Bernanke's Conundrum What it Might Mean for Gold

Commodities / Gold and Silver 2013 Jul 02, 2013 - 05:04 AM GMT “Central banks sold a record amount of US Treasury debt last week and bond funds suffered the biggest investor withdrawals on record as global markets shuddered at the prospect of the US Federal Reserve ending its quantitiative easing program.”

“Central banks sold a record amount of US Treasury debt last week and bond funds suffered the biggest investor withdrawals on record as global markets shuddered at the prospect of the US Federal Reserve ending its quantitiative easing program.”

“People are throwing in the towel. It’ll drag the market down lower over the course of the summer.” Markus Rosgen, chief Asia equity strategist at Citigroup

If “people are throwing in the towel” as Mr. Rosgen suggests, Bernanke will find himself in an all-new conundrum quite the opposite of the one in which Alan Greenspan found himself in 2005.

For the Fed, the Treasury debt selling creates a twofold problem:

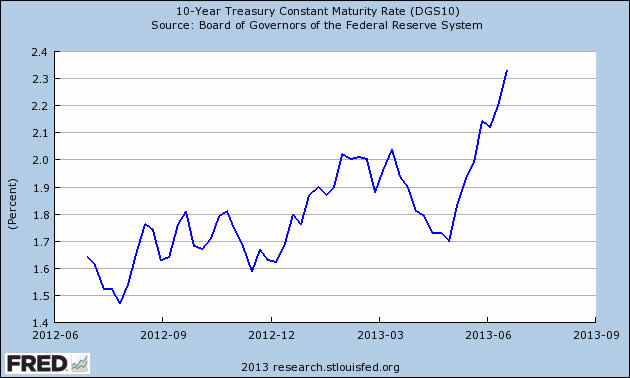

First, the supply of bonds in the open market will continue to drive up rates. When the goal is to keep rates down, it presents a new kind of conundrum - a Bernanke version the exact opposite of Greenspan’s. Greenspan wanted higher rates. The market gave him lower rates by accelerating its purchases of Treasuries, thus the conundrum. Bernanke wants the exact opposite, that is, lower rates. The market is giving him higher rates by accelerating the sale of U.S. government debt - a conundrum opposite to the one Greenspan encountered. Then and now, the market pundits fret that the Fed is losing (has lost) control of interest rates.

Second, if the world is selling Treasuries, some entity will have to pony up with the purchases of newly-issued U.S. government debt. That entity is the Federal Reserve - the government’s lender of last resort. The new Bernanke conundrum will force the Fed to continue its QE program until such time that other private and public sector buyers of U.S. debt materializes. Ironically, the stock market, like the bond market, might already be reacting to the new rate reality, while gold’s sudden demise, if indeed caused by the so-called “paring down of quantitative easing,” might have been false. If that is the case, a make-up rally could be in the offing.....in fact it might already have been launched.

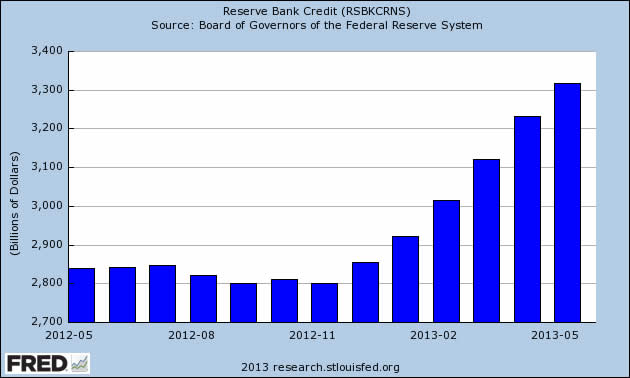

In an earlier article, I advised that we should take heed of what the Fed does, not what it says. In a certain sense, as you see in the two graphs below, the Federal Reserve may have already launched QE4 while simultaneously talking about ratcheting monetization down. The two graphs together show cause and effect and tell the real story of what is happening at the Fed. For a while, it wasn’t clear why bank reserve credit (QE) was rising. When you marry that chart to 10-year Treasury maturity rates, the reason becomes quite clear. The Fed is battling the market to keep rates low and the government financed at favorable rates.

By Michael J. Kosares

Michael J. Kosares , founder and president

USAGOLD - Centennial Precious Metals, Denver

Michael Kosares has over 30 years experience in the gold business, and is the author of The ABCs of Gold Investing: How to Protect and Build Your Wealth with Gold, and numerous magazine and internet articles and essays. He is frequently interviewed in the financial press and is well-known for his on-going commentary on the gold market and its economic, political and financial underpinnings.

Disclaimer: Opinions expressed in commentary e do not constitute an offer to buy or sell, or the solicitation of an offer to buy or sell any precious metals product, nor should they be viewed in any way as investment advice or advice to buy, sell or hold. Centennial Precious Metals, Inc. recommends the purchase of physical precious metals for asset preservation purposes, not speculation. Utilization of these opinions for speculative purposes is neither suggested nor advised. Commentary is strictly for educational purposes, and as such USAGOLD - Centennial Precious Metals does not warrant or guarantee the accuracy, timeliness or completeness of the information found here.

Michael J. Kosares Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.