Major Bank Makes A Freudian Slip About The U.S. Dollar

Currencies / US Dollar Jul 11, 2013 - 02:19 AM GMTBy: Jeff_Berwick

The cognitive dissonance about the dollar never fails to amaze me. People know in their bones that their dollars will be worth a lot less in the future...yet they continue to trust and cling to the dollar as a store of value. They invest in things denominated in dollars that pay interest well below the rate of inflation. Or they go for all out gambling in the stock market to have a hope of outpacing inflation enough to build a tiny bit of wealth to leave to their grandkids.

The cognitive dissonance about the dollar never fails to amaze me. People know in their bones that their dollars will be worth a lot less in the future...yet they continue to trust and cling to the dollar as a store of value. They invest in things denominated in dollars that pay interest well below the rate of inflation. Or they go for all out gambling in the stock market to have a hope of outpacing inflation enough to build a tiny bit of wealth to leave to their grandkids.

Commodities like copper with an industrial demand may fall in price -- even drastically -- in the midst of a global depression. But the 30% or so drop in the price of something like copper will be running hard against the US government's need to inflate away the value of the US dollar by having the Fed create new money to buy up more and more government debt. Inflation tends to outpace falling prices due to falling demand. The folks at Wells Fargo understand this and seem to be trying to help clear up some of the public confusion.

The funniest part of this advertisement is that the essential truth it spoke was unintentional. The unwitting ad copywriter from Wells Fargo likely meant to tell you that if you invest in "other things", your money will be worth more tomorrow. But what actually ended up happening is that he spoke the truth about the dollar... and the entire fiat currency system.

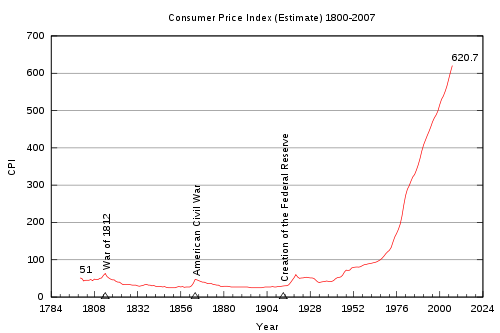

This graphic says it all.

Anyone notice something interesting in that chart after around 1971? Something interesting like what that Asiana airliner did in San Francisco last week but in the opposite direction?

And that is just an estimate of the Consumer Price Index as defined by the US government... which of course is completely hedonistically adjusted!

Wells Fargo just had a Freudian moment. A dollar tomorrow is worth less than a dollar today.

It's actually designed that way. Why most people still don't know it is a mystery to us. Buy gold. Buy silver. Gold and silver are commodities...but they are also monetary metals. They have been used as money for thousands of years and even the most brainwashed monopoly fiat money victims will catch on when things get bad enough.

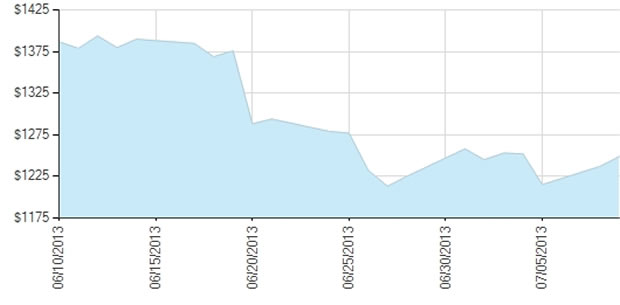

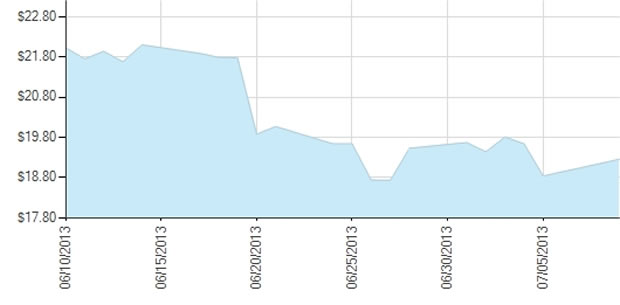

Those brainwashed victims aren't ready to catch on just yet, however. Right now they're buying the story the government tells the mainstream media to spread: the money supply inflation unleashed by the Fed has worked...The recovery is on! So the masses aren't looking to gold and silver anymore since they're no longer worried about the health of the economy. So gold and silver prices have taken an enormous beating.

Gold 30-Day Chart

Silver 30-Day Chart

But the masses will soon find out that they've been fed lies. Then they're really going to wish they'd paid more attention to this quote from Irwin Schiff:

"All of the government's monetary, economic and political power, as well as its extensive propaganda machinery, will be enlisted in a constant battle to drive down the price of gold - but in the absence of any fundamental change in the nation's monetary, fiscal, and economic direction, simply regard any major retreat in the price of gold as an unexpected buying opportunity."

This is an almost embarrassingly obvious opportunity to snatch up gold and silver before the inevitable happens and the government and central bank destroy the monetary system with inflation-fueled debt. So I repeat: Buy Gold. Buy Silver.

But if you acquire significant amounts of gold (and silver) -- amounts large enough for a desperate thug like the USSA government to notice -- then leaving them in the USSA is as good as putting them in the government's hands. Be sure to protect your gold by getting it out of Dodge. Learn how to Get Your Gold Out Of Dodge with the report of the same name. You can learn more about getting the report here...or you can get it free when you sign up for all the macro analysis and actionable advice in the TDV subscription newsletter.

Get your assets out of the Western financial system before it completely collapses. And get your ass out from the Western world, too, into a freer, more prosperous place -- like Latin America, specifically Galt's Gulch, Chile . And also be sure to get yourself much better slave papers (citizenships and passports). It's essentially impossible (sadly) to be stateless in this world. But at this point the non-Western states are much better plantations to belong to than the Western ones.

Anarcho-Capitalist. Libertarian. Freedom fighter against mankind’s two biggest enemies, the State and the Central Banks. Jeff Berwick is the founder of The Dollar Vigilante, CEO of TDV Media & Services and host of the popular video podcast, Anarchast. Jeff is a prominent speaker at many of the world’s freedom, investment and gold conferences as well as regularly in the media.

© 2013 Copyright Jeff Berwick - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Jeff Berwick Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.