U.S. Government Shutdown Synopsis And Which Payment Are Due When

Politics / US Politics Oct 15, 2013 - 12:05 PM GMTBy: Sahil_Hafeez

Shutdown synopsis - Here's a summary of where things stand:

Shutdown synopsis - Here's a summary of where things stand:

October 1 - Day 1 of the administration shuts down. The news shows veterans who can't visit the WWII Memorial, and cancer patients who can't advantage treatment trials at the National Institute of Health.

October 2 - House Republicans send a bill to the Senate that finances national parks, and veterans' programs.

October 3 - Obama approaches the House to carry the Senate's "clean continuing resolution" to a vote.

October 4 - Speaker Boehner recognizes interfacing a complete budget negotiation with raising the debt ceiling.

October 5 - Defense Department gets back to regular civilian employees to work.

October 6 - Boehner won't finance government or raise the debt ceiling without a budget negotiation.

October 7 - Republicans utilize the debt ceiling and discretionary budget process to cut spending on Medicare, Medicaid and Obamacare. These are all Mandatory programs, and not subject to the twelvemonth budget process.

October 8 - The shutdown influences veterans, and food safety. Obama says he will negotiate a budget, however not with "the threats of an administration shutdown or economic chaos over the leaders of the American individuals."

October 9 - President Obama assembles for conferences with House Democrats and House Republicans.

October 10 - House Republicans meet with President Obama.

October 11 - Republicans consent to debt ceiling and conceivably revive government in return for budget talks with the President and Democrats.

October 12 - House Republicans surrender negotiated with the President, moving the load of result onto the Senate.

October 13 - Senate Democrats need a one-year extension of the debt ceiling and easing of sequestration cuts.

October14 - Senate talks split up as fears grow develop over markets' reaction.

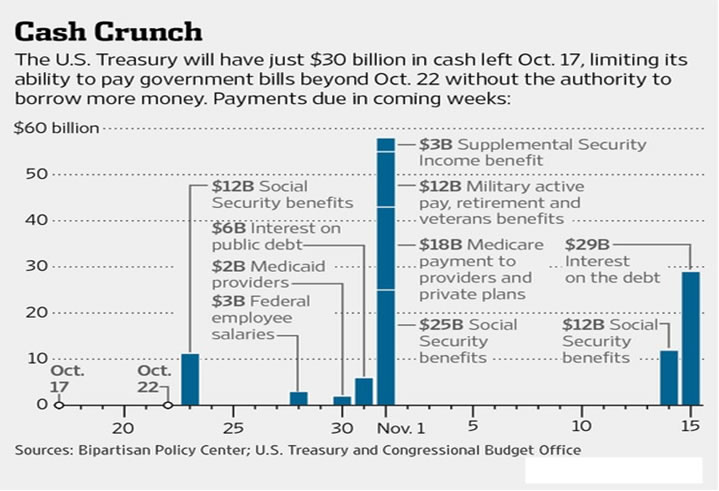

The Treasury Department says it could begin defaulting on U.S. commitments after Oct. 17. Different evaluates propose it could be weeks until the U.S. achieves that focus. Key dates that investors and policy makers are viewing:

Oct. 17

What happens: The U.S. will debilitate crisis measures it has utilized since arriving at the $16.7 trillion debt limit in May. By this date, it hopes to have just $30 billion of cash and any incoming tax revenue to pay commitments. Unanticipated that evening, the government moves over, or replaces, $120 billion in maturing debt.

Why it matters: Missing the publicly established due date could shake investors and reduce the appetite for some debt, as the potential for a default draws closer.

Oct. 22

What happens: The first day the government could begin missing payments, as per examiners at the Congressional Budget Office and Bipartisan Policy Center.

Why it matters: Passing this date could be seen in markets as the begin of a more serious emergency.

Oct. 23

What happens: $12 billion in Social Security payments due

Why it matters: It is the first of numerous huge approaching payments. The Obama administration hasn't said openly if it is practical to pay Social Security beneficiaries while skipping other payments.

Oct. 24

What happens: A rollover of anyhow $93 billion in maturing debt, as per the Bipartisan Policy Center.

Why it matters: Investors could need higher interest rates on any debt, raising the cost to the U.S.

Oct. 28

What happens: Payment due on $3 billion in federal workers' salaries.

Why it matters: The halfway government shutdown has made remains skeptical about which employees will be paid and when. A month long shutdown is unrealistic to defer the date of a U.S. default by more than a few days.

Oct. 30

What happens: $2 billion in payments because of Medicaid providers

Why it matters: Missing the payment might throw question about the capacity to keep up backing for the medical services program in the close term.

Oct. 31

What happens: $6 billion interest payment due; the rollover of in any event $89 billion in maturing debt.

Why it matters: It will test if the administration might prioritize payments to debt holders over different commitments. Oct. 31 is likewise the last date of the CBO’s run for when the administration might even now have cash accessible to continue paying bills.

Nov. 1

What happens: $55 billion in Medicare, Social Security and military payments due

Why it matters: By this date, the Bipartisan Policy Center gauges the administration might have depleted any remaining reserves and would have to default on other payments.

Sahil Hafeez, CFA, FRM, MBA

Financial Analyst

Financial Analyst

sahilhafeez@ymail.com

Qualifications: MBA, CFA, FRM

Current City: Hong Kong

© 2013 Copyright Sahil Hafeez - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.