Getting Shocked by Utility Stocks

Companies / US Utilities Sep 17, 2013 - 03:39 PM GMTBy: Don_Miller

Retirees' portfolios need to be defensive, meaning they minimize risk but still have the potential for growth and income. Historically, this meant including a few widow-and-orphan stocks in your retirement portfolio—public utilities with nice dividends.

Retirees' portfolios need to be defensive, meaning they minimize risk but still have the potential for growth and income. Historically, this meant including a few widow-and-orphan stocks in your retirement portfolio—public utilities with nice dividends.

Utilities experience little volatility, their dividends are solid, and the demand for their product is constant, regardless of how well the economy is doing. Government regulation also gives them a leg up, since utilities face little competition. They set their rates, consumers pay up with little fuss because they have few alternatives, and the utilities turn a profit.

So, we at Miller's Money Forever wondered, is it time to add one or two utilities to our own portfolio? As I talked through the idea with our chief analyst, I could hear him clicking away on his keyboard in the background. A little research on a couple of utilities quickly put things in perspective. Had we bought in to Exelon (EXC) in early May at the wrong time, we almost would have been stopped out by a 20% trailing stop, since the stock fell as far as 19%. We were both shocked.

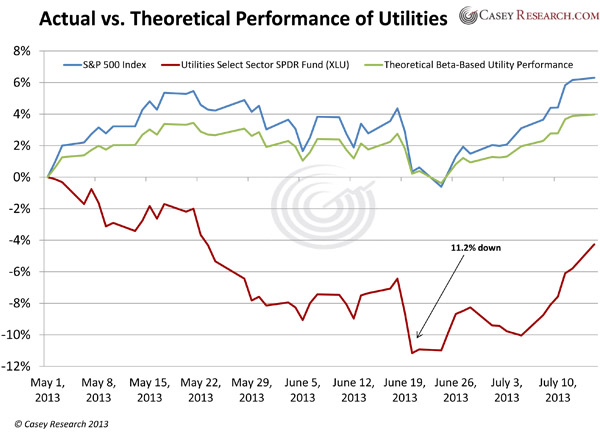

But that's only one utility. What about the sector as a whole? With a few more clicks, we learned that the Utilities Select Sector SPDR (XLU), a $5.4-billion exchange-traded fund of utilities, had fallen as far as 11% since the beginning of May. That's an enormous move in such a short period of time for what many consider a staple sector for retirement portfolios.

Wait a minute here! Utility stocks are supposed be the ultimate safe investment. They didn't earn the nickname "widow and orphan stocks" for being volatile, so what the heck happened?

History Does Not Guarantee Future Performance

We ran an in-depth analysis and came up with a bit of a history lesson for me to pass along. Let's start with where defensive stocks stood prior to the rapid rate increase in Treasuries. With yields near record lows, investors piled in to dividend stocks in search of income. But they didn't pick just any type of stock—they specifically chose defensive stocks with a beta of less than one. For a quick review, a beta of one means a 10% move in the stock market should theoretically move the stock 10%. A beta of 0.5 means a 10% move in the market should move the stock only 5%.

In addition to retail investors, more sophisticated analysts suggested moving in to these stocks as well. One of the most common Wall Street valuation models examines three primary factors: dividends, beta, and the US Treasury rate. When the beta and Treasury rates are low and the dividend is high, a stock is shown to be more valuable. Based on this model, a stock's value is more dependent on Treasury rates and the dividend than what often drives value: cash flows and growth.

In a nutshell, because there are no safe, decent interest-bearing investments available, many billions of dollars went into utility stocks. In some sense, utilities began to act like bonds. And when interest rates rise, bond prices fall. As a result, what was once considered the definitive stable investment is now interest-rate sensitive, just like long-term bonds.

In order to get a better visual of what's been happening, we tracked XLU's performance since May 1—a period of rapidly rising rates—and compared it to a theoretical beta-based utility performance as well as the S&P 500. With a beta of 0.63, XLU should move 6.3% whenever the market moves 10%. In many situations beta works well, but unfortunately, it doesn't capture every risk, including interest-rate risk.

The blue line traces the return on the S&P 500. The green line depicts how XLU theoretically should have moved based on its beta. The red line shows how it actually performed. Note the enormous difference, bottoming out as far as 11.2% down.

Although beta is typically used as a back-of-the-envelope measure of risk, it's not doing a particularly good job for utilities in a rising-rate environment. And while the S&P 500 has recovered from June's turbulence, utilities are still down for this period.

After I saw the data, I asked what we should expect in the future. While I suppose it makes little difference if a retiree is holding utility stocks for the dividends, utilities will likely lose value as interest rates rise. That could be a bit unnerving.

This could be a real problem for retirees, as it's common practice for investment advisors at major brokerage firms to put their more conservative investors in utilities. A seasoned veteran once told me that no broker ever got sued for putting clients' money into utilities. I wonder how many brokers and investment advisors have noticed the shift happening in utilities with higher rates.

In light of rising interest rates, we have refined our criteria for selecting solid and safe investments for the Money Forever portfolio. Unfortunately, not everyone was has caught on. Take a look at your portfolio to see whether you need to trim down your utilities exposure. Should the market crash, I'd rather be holding a utility than General Motors, but at the same time, if interest rates keep going up utilities will feel the pain.

I discussed this issue—as well as others facing retirees—in a very recent and timely online event called America's Broken Promise: Strategies for a Retirement Worth Living. This free event’s all-star cast explains the unique challenges retirees face today—challenges far different from what we were raised to expect.

The presentation is hosted by my colleague, David Galland of Casey Research, and features John Stossel, formerly on ABC's 20/20 and now with Fox Business Network, David Walker, former Comptroller General of the United States, Jeff White, President of American Financial Group, and me of course.

This is the one event you must see to ensure you retire on your own terms. Use this link to find out more and to sign-up.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Casey Research Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.