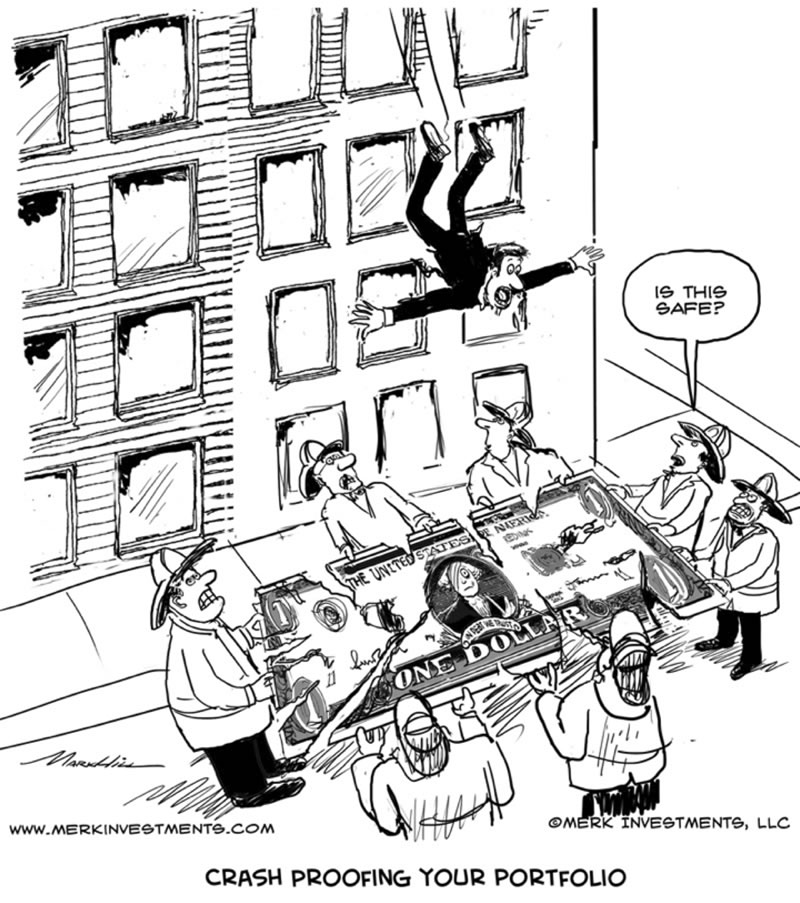

Concerned about the U.S. Dollar? How to Manage Dollar Risk

Commodities / US Dollar Jul 30, 2013 - 12:09 PM GMTBy: Axel_Merk

Are you concerned about the U.S. dollar? Are these concerns justified? If so, what do you do about it?

Are you concerned about the U.S. dollar? Are these concerns justified? If so, what do you do about it?

Fiscal sustainability

In a recent Merk Insight entitled "Why I own gold", I wrote:

"In a recent presentation, the 67 year-old Erskine Bowles (of the Simpson-Bowles commission) said, among others things:

• We are doing this (traveling around the country to drum up support for fiscal reform) not for our grandkids, not even for our kids, but for us.

• If we don’t get elected officials to pull together, we face the most predictable economic crisis in history. The most predictable, but avoidable crisis."

Mr. Bowles doesn't just lament: he drives the discussion, engages in constructive criticism, proposes solutions and encourages others to get involved. However, as investors, we have to take into account the possibility that he will not succeed before markets assign a higher probability to the said "most predictable economic crisis." Things aren't made any easier by the fact that tax revenue are coming in ahead of expectations, reducing the sense of urgency amongst policy makers.

Bonds at risk

Europe has shown us an important part of the playbook when the market loses confidence in the fiscal sustainability of a country: investors sell their bonds. Maybe more importantly, the selling of bonds by investors gets the message to policy makers. In that context, we are actually rather optimistic that U.S. policy makers will get their act together to engage in entitlement reform to make our budgets sustainable. However, when dissatisfied citizens looking for change on both the political left and right are understandably drawn to ever more polarizing politicians, necessary reform may only happen when the pain of acting is less than the pain of not acting.

Current account deficit

So what does a fiscal crisis, or a possible crisis in the bond market, have to do with the vulnerability of the U.S. dollar? You see, unlike the Eurozone, the U.S. finances its budget deficit by borrowing from abroad; through what economists call a current account deficit. In Europe, when the bond market "acted up," money fled from weaker Eurozone countries to stronger ones, but on a net basis, didn't really ever leave the Eurozone. In the U.S., however, the current account deficit is exactly the amount of U.S. dollar denominated assets that foreigners need to buy, all else equal, to keep the dollar from falling. As Mr. Bowles quips: if the U.S. were to ever have a military conflict with China, say, because of treaty obligations with Taiwan, the U.S. would need to borrow money from China to fight the war. That makes the U.S. vulnerable in more than one way. Relevant to the discussion about the U.S. dollar is that it might be under pressure should foreigners be less inclined to finance our deficits.

Before we get too scared about foreigners dumping their bonds, the notion just presented might give the wrong impression on two accounts:

• If investors lose confidence in U.S. bonds, it matters little whether it is U.S. or foreign investors losing confidence.

• One does not need to conjure up images of war to think of reasons why the dollar might be at risk should bonds come under pressure.

Confidence

We have discussed how market concerns of fiscal sustainability could cause the bond market to sell off. Important to note here is that perception might be more important than reality. Spain, for example, has had rather prudent debt management, with the average duration of government debt at roughly 7 years; however, when markets get nervous, math matters little. Similarly, the saying that markets may stay irrational longer than investors can stay solvent also applies to investors pricing U.S. bonds. U.S. bonds might sell off either much earlier or much later than some investors expect. Those who believe the U.S. bond market has already held on longer than it should have are told that the U.S. is different, because the dollar is the primary international reserve currency. Maybe, but note that such status must be earned. In our humble opinion, one cannot turn that concept upside down and pursue what might be considered fiscally irresponsible policies and then assume the reserve currency status is some ex ante right never to be questioned.

A key reason why investors have more confidence in the U.S. to finance itself than weak Eurozone countries is that the U.S. can print its own money whereas Eurozone countries have delegated that responsibility to the European Central Bank (ECB).

Inflation

Fear of inflation could also derail the bond market. However, as we are told over and over again, inflation is not today's problem. Skeptics point out how the Consumer Price Index (CPI) has been redefined about 20 times since 1980, and that if we were to apply inflation measures of those days, inflation would indeed be a serious concern. We sympathize with the view that the CPI understates inflation, however, it matters little what we think: what matters is that the bond market appears to shrug off inflation concerns - at least for the time being.

The biggest threat to the bond market: economic growth?

Which brings us to what the market does appear to care about: good economic data. A more positive assessment of the economic outlook by the Federal Reserve (Fed) has the potential to send shockwaves through the bond market. The shockwaves of recent months appear to have surprised even the Fed. We haven't been surprised for the simple reason that when you artificially inflate bond prices (keep yields low) for an extended period, a violent reaction should be the base line scenario when the Fed takes a step back ("tapers").

In some ways, it's of course perfectly feasible that more economic growth is associated with higher inflation. But the canary in the coal mine appears to be good economic data that might foreshadow higher inflation. The reason for concern, in our assessment, is justified because we don't see how the Fed can mop up all the liquidity when needed. We have already seen what a fit the market can throw at even the talk of tapering. Good luck trying to "fine tune" an "exit" from super-accommodative monetary policy.

And this is where the loop closes to fiscal policy. With bond prices falling, it becomes more expensive to finance debt. In 2001, the average cost of borrowing for the U.S. government was around 6%. Currently, it's a little over 2%. I'm not suggesting that the average cost will move back up to 6% in the near future, however, financing debt that matures in the coming years, as well as the trillions in additional debt we have been piling on, and we are faced with a gargantuan task to find ways to finance government spending. On a side note, there aren't enough rich people around to tax to "fix" the problem. The challenges can be fixed currently with what are still rather minor adjustments to entitlements, but cutting benefits is politically an extraordinarily difficult task; possibly all but impossible with gridlock in Congress.

Kicking the can down the road

As long as policy makers will get away with it, we believe they will "kick the can down the road." Some of the actions taken may be subtle, such as changing the way social security benefits are calculated: contractually, the U.S. may live up to its obligations, but in real terms, the benefits received will erode. And just as the Fed has been effectively financing government deficits in recent years, it might be willing to do so in the future.

Japan: a peak into the future?

Japan may well be a step ahead of the U.S. With a bond market not as deep and liquid as the U.S. bond market, there has been notable volatility in their bond market. The Bank of Japan (BoJ) has so far resisted intervening in the markets to put a lid on Japan's 10 year bonds, the JGBs. In our assessment, the reason the BoJ has so far refrained from intervening is because while yields have spiked, they are only where they were about a year ago. Interestingly, in the most recent bout of global bond market volatility, JGBs were eerily quiet. That aside, however, in Japan, too, the biggest threat might be economic growth. In our assessment Japan simply cannot finance its deficits at substantially higher rates. In our analysis, the yen has become more vulnerable as Japan's current account surplus has melted away. We deem it quite likely that should the Japanese economy indeed kick into higher gear that the BOJ would then put a ceiling on JGBs, i.e. print money in large quantities in an effort to contain rising yields. The "valve", then, in our assessment is going to be the currency. This isn't the venue to discuss Japan in more detail (please make sure you read Merk Insights on Japan for more detail; it shall just be said that we don't see how the yen can survive the dynamics we see unfolding.

Short bonds?

So what are investors to do? Short bonds? The challenge with selling bonds is that one has to supply the interest to those one is borrowing bonds from. In Japan, with long-term interest rates even lower than the U.S., there have been some brave investors on the short side as the cost of shorting is contained. However, aside from the risk that regulators react to political pressures and find ways of banning short selling, the key parameter here is timing. In recent months, those shorting U.S. bonds might have made some money. But unless one gets the timing right, it can be a very costly endeavor. While exchange traded funds (ETFs) that cater to the service make shorting bonds as easy as pushing a few buttons to many investors, the cost of the ETF needs to be added to the cost of the underlying shorting. While we are concerned about many of the issues laid out here, if history is any guide, timing is rather difficult. As such, any investors considering shorting bonds should seriously study the risks; we think there may be better ways to prepare for falling bonds.

Buy stocks?

Now here's one for the pundits: sell bonds, buy equities? As investors have been fleeing the bond market of late, much of the money has made it into equities. Because bonds are suddenly riskier, the conclusion is to go into the ultimate risk asset, stocks? Investors must be aware that this is unlikely to lower their risk profile. But if investors believe stocks only go up, and upside risk is a good thing, then that's where they want to be. Until, of course, they realize that risk more importantly also refers to downside risk. Indeed, as investors are taught to buy every dip, we are increasingly concerned about a major correction. In 1987, investors thought they were protected by portfolio insurance; now, algorithmic traders don't even need insurance anymore, as they think they can exit the markets in a fraction of a second. We aren't so certain liquidity is going to be there should a larger group of investors all decide to take some profit at the same time.

Sell the Dollar?

What a novel idea: sell the dollar if one is concerned about the dollar? The Chinese central bank does it by diversifying to a basket of currencies they manage. Quite simply, investors that think we have the better printing press than others, might diversify to other currencies accordingly. Investors have been a bit jittery on the concept in recent years, as the U.S. was touted to be the cleanest of the dirty shirts in referring to other currencies. When investment firm PIMCO came up with that slogan, they forgot to mention that the euro appreciated against the U.S. dollar last year by 1.76%; and as of this writing, the euro is also ahead of the U.S. dollar year-to-date- against the euro, with all the trouble they have had! Maybe having the biggest bragging rights (reserve currency status) isn't a panacea after all, and when there's blood on the street (Eurozone), there might be some value?

Aside from buying a basket of currencies, one can of course also take a pro-active approach, selling some, buying others. As might have become apparent from reading in between the lines, we are these days more negative on the yen than the U.S. dollar, but we see opportunities elsewhere. We believe currency wars are raging which brings both risks and opportunities. Think of it this way: we may not like what our policy makers are up to - be that in the U.S., UK, Eurozone or Japan, but we believe they are rather predictable. More importantly, we believe policy makers will continue to stay very involved in the markets; as a result, asset prices may not reflect fundaments, but rather the next perceived intervention of policy makers. If one agrees, why then bother taking on equity risk when there may be a more direct projection of policies onto the currency market.

Recently, an email we received referred to currencies as esoteric. I understand not everyone is as passionate about currencies as we are, but what is esoteric about tackling U.S. dollar risk at the source, by managing currency risk?

And then, of course, there's gold or other hard assets. Clearly, those that believe the purchasing power of the U.S. dollar is at risk may want to consider investing in gold or other hard assets. Just keep in mind that such investments can be rather volatile (not many are aware that currencies are actually less volatile than equities, bonds or commodities - just think of the euro moving a full cent versus the dollar - a major move for a currency in a day, but rather little on a percentage basis). We have an in-depth discussion about gold in our upcoming Webinar on August 22nd: please click here to register. Importantly, please make sure you are subscribed to our newsletter so you know when the next Merk Insight becomes available.

Manager of the Merk Hard, Asian and Absolute Return Currency Funds, www.merkfunds.com

Rick Reece is a Financial Analyst at Merk Investments and a member of the portfolio management

Axel Merk, President & CIO of Merk Investments, LLC, is an expert on hard money, macro trends and international investing. He is considered an authority on currencies. Axel Merk wrote the book on Sustainable Wealth; order your copy today.

The Merk Absolute Return Currency Fund seeks to generate positive absolute returns by investing in currencies. The Fund is a pure-play on currencies, aiming to profit regardless of the direction of the U.S. dollar or traditional asset classes.

The Merk Asian Currency Fund seeks to profit from a rise in Asian currencies versus the U.S. dollar. The Fund typically invests in a basket of Asian currencies that may include, but are not limited to, the currencies of China, Hong Kong, Japan, India, Indonesia, Malaysia, the Philippines, Singapore, South Korea, Taiwan and Thailand.

The Merk Hard Currency Fund seeks to profit from a rise in hard currencies versus the U.S. dollar. Hard currencies are currencies backed by sound monetary policy; sound monetary policy focuses on price stability.

The Funds may be appropriate for you if you are pursuing a long-term goal with a currency component to your portfolio; are willing to tolerate the risks associated with investments in foreign currencies; or are looking for a way to potentially mitigate downside risk in or profit from a secular bear market. For more information on the Funds and to download a prospectus, please visit www.merkfunds.com.

Investors should consider the investment objectives, risks and charges and expenses of the Merk Funds carefully before investing. This and other information is in the prospectus, a copy of which may be obtained by visiting the Funds' website at www.merkfunds.com or calling 866-MERK FUND. Please read the prospectus carefully before you invest.

The Funds primarily invest in foreign currencies and as such, changes in currency exchange rates will affect the value of what the Funds own and the price of the Funds' shares. Investing in foreign instruments bears a greater risk than investing in domestic instruments for reasons such as volatility of currency exchange rates and, in some cases, limited geographic focus, political and economic instability, and relatively illiquid markets. The Funds are subject to interest rate risk which is the risk that debt securities in the Funds' portfolio will decline in value because of increases in market interest rates. The Funds may also invest in derivative securities which can be volatile and involve various types and degrees of risk. As a non-diversified fund, the Merk Hard Currency Fund will be subject to more investment risk and potential for volatility than a diversified fund because its portfolio may, at times, focus on a limited number of issuers. For a more complete discussion of these and other Fund risks please refer to the Funds' prospectuses.

This report was prepared by Merk Investments LLC, and reflects the current opinion of the authors. It is based upon sources and data believed to be accurate and reliable. Opinions and forward-looking statements expressed are subject to change without notice. This information does not constitute investment advice. Foreside Fund Services, LLC, distributor.

Axel Merk Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.