Why Wages Don't, Won't, and Can't Keep Up With Productivity

Politics / Social Issues Aug 26, 2013 - 06:01 PM GMTBy: Mike_Shedlock

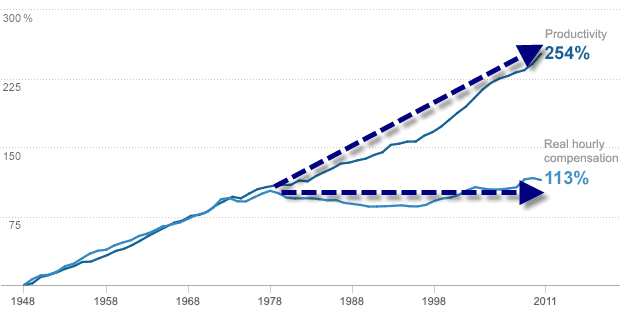

By now, everyone is well aware that real wages have not kept up worker productivity. But why is that?

By now, everyone is well aware that real wages have not kept up worker productivity. But why is that?

The Fed, government bureaucrats, and economists are puzzled by the phenomenon as well as what to do about it.

I can explain easily, but first let's zero in on what is happening.

Workers Don't Share in Companies' Productivity Gains

In stark contrast to the great American dream, CNN notes Workers don't share in companies' productivity gains.

Companies are on a tear in terms of productivity and profits, but they aren't sharing much of the gains with their workers.

The gap between hourly compensation and productivity is the highest it's been since just after World War II. This divergence is one of the major drivers of the nation's growing income inequality.

"A bigger share of what businesses in the U.S. are producing is going to the owners of the firms and the people who lent money to the firm, and a smaller share is going to workers," said Gary Burtless, senior fellow in economic studies at The Brookings Institution.

Productivity, which measures the goods and services generated per hour worked, rose by 80.4% between 1973 and 2011, compared to a 10.7% growth in median hourly compensation, according to the left-leaning Economic Policy Institute, which crunched the numbers last year.

Real Wages vs. Productivity

CNN states "Global competition and national deregulation have kept compensation down, while the decline of union power weakened workers' ability to bargain for higher pay."

Where Did the Productivity Go?

Is the demise of unions and deregulation really the story? The answer is "no", but first consider superficial analysis by Paul Krugman in Where The Productivity Went.

Where did the productivity go?

The answer is, it's two-thirds the inequality, stupid. One third of the difference is due to a technical issue involving price indexes. The rest, however, reflects a shift of income from labor to capital and, within that, a shift of labor income to the top and away from the middle.

Krugman offered no insight as to why this was happening, but he did accurately state "Income stagnation does not reflect overall economic stagnation; the incomes of typical workers would be 30 or 40 percent higher than they are if inequality hadn't soared."

The Wedge Between Productivity and Wages

Mark Thoma commented on Krugman's post in his Economist's View take on The Wedge Between Productivity and Wages

Inequality has reverted to levels unseen since the Gilded Age, financial regulation has waned, monopoly power has increased, union power has been lost, and much of the disgust with the political process revolves around the feeling that politicians are out of touch with the interests of the working class.

We need a serious discussion of this issue, followed by changes that shift political power toward the working class. But who will start the conversation?

Who Will Start The Conversation?

Thoma asks "Who will start the conversation?"

I am more than happy to start the conversation (and indeed already have on numerous occasions). Nonetheless, let's try once again, starting with a link a close friend sent just today: "A Peek Inside Tesla's Robotic Factory"

I invite you to read the article, but please watch the video.

Technology Overtakes Demographics

Watching that video should explain many things. The key point that should be easy to spot is technology has surpassed demographics.

Krugman's Mea Culpa

Paul Krugman was let to the recognition party as evidenced by his article Is Growth Over?

"Smart machines may make higher GDP possible, but also reduce the demand for people -- including smart people. So we could be looking at a society that grows ever richer, but in which all the gains in wealth accrue to whoever owns the robots."

Robots, Demographics, the Fed

Amusingly, Krugman admitted in December of 2012 that he did not understand what was happening (let alone what to do about it).

In Human Versus Physical Capital Krugman stated ...

So the story has totally shifted; if you want to understand what's happening to income distribution in the 21st century economy, you need to stop talking so much about skills, and start talking much more about profits and who owns the capital. Mea culpa: I myself didn't grasp this until recently. But it's really crucial.

Not only was Krugman was late to the problem, he also missed the central cause of the problem, who is to blame, and what to do about it.

As noted above, technology has overtaken demographics. Before that happened, the Fed (central banks in general) could inflate at will, waiting for wages to rise with inflation.

However, the natural state of affairs as a result of productivity increases is falling prices (not rising nominal wages). One look at computer prices (where there is no government or union interference) should suffice to prove the point.

Yet the Fed is hell bent on preventing price deflation. The Fed succeeded but it has been a Pyrrhic victory.

Prices are going up, but wages have not kept up. It is as simple as that.

In the absence of Fed policies, wages would be stable to declining, but prices would fall more, and thus real wages would rise.

Instead, and as a direct result of Fed inflationary policies, profits have gone to those with first access to money, notably banks and the already wealthy.

The solution is to get rid of the Fed and fractional reserve lending, not tax robots or increase inflation as Krugman and others hypothesize.

Unfortunately, we see all sorts of preposterous proposals by various inflation proponents stating that more inflation is the key to success.

For example, Noah Smith, economist author of the "Not Quite Noahpinion" blog, recently proposed 5% inflation stating "Inflation makes you richer ... to the benefit of the young and the poor ... which is why conservatives don't like inflation"!

For details of Noah's Alice in Wonderland economic thesis, please see Ivory Tower Academics, Inflation, and Kindness.

Bottom Line

The Fed and its inflationary policies are directly responsible for the massive rise in income inequality, yet numerous economists promote more inflation and taxation of robots as the solution.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2013 Mike Shedlock, All Rights Reserved.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.