Gold, Stock Market Investors Time to Sit on the Sidelines

Stock-Markets / Financial Markets 2013 Oct 25, 2013 - 01:59 PM GMTBy: Toby_Connor

My best guess continues to be that stocks will extend this consolidation on Friday and then deliver one more push higher into the FOMC meeting next week. I expect the Fed will confirm no tapering which will likely trigger a big rally and probably reversal as smart money traders sell into the emotional move. Barring an immediate Fed intervention, that should give us the drop down into the half cycle low.

My best guess continues to be that stocks will extend this consolidation on Friday and then deliver one more push higher into the FOMC meeting next week. I expect the Fed will confirm no tapering which will likely trigger a big rally and probably reversal as smart money traders sell into the emotional move. Barring an immediate Fed intervention, that should give us the drop down into the half cycle low.

At that point one could enter long positions and use the half cycle low as your stop.

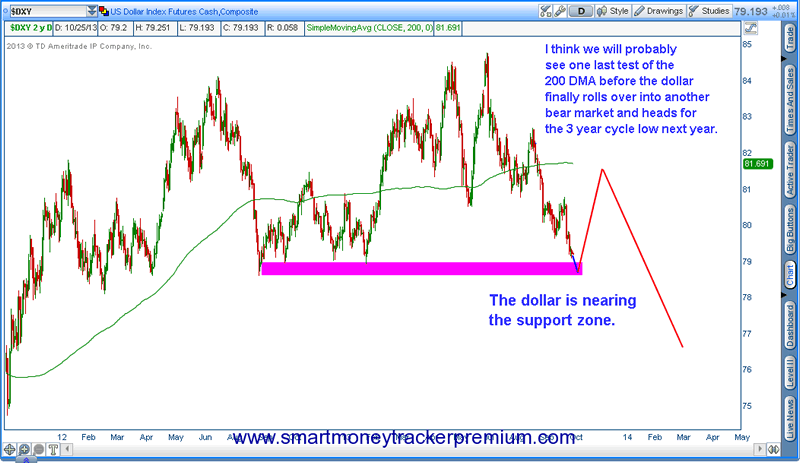

Dollar:

We should be coming down to the final few days in this yearly cycle decline. As you can see in the following chart the dollar is rapidly approaching that major support zone we talked about between 78.90 and 78.60.

Again I think the FOMC meeting next week will be the trigger to put in this bottom. As I said earlier I expect the Fed will confirm no taper this year. That would likely cause a final spike down in the dollar where smart money traders will cover shorts on the news and reverse position to go long, leaving emotional retail traders holding the bag again.

Most bear markets will make one final test of the 200 day moving average before really starting to accelerate to the downside. I think this is probably what is in store for the dollar index over the next 4 to 6 weeks. A final counter trend move back up to test the underside of the 200 day moving average along with a resurgence of taper talk as traders try to rationalize some reason for the rally.

Gold:

I'm going to start off today by revisiting the one-year gold chart. As I have noted on the chart, there are several key levels where we saw blatant manipulation in the gold market. Back in late May and early June gold was clearly capped at the $1425 level to set up the final June crash. Not surprisingly this intermediate rally was also capped at that exact same level even though the dollar still had a long way to fall in its intermediate cycle low.

The next blatant manipulation came almost immediately after the September FOMC meeting where it was confirmed that tapering was off the table for the rest of this year.

With the dollar rapidly approaching an YCL, and gold chewing through a lot of days in this daily cycle I suspect we are going to see a concerted effort made to hold gold at or below that FOMC top over the next week. If one is holding long positions I think that is the level where I would sell.

If on the other hand gold can manage to break through that $1375 manipulation zone, there is very little chance it is going to make it past the $1425 level and 200 day moving average before this daily cycle tops. At that point gold will almost certainly drop down into a daily cycle low that will retest the $1350-$1375 level before making another attempt at penetrating the $1425 zone.

What I'm trying to say, is that there is no compelling reason to risk capital right now under the assumption that we are moving higher, because we will almost certainly make this same trip twice. With a major dollar bottom probably only 3 to 4 days away, and manipulation likely to return at $1375 level, it doesn't make a lot of sense to roll the dice right here and hope the rally continues.

If it does continue, then great, it will confirm an intermediate cycle bottom occurred at $1250. But the buy point will still be at the next daily cycle low, which will likely be at about the same level as we're at today.

I know it's hard for many people to sit on the sidelines, but there are times when that is the correct investment strategy. I suspect more money has been lost in the markets due to impatience than just anything else. With the multiple threats of the $1375 manipulation level, and impending dollar rally hanging over this market, I think it's important to not let emotions force one to make a mistake that one logically knows doesn't have to be made at this point.

This market isn't going to runaway from us. Runaway moves occur during a third or fourth daily cycle, not a first. Sentiment is still too depressed during a first daily cycle to generate a runaway type move. And after the kind of bear market we've seen, the bears aren't going to roll over and die easily. They most certainly aren't ready to give up yet. I expect they are going to return in force at the $1375 level while at the same time a lot of savvy longs are going to take profit at that level.

This is a copy of the Thursday night premium report. Click here to try a one week trial subscription.

Toby Connor

Gold Scents

GoldScents is a financial blog focused on the analysis of the stock market and the secular gold bull market. Subscriptions to the premium service includes a daily and weekend market update emailed to subscribers. If you would like to be added to the email list that receives notice of new posts to GoldScents, or have questions,email Toby.

© 2013 Copyright Toby Connor - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Toby Connor Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.