How Do Social Media Companies Like Facebook and Twitter Make Money

Companies / Internet Oct 11, 2013 - 12:44 PM GMTBy: Money_Morning

Tara Clarke writes: Over the last month we've seen Facebook's (Nasdaq: FB) dramatic share price rebound, Twitter's stock IPO announcement, and LinkedIn (NYSE: LNKD) stock on fire, but have you ever wondered... how do social media companies make money?

Tara Clarke writes: Over the last month we've seen Facebook's (Nasdaq: FB) dramatic share price rebound, Twitter's stock IPO announcement, and LinkedIn (NYSE: LNKD) stock on fire, but have you ever wondered... how do social media companies make money?

To find out, we turned to Money Morning E-commerce Director Bret Holmes. Part of Holmes' job is to utilize web advertising via social media platforms to best market Money Morning. As a result, he's on top of what's going on inside of today's social media giants.

Holmes said the key to unlocking value for social media companies is successful advertising models.

"Social media companies are legitimate advertising websites, no different than, say, Google or Yahoo. The same way Google made its money is the same way Twitter and Facebook will make their money," Holmes explained.

Web advertising is a growing market. In a 2013 Nielsen report, data showed that 89% of advertisers use free social media advertising, and 75% use paid social media advertising. The report also highlighted that 64% of advertisers expect to increase their paid social media advertising budgets over the course of 2013.

That means a lot of opportunity for social media companies to make major money.

The trick for social media companies looking to profit as ad platforms is to find the best way to insert advertising into the user's experience without impacting the user in a negative way.

For any doubters out there who don't believe that advertising methodology is hugely important to investing in social media stocks, take heed...

In late July, Facebook announced that mobile ads account for a whopping 41% of its $1.6 billion second quarter ad revenue. Facebook shares closed at $26.51 that day. But in after-hours trading, shares skyrocketed to nearly $31.

It's clear that advertising plays a huge role in a social media company's value - and the success of social media stocks.

To learn how to gauge which companies will succeed, here's how social media advertising actually works...

How Social Media Companies Make Money: A Lesson from Facebook

The Facebook initial public offering (IPO) was an unmitigated disaster. It lost more than half of its value within six months of listing and was priced at 107 times trailing 12-month earnings, making it pricier than 99% of all companies in the S&P 500 at the time.

But boy did it rebound.

From July through September, the Facebook stock price has more than doubled. On Sept. 30, it hit an all-time high of $51.5 a share, putting it $13.5 over its IPO price of $38.

It was advertising that undoubtedly turned the tides for Facebook.

"Facebook has gotten really good at advertising. It's new, it's inexpensive, and it's smartly done," Holmes said. "When Google first started, it wasn't good at advertising, and look at them now. Facebook is going to be a success story."

Here is what Facebook did to unlock its value and become what Holmes described as "the most advantageously competitive product on the market for advertisers, hands down"...

Originally, Facebook started with space ads. Then, it added self-promoting individuals' or a company's Facebook page. But things were still sluggish.

However, about nine months ago, Facebook developed a new advertising format.

"Facebook has integrated in-stream ads to the user experience. Response rates are high and advertisers will always chase the least expensive ad with the best response. It works because it's new and cheap," said Holmes.

In-stream ads can be videos. For instance, a commercial will appear before the user may watch an Internet video. The in-stream video ad will typically last 15-30 seconds.

On a social media site like Facebook, which has real-time update feeds, in-stream ads can be inserted into a streaming feed. So, for example, the user scrolls through the News Feed to see what friends and family are up to, and in-stream ads are peppered into the Feed.

By far the largest social network, Facebook saw over $1 billion in ad revenue at the beginning of 2013, and it's getting better at integrating ads into its News Feed.

"Recently, Facebook let advertisers access FBX, an ad exchange where you can customize your own ads," explained Holmes. "Now we can glean information and better target our audience. We can also advertise on mobile now."

The ad model is helping Facebook monetize its massive 1.15 billion users who increasingly access the site via mobile devices.

And to top it all off, Facebook continuously improves its method to provide performance-based analytics that are invaluable to advertisers.

Watching Facebook's advertising Cinderella story shows us a great deal about how advertising makes money for social media companies. Having taken a glimpse into the past, we can now see if Twitter - and its stock - will have the same success...

Twitter Stock Success Hinges on Ad Model

Just on Sept. 12, Twitter filed its IPO. And according to Holmes, its advertising will have to improve to make it a viable success.

"Twitter is going to start off similarly to where Facebook did last year," Holmes said. "Advertisers aren't flocking to Twitter. I'm sure it will try outside ads, and that will probably yield good results, but unfortunately for Twitter, it just doesn't have the right demographic."

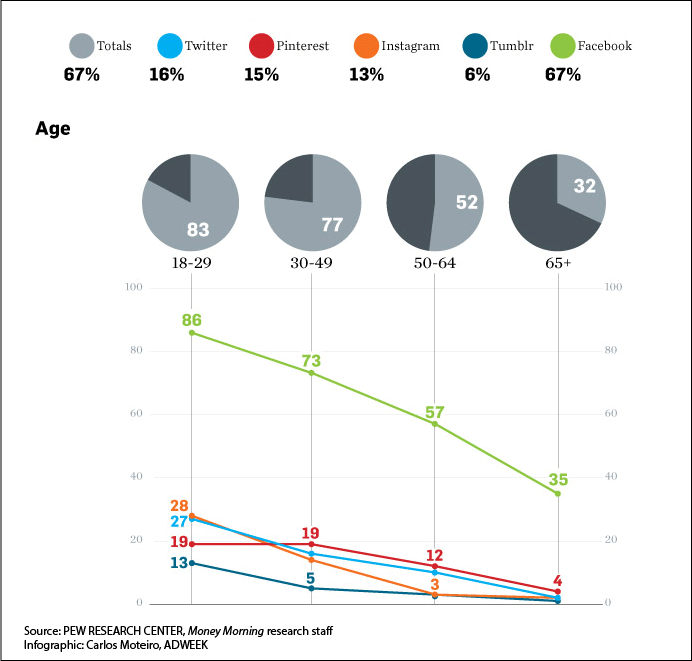

According to an August study released by nonprofit research company Pew Internet, Facebook not only has by far the largest user base, but it also reaches an older demographic.

When compared to other social media sites, Facebook blows away the competition - as shown in this chart by Adweek.

Reaching an older demographic means you're reaching more users who click ads. According to PaidContent.org, women over the age of 50 have a 22% click rate, significantly higher than any other demographic.

"If Twitter can tweak its advertising and reach an older demographic, it will get closer to the kind of profitability that has fueled Facebook's rise over the last four months," Holmes noted.

Just yesterday, the Twitter IPO became official - the U.S. Securities and Exchange Commission filing was revealed to the public. The symbol is to be TWTR, though no exchange, pricing, or share information has been listed yet.

But will Twitter's IPO bomb like Facebook's?

Here are 5 reasons why we think it won't...

Source :http://moneymorning.com/2013/10/04/how-do-social-media-companies-make-money/

Money Morning/The Money Map Report

©2013 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Money Morning Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.