Japanese Yen USD Elliott Wave Forecast : Bullish Reversal Could Be Near By

Currencies / Japanese Yen Oct 07, 2013 - 03:15 PM GMTBy: Gregor_Horvat

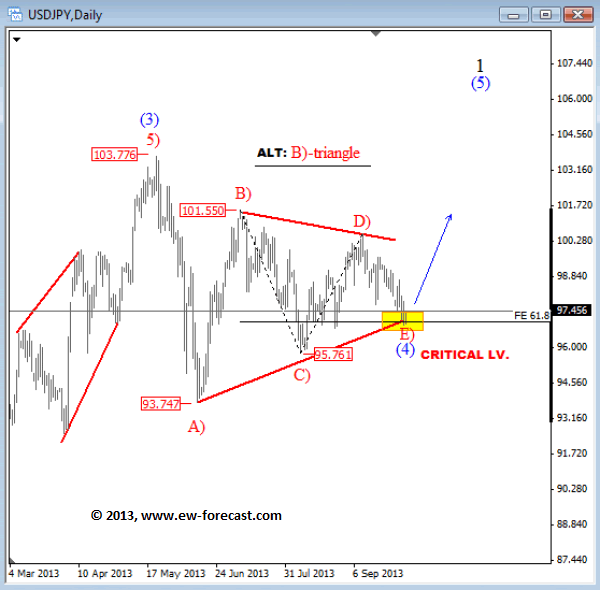

USDJPY did not accelerate to the upside yet, so it seems that we will have to wait on a bullish price action a little longer, As such, we adjusted the wave count and suspect that pair is in final stages of a wave (4) now. We however are still observing a triangle that should be near completion. We see wave E) down that could look for a bottom around 97.00 area from where we could reverse up in wave (5). An impulsive rally from current zone would be a confirmation for a new bullish period on USDJPY.

USDJPY did not accelerate to the upside yet, so it seems that we will have to wait on a bullish price action a little longer, As such, we adjusted the wave count and suspect that pair is in final stages of a wave (4) now. We however are still observing a triangle that should be near completion. We see wave E) down that could look for a bottom around 97.00 area from where we could reverse up in wave (5). An impulsive rally from current zone would be a confirmation for a new bullish period on USDJPY.

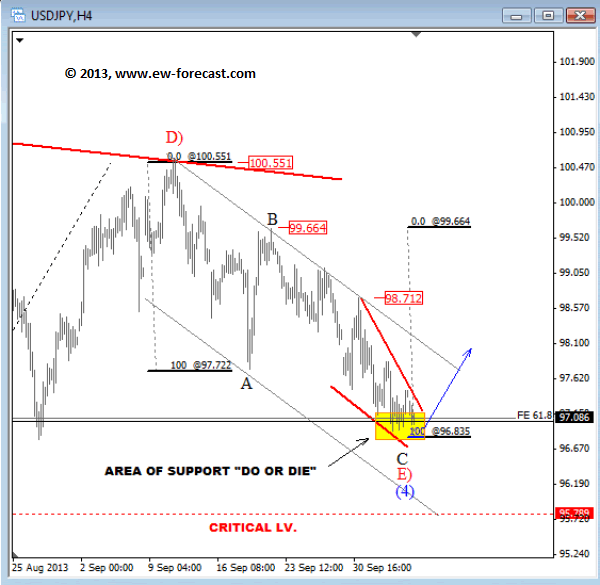

USDJPY 4h

On 4h Chart, USDJPY is still in bearish mode and testing 97.00 level where we see some very important Fibonacci levels that could react as a strong support for the pair. In fact, we are tracking wave E from 100.55, which is a final leg within larger fourth wave triangle so bullish reversal could be near, and should not be a surprise if we consider that decline from early September is looking corrective in nature with its overlapping wave structure within corrective channel., labeled now as a simple A-B-C move.We however need an impulsive bounce in price back to 98.70 swing high to confirm low in place.

USDJPY Intraday

On Intraday Chart USDJPY we see a wedge shape formation that has taken place in the last few days that could be an ending diagonal. This pattern occurs at the end of a larger trend, and usually predicts a strong reversal in trend. It’s also important to know that each leg of an ending diagonal is made by three waves. For now we have a textbook example of this structure. If our bias is correct then pair is now in wave (v), final leg of an ending diagonal that could find a support around 96.60/96.80. Pair on the radar screen!

Written by www.ew-forecast.com | Try our 7 Days Free Trial Here

Ew-forecast.com is providing advanced technical analysis for the financial markets (Forex, Gold, Oil & S&P) with method called Elliott Wave Principle. We help traders who are interested in Elliott Wave theory to understand it correctly. We are doing our best to explain our view and bias as simple as possible with educational goal, because knowledge itself is power.

Gregor is based in Slovenia and has been in Forex market since 2003. His approach to the markets is mainly technical. He uses a lot of different methods when analyzing the markets; from candlestick patterns, MA, technical indicators etc. His specialty however is Elliott Wave Theory which could be very helpful to traders.

He was working for Capital Forex Group and TheLFB.com. His featured articles have been published in: Thestreet.com, Action forex, Forex TV, Istockanalyst, ForexFactory, Fxtraders.eu. He mostly focuses on currencies, gold, oil, and some major US indices.

© 2013 Copyright Gregor Horvat - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.