Gordon Gecko Moved To London To Finish Where He Left Off

Politics / UK Politics Oct 08, 2013 - 05:08 PM GMTBy: Raul_I_Meijer

Last week I saw a headline in the Daily Telegraph that got me thinking. It encapsulates a lot of what poses as philosophy in our world today, as a valid way of thinking and a relevant approach to all the crises we live through simultaneously at the moment. One which, when you look longer and closer, appears at least at first glance to lack all philosophical value - since it doesn't actually weigh any pros and cons -, and turns out to be a rehash of a hodge-podge of the very failed old theories that have led us into our crises.

Last week I saw a headline in the Daily Telegraph that got me thinking. It encapsulates a lot of what poses as philosophy in our world today, as a valid way of thinking and a relevant approach to all the crises we live through simultaneously at the moment. One which, when you look longer and closer, appears at least at first glance to lack all philosophical value - since it doesn't actually weigh any pros and cons -, and turns out to be a rehash of a hodge-podge of the very failed old theories that have led us into our crises.

When I read Cameron: Profit Is No Longer A Dirty Word , I immediately had one image in mind: Gordon Gecko. Greed is good. Which is of course just another way of saying "Profit Is No Longer A Dirty Word". My initial reaction at The Automatic Earth's Facebook page was:

Well, what do you know, Gordon Gecko is alive and well and he lives at 10 Downing Street. Wonder where he went since we last saw him. Hang out with the rest of the zombies? Gordon Gecko gave the world one financial crisis, and he's hellbent on giving us another one.

Our problem is, these days you don't get to rise to power where we live until you're a fully certified assclown. Profit has of course never been a dirty word, unless the profit has been gained by dirty means. I'd suggest we keep it that way. As for "land of opportunity", that term's too arcane to be true, and it never referred to Britain to begin with.

But assclowns specialize in distorting basic instincts, and then appealing to them. So in the UK, we're back to stomping on the poor, and the poor will vote to be stomped upon.

Gordon Gecko's first installment 26 years ago was symbolic of a change of ideas. The Reagan and Thatcher years had given birth to Greed is Good, and Gecko merely served to put it into words. It's certainly no coincidence that he appeared on the scene at the same time Alan Greenspan did. Who just a few years later with Bob Rubin and Larry Summers fought for - and won - the deregulation of huge segments of the financial sector, in particular the derivatives sector that was coming of age.

Large scale privatization of what were once considered public assets, the demise of unions, and rapidly developing globalization: the financial system had started buying into the political system for real, opening up the public coffers to its cold and greedy fingers, and it never looked back. It wasn't even much of a fight when it happened because a fight requires two opposing parties, and there was no such thing any longer in politics. The appearance of the likes of Bill Clinton in Washington and Trojan opportunist Tony Blair in Britain made that a done deal. Money had won. And it's still winning.

You don't have to lean any which way politically to understand that this is a problem for any democratic society. There are still voices criticizing some of the consequences it all leads to, and where it's al going, but they've been pushed into the fringes of what we once thought of as both left and right, where they're conveniently labeled out-of-touch libertarians and commies. In the center of power, the division between left and right only exists anymore to serve as a kind of spectator sport, to fool the public into thinking they still have a valid choice and a meaningful vote to cast. The current shutdown in the US is nothing but another piece of theater performed for this purpose. Capitol Hill will do what Gordon Gecko tells it to. He owns the Hill.

You don't have to adhere to any left or right view to see why and how this is a huge potential problem for a democracy based on capitalism. And you don't have to even be able to spell Karl Marx' name to recognize that there are two main groups in such a system: the richer and the poorer. Broadly speaking, these two groups will divide into two political views: the richer who want to protect what they own, on the right, and the poorer who want what they perceive as fair compensation for their labor (provided they can find work), on the left. In order to maintain a viable balance between the two, you will need both to either merge their interests (which they can't), or to share political power by alternating governments every few years. If that doesn't happen, democracy is in danger, and Gordon Gecko is no worse of a threat in that sense than Vladimir Lenin: give either side too much power and they will end up abusing it and develop dictatorial traits.

But let's return to the practical side of things. David Cameron, in the article with the headline I quoted above, has this to say, according to the rightwing Telegraph interpretation:

Cameron: profit is no longer a dirty word

David Cameron will offer a wholehearted defence of British business, arguing that only successful companies can make the country a true "land of opportunity" .

The Prime Minister will say that profit is not a dirty word, insisting that moneymaking businesses are the only source of wealth and employment. He will also appeal to voters to elect an all-Conservative government in 2015, hinting at frustrations over his coalition deal with the Liberal Democrats.

Mr Cameron's speech to the Conservative Party conference on Wednesday is a direct response to Ed Miliband, the Labour leader, who spoke out against big companies, especially energy firms. The Conservatives have hesitated over how to respond to Mr Miliband's populist attack on big companies, which has seen Labour's poll ratings rise in recent days.

[..]

Oh, the sweet foul smell of politics. As I said: "distorting basic instincts, and then appealing to them". Profit has never been a dirty word in our capitalist societies (unless it consists of dirty money, ill-gotten gains). But Cameron still claims it has. His opponent's suggestion had been to freeze energy prizes for 20 months. And that proved a popular idea in the polls. So Cameron's (or rather his speechwriter's) riposte is to drag that into some sort of communist territory. Which he hopes will appeal to people's fears of Soviet Russia, the one place where profit might have been a dirty word. And undoubtedly for many voters this distortion works. They may even tolerate the ill-gotten gains just to stave off the threat of communism.

The fact that his American speechwriter come up with the term "land of opportunity" is plain hilarious, since America stopped being that land a long time ago; just look at upward mobility numbers, income equality, or check where the US education system stands compared to other nations. But plenty of Brits will buy into that pipedream as well, just like many Americans still do. Just because it sounds so good.

It's funny to see items like profit, enterprise and tax cuts mentioned as "equal partners". We all understand that business profits will rise if they pay less taxes, but not necessarily why the two are thrown together. Is British industry so weak that it needs its workers to cough up - part of - its profits? Or are UK business taxes simply so exorbitantly high? Wait, that reminds me of something:

George Osborne told to bring in flat tax to help middle income families

[UK Chancellor] George Osborne is being urged to bring in a simple flat tax system after it emerged that some middle income families are paying an effective rate of 73% because they have been stripped of their child benefit.

Simon Walker, the director general of the Institute of Directors, said that such large "marginal" tax rates on hard pressed families who are struggling to make ends meet "degrades the motivation to work". "This is a huge disincentive as it is for beneficiaries on the lowest wages – some of them can be paying 70%, 75%."

Hmm. You may now be excused for wondering how Cameron et al. are planning to pay for those business tax cuts. Not by burdening the upper classes, that would be blasphemy in their books. Not the middle class either, when rates are always at 75% there. That seems to leave only one group:

George Osborne signals spending cuts for next seven years

The chancellor, George Osborne, warned on Monday that austerity may continue until 2020 as he set out plans for a new fiscal mandate that will require further welfare cuts to build an overall budget surplus by the end of the next parliament.

In his keynote speech to the Conservative party conference in Manchester, he said the budget surplus, a post-war rarity for UK governments, could be achieved without raising taxes, but added: "We have to confront the costs of modern government and cap working age welfare." [..]

David Cameron wants tax breaks for UK companies, especially those that export. Which is perhaps kind of strange to begin with, since if they could be relied on to shoulder Britain's "rebirth", why do they need subsidies? And there's more: Cameron wants to hand out money to industry, but he also wants to cut the nation's deficit. There's only one way left to do that: cut what he suggestively labels "welfare". Take money from the poor and hand it to the rich. Who will then, so the thinking goes, generate money for the poor in return. By creating jobs and economic growth etc..

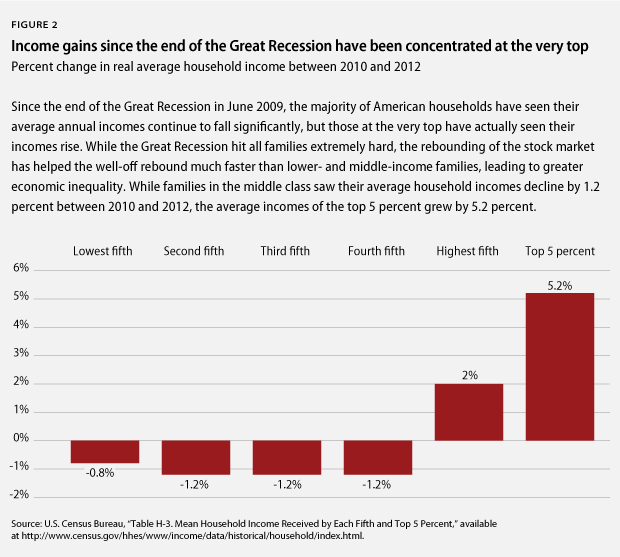

Now there are multiple problems with that, but one sticks out for me at this point. That is, the trendline is that income inequality has grown, and widened, in the UK, the US, all over the western world. All income growth over the past years has gone to the top 10% or so, and Cameron doesn't as much as hint at wanting to change that. So even if his scheme would work, what exactly would be good about it for the 90%? Wouldn't any and all potential growth simply keep going to the same 10%? What is there to break that trend? The Center for American Progress recently published a few graphs for the US:

The picture is the same whether you look at a short-term trend:

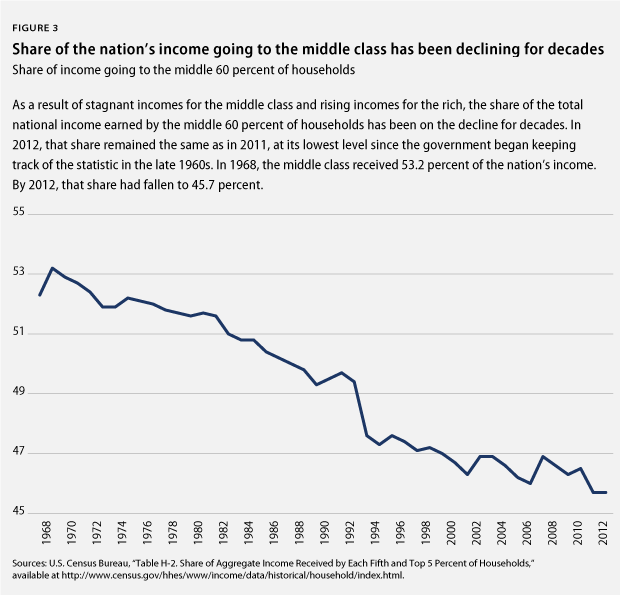

Or a long term one:

Once again: why would this trend, which has been going on since 1968(!), break even if the British government's ideas work out? Especially since they don't provide one single indication that they're even aware of, let alone concerned by, the trend? It has Gordon Gecko written all over it. Let's look at what their plans are - as seen through the eyes of the Telegraph:

Last week in Manchester, the Prime Minister made a staunch and very welcome defence of business, pointing out that it is companies which provide the high-value jobs we need.

He was right to emphasise that the UK must compete in high-end manufacturing, design and engineering excellence because our competitors are not just China and other emerging markets, but also Germany and California. He was also right to highlight the importance of trade and how the UK is once again selling to the world.

But, behind the political positioning, what is the real picture and how much closer are we towards the Chancellor's target of getting 100,000 more companies exporting and a doubling of our exports to £1 trillion by 2020? [..]

The average contribution of net trade to growth from 2010 to 2013 has been minimal, and was lower than some of our key European competitors, including Spain, Italy and France. Furthermore, achieving the £1 trillion target requires exports to grow by 9.2% per annum from 2013.

Oh boy, that sounded so good in the first two lines, when it was just abstract stuff, didn't it? But alas, what a fall it made in the second part! Over the past three years, UK exports have contributed less to GDP growth than those of Spain and Italy. No mean feat... And to achieve that lofty target of £1 trillion in exports, these will need to rise by almost 10% every year between now and 2020 (miss one year and you're over 10%).

Moreover, 100,000 additional (!) British companies will need to start exporting their products and/or services, something that would presumably involve the additional (?) efforts of well over 1 million workers.

And all those 1 million+ workers would have to do to make these dreams come true is to work harder and smarter than the Chinese, be more efficient than the Germans - at high-end manufacturing -, and more innovative than California. While, mind you, seeing any benefits they now enjoy, which their government deems worthy of labeling "welfare", be cut; that's what's supposed to pay for this new-found "land of opportunity".

It's exactly the same thing Obama wishfully projected a few years ago for America: a doubling of exports within 5 years. And China might have a revolution if it only managed a doubling. Question for all parties is, as it was Obama spoke, who’s going to buy?

Meanwhile, that same government has more great ideas. Say what you will, but they ain't sittin' still. They've already declared themselves something akin to the staunchest supporters of greenability (yes, I just made that word up) in the history of the planet, without having much if anything to show for it. I'd be curious to know how they plan to combine their sustainability stance with those extra 100,000 companies producing for exports, though. Should be interesting.

Then of course there's the pledge to "make Britain's tax regime the most generous for shale in the world", as I detailed in London Is Fracking, And I Live By The River. I also explained in that piece how nonsensical a pledge that is. Which makes it nice to see Anglo/Dutch oil behemoth Royal Shell CEO Peter Voser confess in the Financial Times that his deepest regret is the company's $24 billion investment in US ... shale.

At some point, someone might get the idea that what Cameron et al want is to dole out tax breaks and subsidies to their buddies, not to help - all of - Britain recover. Just saying. I mean, look at the next example, the sell-off of Royal Mail. The Guardian's Alex Andreou finds it as puzzling as I do:

The Royal Mail sale is grotesquely illogical

"There's no way we will sell Royal Mail 'on the cheap,'" promised the government in its "myth-busters" factsheet. Yet this is precisely what it is doing; the valuation is believed by many experts to be on the embarrassingly low side. Experts from Panmure Gordon say that its lower value estimate of £2.6 billion could be undervalued by up to £1.9 billion pounds, or over 40%.

Labour points out that the valuation does not seem to include up to £1 billion of property assets – such as the Mount Pleasant or Nine Elms sites in London. Add to this that Royal Mail has an accumulated backlog of tax credits of about £2.8 billion, which means that it is expected not to pay any tax for between five and 10 years. And here is the kicker – not only is this government selling the service significantly under any sensible valuation, it is retaining its biggest liability – pensions. Why wouldn't there be frenzy for its undervalued, no-strings-attached shares?

This is privatization the way Maggie Thatcher intended it. Under the guise of the private sector being much more efficient, a presumption that hardly ever holds up, public assets are sold at lowball valuations, and in this case the public is even invited to invest their own money back into what they already owned in the first place, but for which large financial players will now call the shots, not the government. What's that called, bait and switch?

And then there are Cameron and Osborne's grand plans to "heal" the housing market. With names like Funding for Lending and now Help to Buy, what could go wrong? First, here's a summary of what it means.

Help to Buy scheme has been brought forward – here's how it works

David Cameron has announced stage two of mortgage scheme will be launched within days, three months ahead of schedule. The scheme announced by George Osborne in March's budget is the Treasury's attempt to encourage banks and building societies to offer mortgages to homebuyers with small deposits for properties of up to £600,000.

The first part of the scheme began in April. It allowed first-time buyers, and movers who want to purchase a new-build house or flat, to borrow 20% of the property's value from the government. Those loans were interest free for the first three years; all borrowers needed was a 5% deposit and a 75% mortgage.

• So how is phase II different? It will see taxpayers underwrite up to 15% of a mortgage for loans where a buyer has only a small deposit, of 5% (or more) of the property's value.

Lenders who want to offer mortgages of up to 95% loan to value (LTV) but do not want to take on all of the risk will be able to buy a guarantee [valid for up to seven years] from the government for up to 15% of the loan. This allows the lender to claim on the guarantee if the property is ever repossessed and sold at a loss. [..]

• What if the property goes into negative equity? The guarantee will not help the buyer or lender if the property falls in value. It only kicks in if the borrower falls into difficulty with the mortgage and their home is repossessed. [..]

• What type of properties can they buy? The scheme is available on both new and existing homes costing up to £600,000. [..]

• How will people apply? It is possible that borrowers will not know that they are applying for a loan through this part of the Help to Buy scheme as the guarantee will be bought by the lender and the deal could happen behind the scenes – lenders might just advertise 95% loans with no mention that they are being backed by the taxpayer.

• Won't the scheme push up house prices? The cost of a home has been rising steadily since the chancellor announced Help to Buy.

For anything that could go wrong, Cameron, while claiming he himself is just helping out the little man, has made new Bank of England governor Mark Carney responsible:

Cameron Says Help-to-Buy Will Fix Broken U.K. Mortgage Market

U.K. Prime Minister David Cameron defended his decision to bring forward the Help-to-Buy program by three months, saying there were “very robust” controls in place to prevent a housing bubble. “The mortgage market today isn’t working,” Cameron said [..] . “There’s a market failure going on which the government is helping correct.”

[..] “The controls in place with the Bank of England are very, very robust,” Cameron said today. The current system only allows people to buy homes if they have rich parents and that “is simply not fair,” he said.

So the government's story is that because of the BOE controls in place, blowing a new bubble, which apparently is just about everyone's fear but Cameron's, is not possible. In the end, of course it all depends on what one's definition of a bubble is.

Fastest house-price rise in three years fuels bubble fears

House prices rose at their fastest rate for more than three years in the three months to September, the Halifax said today, adding to fears the Government’s Help To Buy scheme could create a price bubble. Halifax said prices rose nationally by 6.2% in the period against a year earlier. Month-on-month prices grew by 0.3% to their highest for five years.

[..] The Bank of England has repeatedly said that it will intervene if its sees real signs of a housing bubble starting, and has been given greater powers by the Treasury to do so. Governor Mark Carney said last night that the Bank now had a “range of tools” it could use to ensure that the housing market “isn’t in a boom and then bust phase”.

Halifax suggested there was evidence the market was starting to unlock. Ellis said: “There are signs that supply is beginning to respond to the pick-up in demand, which if continued should help to constrain the upward pressure on prices.

“The recent strengthening in house prices is increasing the amount of equity that many homeowners have in their home, enabling more to put their property on the market for sale. Levels of housebuilding are also increasing, albeit from a very low base.”

Apparently, 6.2% in one year does not constitute a bubble. And neither does 25% in 5 years:

The average price of a home in Britain will jump by a quarter in five years to reach a record figure of nearly £280,000, a report predicted today. In London prices will rise even higher, from £395,000 today to £566,000 in 2018, according to the Centre for Economics and Business Research. Experts warn a generation of young people are being frozen off the property ladder by the crippling cost of homeownership at a time when the average full-time salary is £26,500.

I try to use the term "perverse" sparingly, which is not easy, because so much in our economies has been perverted one way or another, but this is a really good example. Cameron says it's not fair that only rich kids can buy houses, but his Help to Buy scheme in fact makes houses more expensive, which means the not-so-rich will now need to go deeper into debt to buy the same house, if they can still afford it at all. With an average full-time salary of £26,500, the £600,000 properties are off limits to them. Those will go to those same rich kids, who now can buy them at much more lucrative conditions, like a £120,000 interest free loan (about as much as the poorer can spend on an entire house).

So most of the booty will go to people who probably don't even need it, while the price jump the plan results in pushes the not-so-rich either off the market or deeper into debt than they would have been without it. Of course, the banks are happy with the extra spoils from the public coffers. I think I see a pattern here. And the next time Mr. Cameron mentions "free market", please laugh in his face. Free market means something different altogether.

Of course it's not just David Cameron and his people who re-enact the Gordon Gecko theme, though he's still a prime example. The entire western world, its governments and its economies have been taken over by the financial sector. Allow money to enter your political system and it will end up purchasing it outright. That's as good as any law of physics. Take any government you want in North America, Europe, and capitalist Asia: none act in the interests of their poorer citizens anymore. Even if one would insist on still calling them democracies, it should be clear they're severely out of balance. And that does not bode well. Even the Southern European countries, desolate and desperate as they are, play along, and how could they not, all their ruling politicians come from the financial industry.

The entire system has become very clever at spinning the stories into those it knows you want to believe. The banks need to be saved with trillions of dollars of your money or else all hell will break loose. And yes, that means bankers need to be paid bonuses every year that are larger than the income you will make in your entire lifetime. And now, 5 years later, look, the economy is recovering; it all worked out! Ain't you glad Gordon Gecko calls the shots? So your benefits are cut, and your salaries, and your pensions, but it's all your fault really, you're the one who's not working harder and smarter than the Chinese, more efficiently than the Germans, or invent more stuff than California. But it can only get better from now on in.

Don't despair, you will be made smarter and more efficient, if only you start working harder and for less pay and benefits. Gordon has it all under control. All you got to do is trust him.

By Raul Ilargi Meijer

Website: http://theautomaticearth.com (provides unique analysis of economics, finance, politics and social dynamics in the context of Complexity Theory)

© 2013 Copyright Raul I Meijer - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Raul Ilargi Meijer Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.