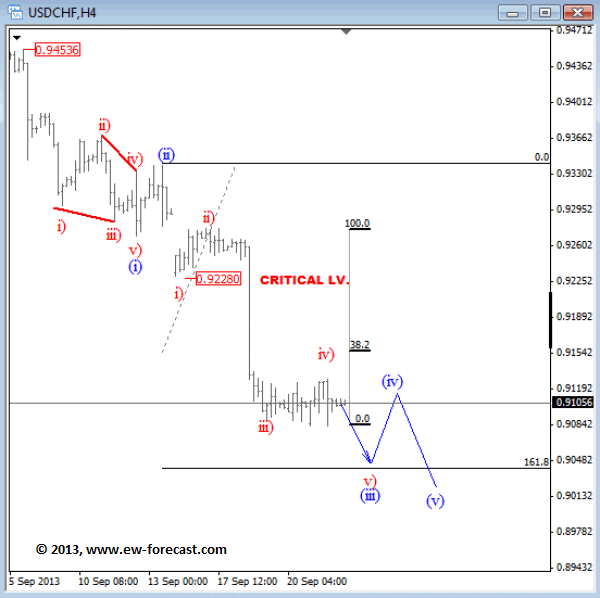

USD-CHF Bearish Waves Are Pointing Towards 0.9050

Currencies / Forex Trading Sep 24, 2013 - 03:39 PM GMTBy: Gregor_Horvat

USDCHF is showing some nice sharp downside price action after recent sharp fall to 0.9100 area which appears to be wave three of three of an impulsive structure. If that's the case then we know that market will move even lower in sessions ahead but after a completed fourth wave pull-back that is now in progress. Ideally pair will test 0.9150 area before downtrend resumes. Generally speaking trend is clearly bearish on the 4h time frame posted below and it will stay down as long as 0.9228 level is not breached because we know that wave four must not trade into a temerity of a wave one.

Impulse is the most common motive wave.

• wave 1 must be an impulse or a leading diagonal • wave 2 can be any corrective pattern except a triangle • wave 2 must not retrace more than 100% of wave 1 • wave 3 must be an Impulse. • wave 3 must be longer than wave 2 • wave 4 can be any corrective pattern (zig-zag, double or triple zig-zag, triangle, flat, double or triple three) • waves 4 must not trade into a territory of a wave 1 • wave 5 must be an impulse or an ending diagonal • wave 3 must never be the shortest wave when compared to waves 1 and 5.

Impulse extension

Most impulses contain what Elliott called an extension. An extension is an elongated impulse with exaggerated subdivisions. The vast majority of impulses contain an extension in one and only one of their three actionary subwaves.

The fact that extension typically occurs in only one actionary subwave provides a useful guide to the expected lengths of upcoming waves. For instance, if the first and third waves are about equal length, the fifth wave will likely be a protracted surge. Conversely, if wave three extends, the fifth should be simply constructed and resemble wave one. In the market, the most commonly extended wave is wave 3.

Written by www.ew-forecast.com | Try our 7 Days Free Trial Here

Ew-forecast.com is providing advanced technical analysis for the financial markets (Forex, Gold, Oil & S&P) with method called Elliott Wave Principle. We help traders who are interested in Elliott Wave theory to understand it correctly. We are doing our best to explain our view and bias as simple as possible with educational goal, because knowledge itself is power.

Gregor is based in Slovenia and has been in Forex market since 2003. His approach to the markets is mainly technical. He uses a lot of different methods when analyzing the markets; from candlestick patterns, MA, technical indicators etc. His specialty however is Elliott Wave Theory which could be very helpful to traders.

He was working for Capital Forex Group and TheLFB.com. His featured articles have been published in: Thestreet.com, Action forex, Forex TV, Istockanalyst, ForexFactory, Fxtraders.eu. He mostly focuses on currencies, gold, oil, and some major US indices.

© 2013 Copyright Gregor Horvat - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.