Gambling Banksters - How Many Warnings Do You Need?

Politics / Banksters Jun 30, 2013 - 12:52 PM GMTBy: Rudy_Avizius

If you knew someone with a gambling problem, you probably would not give them your money to hold. If you knew that they had placed bets that were 30 to 70 times more than the amount of money they had, you would certainly consider them totally reckless. If you knew that the money they were holding and betting with was with borrowed money, other peoples’ money not their own, you would probably conclude that they are hopelessly addicted to money. Remember these thoughts as you continue to read this article.

If you knew someone with a gambling problem, you probably would not give them your money to hold. If you knew that they had placed bets that were 30 to 70 times more than the amount of money they had, you would certainly consider them totally reckless. If you knew that the money they were holding and betting with was with borrowed money, other peoples’ money not their own, you would probably conclude that they are hopelessly addicted to money. Remember these thoughts as you continue to read this article.

Picture these scenarios:

1. You go to buy groceries and when you use your credit or debit card the transaction is denied despite the fact you have money in your account.

2. You are a public official, such as a school business administrator, county treasurer, municipal finance manager, pension fund administrator, or anyone who has responsibility for protecting public money. You try to access the money and the transaction is denied.

Under either scenario, you investigate why you cannot access money you know is in your account and you find out that the bank has failed and has been closed until further notice by the authorities. You also discover that the government will be confiscating part of your savings in order to “stabilize” the bank.

So you think that “cannot happen here”? You think you are safe because the FDIC “protects” your money? You placed your money into one of the big banks and believe it is safe because it has large vaults and is insured by the government. Perhaps you placed the public monies you are charged with into a large bank because they are properly “collateralized” and therefore you believe these funds are safe. If you truly believe any these previous statements, you really need to read the rest of this article because your money is at serious risk.

So you think your money is safe? Let’s examine why that assumption could cost you all or part of your savings. Would you be surprised to learn that money sitting in everyday peoples’ savings accounts in Cyprus was confiscated in order to “stabilize” the banks? If you are surprised by this news, hopefully this article will provide you with an incentive to do some research. This article is filled with links to more information, and I encourage you to follow them. If you are aware of this bank confiscation, do not make the mistake of believing that it is an isolated event that “cannot happen here”.

In a nutshell, what actually happened in Cyprus was that the banks were overleveraged and the size of the liabilities of the banks exceeded the Gross Domestic Product (GDP) of the entire country of Cyprus. Given the fact that the “bail outs” of the large banks in 2008 were so politically unpopular, the European “troika” imposed a “bail in”, where customers with savings accounts were to have some of their savings seized (read: stolen) in order to stabilize the banks. The losses to some accounts were as high as 60%. The banks were closed for 12 days, so people had no access to their money and once the banks reopened, they had only limited access to their money in order to protect the banks.

Was this plan by the “troika”, just a one-time event or was this something more? It turns out that this eventuality had actually been planned in advance in 2012 at the G20 Financial Stability Board in Basel Switzerland where the US FDIC and the Bank of England created a joint paper outlining a confiscation scheme. Under the FDIC/BOE joint paper, accounts of $250,000 or less could be seized by the failing bank and converted to stock equity as part of a “bail in” scheme. The stock would of course be essentially worthless because the bank has already failed.

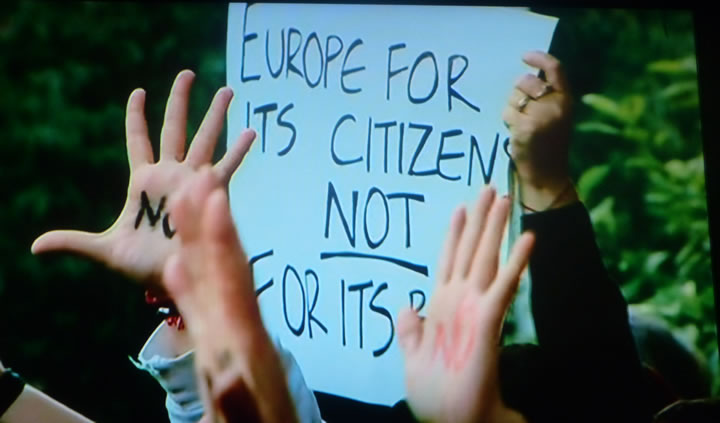

There is also a plan to confiscate savings in New Zealand if necessary to save the banks. Canada also has a confiscation plan in the wings should their banks falter. The European Union has just reached an agreement where shareholders and depositors will be tapped to “bail in” any bank in trouble.

So you still think that this “cannot happen here” because the FDIC will protect your money? Consider that our largest banks have derivative contracts with a notional value of more than $700 trillion (think $700,000 BILLION!). The entire world GDP is only $70 trillion, therefore the liabilities of the big banks could not be covered by the entire GDP of the United States. Does this sound similar to what happened in Cyprus? Does this sound similar to the gambler at the beginning of this article? What is very important to keep in mind is that Cyprus is a small country and that much larger outside forces came in to “stabilize” the banks. If one (or more) of the large U.S. banks experiences a derivative failure, there is not enough money on the planet to “stabilize” them.

These derivatives are really nothing more than “bets” placed by the banks, and when (not if) these “bets” start going bad, the banks will be on the hook for their value. You need to know that these derivative “bets” have been given super-priority status in case of a bank bankruptcy. What this means is that the holders of these derivative contracts will have first priority for payment and that you either as an individual or government entity will be placed at the back of line - as a bank creditor should a large bank fail. This means that you will probably get little or nothing back. Most people do not understand that once you give a bank your money, the money legally is no longer yours. Under the law, you are an unsecured creditor to the bank and are treated as such in any bankruptcy proceeding. As an individual or as a public official, if you have money in one of the big banks, you have essentially given your money to that gambler and now you are a creditor to the gambler.

This sort of loss has already happened with the MF Global collapse. While this was a futures trading company and not a bank, the blueprint for confiscations was tested here and with the Sentinel case the legal system upheld the customer losses. These trading accounts were supposed to be “segregated” accounts that belonged to the account holders, not MF Global. As an analogy, think of a “segregated” account as a safe deposit box at a bank, the contents belong to you, not the bank. Yet in the MF Global collapse, in this analogy it essentially gambled with the assets in the customers’ safe deposit boxes, and the legal system placed the creditors of the bank above the safe deposit box holders.

Still think the FDIC will protect the derivative and account holders? JP Morgan Chase has $1.1 trillion ($1,100 Billion!) in deposits and Bank of America also has over $1 trillion ($1000 Billion!). Again, remember that gambler, JP Morgan Chase has about $70 TRILLION in bets out there, but is holding only about $1 Trillion in deposits and another Trillion in assets. It has made bets with a value approximately 35 times all the money it has access to. Again, this is YOUR money they are betting with, not their money. Bank of America also has about 30 times its assets in derivative bets. Citigroup and Wells Fargo each have over $900 billion each in deposits and also have many times their assets in derivative bets. Once these bets start going bad, there is no way the banks can cover them. The FDIC has only $33 billion available to insure deposits. That means that once any one of these banks fails, the FDIC has less than 3% of the money needed to cover the depositors. If any one of these big banks fails, these banks are so interconnected that it is also likely to bring down the other large banks. In fact both Bank of America and JP Morgan Chase have moved their riskiest derivatives from their uninsured trading houses to the FDIC insured subsidiaries, which are their retail banks, putting the funds in those accounts at a significantly increased risk. Once even one of these biggest banks experiences a derivative meltdown, there is not enough money in the FDIC or probably even the U.S. Treasury to cover the losses. Still think Cyprus cannot happen to you?

If you are a public official who has responsibility for protecting public money, you probably have that money deposited into an account with one of the largest banks. Do you still believe that money is safe? Are you doing your fiduciary duty to protect that money in the public interest? So as a government official in charge of finances, what are your options?

One option is to start a public bank such as the Bank of North Dakota. First public banks do not gamble with derivatives and the Bank of North Dakota thrived during the crisis of 2008. Not only will you get the safety of the money for which you have responsibility for, but other advantages to this approach include: the ability to provide interest free or low interest loans for public infrastructure projects, the ability to create jobs, generate revenue, and build up the local community. This article clearly explains some of the huge advantages of financing your projects using a public bank.

Consider this - if you buy a home for $100,000, by the time you have paid the mortgage in full, the total cost will have been close to $300,000. Consider the absurdity of paying those who build the home and provide the raw materials $100,000, and paying the financiers $200,000 for money that was not even theirs. This makes little sense. The same principle applies if a state, county, or municipality wants to build a road, school, bridge, or other infrastructure. They need to go to Wall Street for financing at high interest rates. However they could form their own bank and finance the project at zero or near zero interest. The projects would cost less than half and the finance costs would not be siphoned out of the community, impoverishing it, and ending up on Wall Street or in Cayman Island tax shelters. The finance costs would stay in the community.

Think of the things that could be accomplished if you could eliminate debt service as a line item in your budget! The money deposited in the public bank would be safe and would serve the local community. You could use the public bank to refinance existing debt at zero or near zero percent interest. You could lower tax rates! This idea has such appeal that currently there are initiatives in 20 states to start public banks.

If you are a public official with a fiduciary responsibility to protect public funds and one of these large banks fails and you lose the public money, think of the consequences that will arise once the public becomes aware that you did not heed the warnings that Cyprus provided. Think of the consequences that will arise when the public becomes aware that you did not consider alternatives to the big vulnerable banks. It is time to bring home the money from Wall Street where it is at risk. If there is a derivative crash, try meeting your payroll with stock equity (in a failed bank). The impact of not meeting a payroll will be both immediate and forceful. It is vital to get that money out of Wall Street BEFORE the next meltdown.

To those public officials who are truly interested in serving their communities, this is your moment. This is your time to step up to the plate. Be bold, be innovative, and empower your communities. You owe this to your fellow citizens, your children and your future. Visit this website to learn more about the possibilities that public banking offers, to learn how to get started, and where to find help in implementation. You are not alone of you wish to make this happen.

If you are an individual saver who wants to protect your money, you need to move your money out of the big banks because that is where it is most vulnerable. Move your money into local community banks or Credit Unions. This will help your local banks as well as your community by keeping the money local. It is also important to MOVE YOUR DEBT to these local banks as well. The way bank accounting works, a deposit is actually considered a liability to the bank, while a loan is an asset on its accounting ledger. (I know this sounds convoluted, but this is the way it is). By moving your debt to the local banks, you create assets for them as well as helping your local community. While there are no guarantees that a smaller bank could survive the crash of one or more of the bigger banks, very few of the small banks have gambled with the super-priority derivatives. This is huge advantage that at provides insulation from the large banks.

So, consider yourself warned, money is not safe in the big banks. The MF Global losses, the Cyprus confiscations, the Sentinel case, the FDIC/BOE Joint Paper, the plans in the European Union, Canada, New Zealand, and Spain to raid private accounts, and finally the information in this article should be raising all sorts of red flags. HOW MANY WARNINGS DO YOU NEED? Personal accounts, as well as any school, municipal, county, and state funds that are deposited in any of the big banks are not safe. The plans for confiscation have already been developed, they have been approved, they are awaiting the next crisis.

Ask your public official in charge of finance where they keep YOUR taxpayer money!

Ask them if they have researched the public banking option! Do not accept no for an answer, ask them why. If they say that you do not understand these things, tell them to explain it to you.

After all, this is your money that you worked so hard for, so don’t let the big gamblers from Wall Street use YOUR personal or taxpayer money to cover THEIR losses. These big bankers are money addicts, they have no appreciation of how much work went into making that money. They do not care about you or your money, all they care about is their addiction. Don’t let public officials continue to put your taxpayer money at risk with these gamblers, just because this is how it has been done in the past.

By Rudy Avizius

http://www.endtheillusion.org/

Email: rudy@endtheillusion.org

Rudy Avizius is a retired school district administrator and a former Director of Technology who has been following economic and political news very carefully for the last 2 decades. He has recently become active in trying to make sure that the government spends taxpayer money wisely with long term benefits to the nation.

© 2013 Copyright Rudy Avizius - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.