 level, which is another all-time record high and a major accomplishment. (See “Dow Jones Transports Showing Life Again; Will the Stock Market Follow?”)

Even though Alaska Air Group isn’t expensively priced on the stock market, with so many transportation stocks trading right near their highs, any good financial reports are like confirmation earnings, helping to justify the recent run-up.

So while growing companies like Alaska Air Group can still see their share prices advance, I’m still mostly a fan of considering higher dividend paying stocks for new buyers. I want a good degree of safety (and income) from a company, especially in a stock market trading at an all-time high on what is mostly very lackluster financial growth.

Mitchell Clark, B.Comm. for Profit Confidential

http://www.profitconfidential.com

We publish Profit Confidential daily for our Lombardi Financial customers because we believe many of those reporting today’s financial news simply don’t know what they are telling you! Reporters are trained to tell you the news—not what it can mean for you! What you read in the popular news services, be it the daily newspapers, on the internet or TV, is the news from a “reporter’s opinion.” And there’s the big difference.

With Profit Confidential you are receiving the news with the opinions, commentaries and interpretations of seasoned financial analysts and economists. We analyze the actions of the stock market, precious metals, interest rates, real estate and other investments so we can tell you what we believe today’s financial news will mean for you tomorrow!

© 2013 Copyright Profit Confidential - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.