New Concerns Will Continue Stock Market Volatility

Stock-Markets / Stock Markets 2013 Oct 19, 2013 - 12:10 PM GMTBy: Sy_Harding

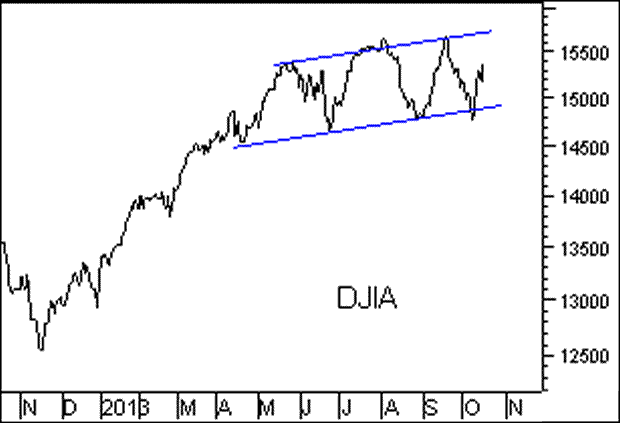

The volatility has been brutal since May when the Federal Reserve first hinted it might begin to taper back its QE stimulus, then relented, only to soon hint again that it might do so by its September meeting.

The volatility has been brutal since May when the Federal Reserve first hinted it might begin to taper back its QE stimulus, then relented, only to soon hint again that it might do so by its September meeting.

When the Fed then made its ‘no-taper’ decision in September, Congress took over as the driving force of the volatility with its ‘on again- off again’ hopes for a resolution to the debt-crisis and government shutdown.

There was not much to like about the shutdown, but at least the market was shielded from important economic reports, most of which had been trending negative prior to the shutdown.

With the government re-opened, next week will begin the catch-up of those delayed reports.

They may not be pretty

So far we know the delayed employment report for September will be released next Tuesday. The last report was that only 169,000 jobs were created in August, falling short of the consensus forecast of 180,000. But more troubling, the prior report for July was slashed to 104,000 jobs from the original report of 162,000.

There’s still no word on when the delayed reports on the U.S. Trade Deficit, Retail Sales, Construction Spending, Industrial Production, and several others will be released.

But as they mix in with the regularly scheduled reports like next week’s updated look at the housing industry (existing home sales on Monday, new home sales on Thursday), along with durable goods orders and consumer sentiment on Friday, there are concerns about September, even before it’s known what effect the shutdown had on October.

So we can expect volatility to continue, with the economy and earnings taking over as the driving force until debt-crisis concerns return at year-end.

Luckily, another positive from the shutdown besides the delay in economic reports, is that markets no longer need be concerned about the Fed tapering back its QE stimulus. If the delayed economic reports confirm a worsening slowdown was underway even before the shutdown added its damage, the Fed could just as likely decide to provide more stimulus and liquidity to try to get it back on track rather than tapering back.

Then there is the history that the market tends to make most of its gains in the winter months. Will favorable seasonality help the Fed maintain an upward bias within the inevitable continuation of volatility?

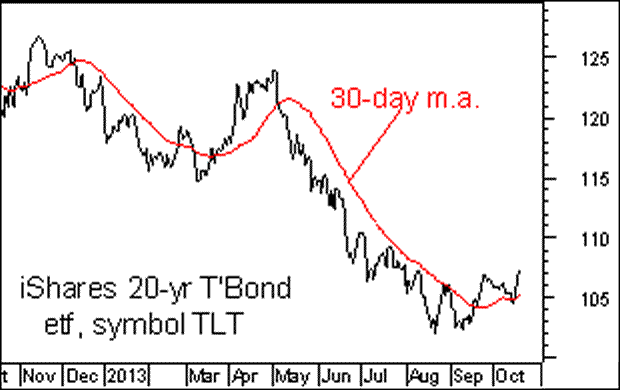

I’m still liking U.S. Treasury bonds and emerging markets as a hedge against the risk that remains in the U.S. market.

They have the added attraction of rallying off lows rather than trying to extend already record highs.

In the interest of full disclosure, I and my subscribers have positions in both TLT and VWO, in addition to positions in the U.S. market.

Sy Harding is president of Asset Management Research Corp., and editor of the free market blog Street Smart Post.

© 2013 Copyright Sy Harding- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Sy Harding Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.