What NIKE’s Earnings Could Reveal About This Proven Wealth Creator

Companies / Corporate Earnings Sep 26, 2013 - 02:17 PM GMTMitchell Clark writes:

One important company that reports its latest earnings this afternoon is NIKE, Inc. (NKE). This company is very good at making money for shareholders, and it should be on every long-term investor’s list to consider when it’s down on the stock market. NIKE has proven itself to be an excellent operator, even in the face of persistently slow economic growth.

It’s very difficult these days to find consistent wealth creators. You need an underlying business that continues to stay ahead of the marketplace, and you need financial metrics that consistently keep institutional investors happy. The combination of factors required to produce both is difficult for any company to maintain. So far, NIKE’s been pretty good at it.

Today, NIKE reports on its fiscal first quarter of 2014. In its previous quarter, the company generated seven-percent growth in revenues to $6.7 billion. Fully diluted earnings per share grew an impressive 27% to $0.76. Cash and short-term investments swelled, and for all of fiscal 2013, the company bought back 33.5 million shares for $1.7 billion.

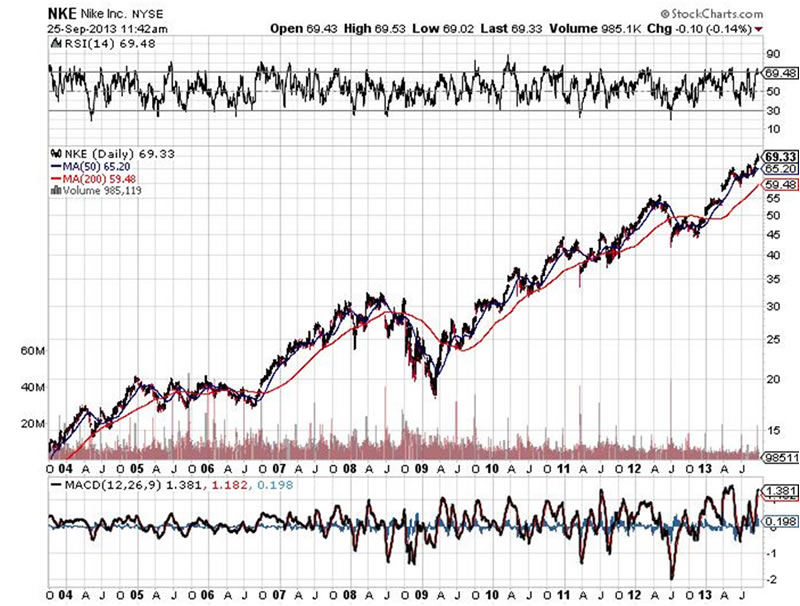

It would not surprise me at all if NIKE boosted its quarterly dividend once again. The company’s 10-year stock chart is featured below:

Chart courtesy of www.StockCharts.com

I’ve always found it kind of odd that the running shoe business can continually be so successful over time, but it is for NIKE. Several Wall Street analysts recently boosted their earnings estimates on the company for its fiscal first quarter of 2014 and fiscal year 2014.

I believe a company like NIKE is a worthwhile buy as a long-term holding when it’s down on the stock market. As a proven operator, this position isn’t typically down for long, and this is more so because of market-related trends than operational weakness. (See “Why Corporate Earnings Are Taking a Back Seat to the Fed.”)

I like proven and consistent wealth creators like this company. It might be a mature, old-economy type of business, but consistency of return on investment is a valuable thing. While you can’t predict the future, NIKE has proven in the past that it can deliver.

I would say that this stock is fully priced right now. But it typically is because it just keeps growing. Last quarter, NIKE noted that it experienced sales weakness in Western Europe and Greater China. But it still managed to generate a solid gain in revenues, which for many other companies of the same size, is no longer achievable.

I look forward to reviewing NIKE’s numbers and its form 10-Q, which is much more revealing.

This year’s stock market leaders are highly likely to continue to be next year’s market leaders. Blue chip leadership is alive and well, and a company like NIKE, which is a mature business and brand, certainly might experience a slow quarter every once in a while. But the company’s track record, to me, is very meaningful. Even though the stock is at an all-time high, I wouldn’t bet against this enterprise.

Source -http://www.profitconfidential.com/stock-market/what-nikes...

Michael Lombardi, MBA for Profit Confidential

http://www.profitconfidential.com

We publish Profit Confidential daily for our Lombardi Financial customers because we believe many of those reporting today’s financial news simply don’t know what they are telling you! Reporters are trained to tell you the news—not what it can mean for you! What you read in the popular news services, be it the daily newspapers, on the internet or TV, is the news from a “reporter’s opinion.” And there’s the big difference.

With Profit Confidential you are receiving the news with the opinions, commentaries and interpretations of seasoned financial analysts and economists. We analyze the actions of the stock market, precious metals, interest rates, real estate and other investments so we can tell you what we believe today’s financial news will mean for you tomorrow!

© 2013 Copyright Profit Confidential - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.