July Jobs Report Confirms Major Problems with U.S. Employment, Economy

Economics / Employment Aug 05, 2013 - 12:18 PM GMTBy: Money_Morning

Diane Alter writes: The July jobs report brings the total number of part-time jobs created this year to more than three times the amount of full-time jobs added.

Diane Alter writes: The July jobs report brings the total number of part-time jobs created this year to more than three times the amount of full-time jobs added.

Welcome to America: Land of part-timers...

The trend was pronounced in June when data revealed part-time jobs grew by a robust 360,000 and full-time jobs declined by 240,000. Friday's July jobs report was further proof.

According to the July Household Survey, of the 266,000 jobs created (a number that differs from the Labor Department's 162,000), only 35% of jobs, or 92,000, were full time.

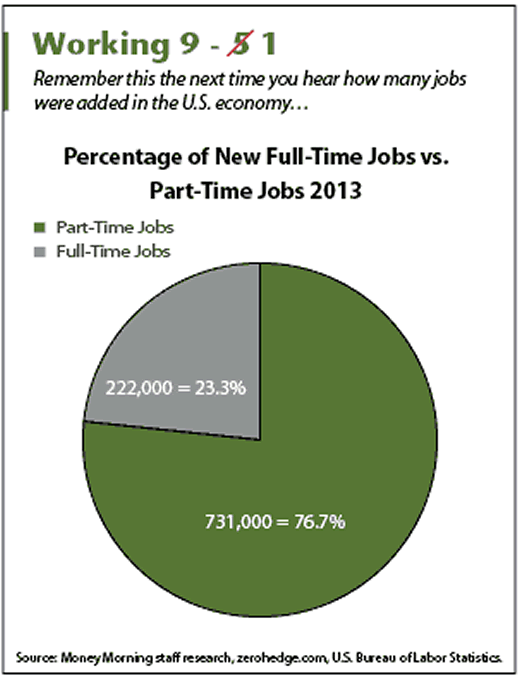

Even more alarming, of the 953,000 jobs created year-to-date, 77%, or 731,000, are part-time jobs, as Zero Hedge pointed out this morning.

July Jobs Report: Fewer Hours, Less Pay

The July jobs report was peppered with dispiriting data.

Most troubling in the government report was that weekly hours dipped to 34.4 from 34.5, and average hourly earnings edged down to $24 to $24.98.

Obviously, dwindling wages are a bad sign. Increasing income is crucial to future job growth. With personal income gains falling, it's impossible for a consumer-based economy, such as that of the United States, to enjoy strong, solid and sustainable growth.

Moreover, the kinds of jobs being added are of lower quality.

Retailers increased headcount by nearly 47,000 in July, the most in eight months. Meanwhile, employment in education and health services showed the slimmest gain in a year. And providing evidence that the slowly recovering housing market hasn't rendered consistent job creation, construction employment fell by 6,000.

The number of temporary workers rose 8,000, less than in previous months, but still a concern.

There were a few bright spots. For the first time in five months, the manufacturing sector added workers (6,000), and the government hired 1,000 employees after months of slashing headcount. Additionally, financial firms grew headcount by 15,000.

But generally, Friday's report was uninspiring at best.

"Overall this is not a strong labor report," Alan MacEachin, an economist at Navy Federal Credit Union, told the Washington Post. The data, he continued, is "consistent with a sluggish, lackluster economy."

The Increasingly Uneven Labor Market

The July jobs report underscores the increasing unevenness in the labor market...

While the U.S. economy added a disappointing 162,000 jobs in the month, below the expected 185,000, the jobless rate dropped two ticks to 7.4%. But the rate decline resulted from more disgruntled job seekers dropping out of the labor force.

The number of discouraged workers (workers not currently looking for work because they believe there are no jobs available for them) rose to 988,000, up from 136,000 a year ago.

And, the underemployment rate (which captures part-time workers who prefer full-time jobs, those who have stopped looking for work, as well as the unemployed), sits at an unhealthy 14%.

The tame jobs creation comes at a critical time for Federal Reserve policy makers and sends mixed signals. The central bank is seriously mulling tapering its $85 billion a month asset purchase program - perhaps as early as September.

"This isn't a disaster of a report but it shows the U.S. remains vulnerable to a slower economic growth performance," Julia Coronado, chief economist for North America at BNP Paribas in New York, told Bloomberg. "This isn't the kind of progress the Fed would like to see. At the margin, it keeps them cautious."

Minutes from this week's FOMC meeting showed the Fed is "winging it" when it comes to deciding how and when to end quantitative easing (QE). One thing is clear: when QE does end, most investors will be unprepared for the resulting market implosion.

As our Executive Editor Bill Patalon told his Private Briefing investors the other day, these market highs "are built on a foundation of quicksand - and it's about to suffocate the careless investor."

That's why Patalon created a survival guide for investors to safeguard their savings against what's about to happen to the U.S. economy and markets. Take a free peek at what this investment blueprint has to offer...

Source :http://moneymorning.com/2013/08/02/july-jobs-report-confirms-these-major-problems-with-u-s-employment/

Money Morning/The Money Map Report

©2013 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Money Morning Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.