Banking Institutions Present Clear and Present Danger to American Citizens

Politics / Money Supply Mar 24, 2008 - 09:01 AM GMTBy: Darryl_R_Schoon

The Die is Cast- The Case Will Die - If the American people ever allow private banks to control the issue of their currency, first by inflation, then by deflation, (i.e., the "business cycle") the banks and corporations that will grow up around them will deprive the people of all property until their children wake-up homeless on the continent their fathers conquered. Thomas Jefferson, President of the United States 1801-1809

The Die is Cast- The Case Will Die - If the American people ever allow private banks to control the issue of their currency, first by inflation, then by deflation, (i.e., the "business cycle") the banks and corporations that will grow up around them will deprive the people of all property until their children wake-up homeless on the continent their fathers conquered. Thomas Jefferson, President of the United States 1801-1809

If Thomas Jefferson were running for the US presidency and spoke the words he uttered two centuries ago, he would be marginalized by today's press just as Ron Paul has been marginalized in his campaign for the US presidency.

If Thomas Jefferson were running for the US presidency and spoke the words he uttered two centuries ago, he would be marginalized by today's press just as Ron Paul has been marginalized in his campaign for the US presidency.

Today, private bankers control not only the issuance of money in America , but the corporations [ that will grow up around the bankers ] control what Americans see, read, and hear because of their influence in the media. The clear and present dangers Jefferson warned about two centuries ago are now clearly present.

America threw off the yoke of British dominion in 1776 only to institute the very form of that dominion in 1913 when US banking and corporate interests—the same forces Jefferson warned about—recreated the British credit-based banking system in the US in the form of the Federal Reserve Bank—a system whereby private bankers control the issuance of the public currency; and, just as Jefferson had warned, America's freedoms are now at risk.

I believe that banking institutions are more dangerous to our liberties than standing armies . Thomas Jefferson, 1816

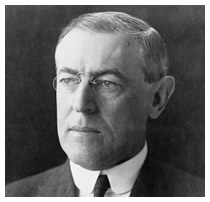

In 1913, Woodrow Wilson was President of the US when the Federal Reserve Act was signed into law. Too late, Wilson recognized the damage he had done; and his own words haunt us today as it is now clear what his approval of the Federal Reserve Act set in motion: A great industrial nation is controlled by its system of credit. Our system of credit is privately concentrated. The growth of the nation, therefore, and all our activities are in the hands of a few men...We have come to be one of the worst ruled, one of the most completely controlled and dominated, governments in the civilized world—no longer a government by free opinion, no longer a government by conviction and the vote of the majority, but a government by the opinion and the duress of small groups of dominant men..

In 1913, Woodrow Wilson was President of the US when the Federal Reserve Act was signed into law. Too late, Wilson recognized the damage he had done; and his own words haunt us today as it is now clear what his approval of the Federal Reserve Act set in motion: A great industrial nation is controlled by its system of credit. Our system of credit is privately concentrated. The growth of the nation, therefore, and all our activities are in the hands of a few men...We have come to be one of the worst ruled, one of the most completely controlled and dominated, governments in the civilized world—no longer a government by free opinion, no longer a government by conviction and the vote of the majority, but a government by the opinion and the duress of small groups of dominant men..

Today, Americans are looking to the Fed to protect them against the financial chaos threatening our economy. This is tantamount to the Jews in 1930s Germany looking to the Nazis to stave off a possible holocaust. The Fed cannot help America with its economic problems because the Fed is itself the cause of those problems.

While it is understandable that slaves would look to their masters to save them, it is futile to believe they will do so when their masters' only concern is to save themselves.

A PRIMER ON JEFFERSON 'S WARNING

In capital credit-based systems, credit is fed into the economy in a process whereby producers and savers are indebted and bankers are enriched. Because credit is an integral part of capital systems, as the economy expands the debt and the interest it produces benefits bankers. The debt and the compounding interest on that debt in turn enslaves producers and savers.

Like parasites, bankers cannot exist without producers and savers. In capital credit-based systems, producers and savers cannot exist without bankers. In savings-based systems where gold and silver are money as was the US prior to 1913, producers and savers can and do prosper without central bank credit and debt.

Over time, in capital credit-based systems, producers and savers become so indebted that the economy is no longer able to service and retire previously created debt. This is where the US economy is today. Homeowners cannot pay their mortgages, consumers cannot pay their credit cards, and governments cannot pay their obligations without issuing even more obligations.

The banker's credit money system is now everywhere as are their resultant unsustainable debts; and those who profit by that system, the bankers [ and the corporations that grew up around them ] now control the media, the political process, and the agencies charged with overseeing and regulating the economy—the US Federal Reserve Bank, the SEC, the US Treasury, and indeed the US government itself: the Presidency, the Congress, and the Supreme Court.

THE US GOVERNMENT, SUSAN WONES, & JP MORGAN CHASE

Susan Wones is one of many millions of Americans with credit cards. James Dimon is the chairman and CEO of Wall Street bank JP Morgan Chase which issued a credit card to Susan Wones at 0 % interest. Then, one month later Mr. Dimon's bank JP Morgan Chase suddenly and without explanation raised the interest rates on Ms. Wones credit card to 23 %.

Susan Wones is one of many millions of Americans with credit cards. James Dimon is the chairman and CEO of Wall Street bank JP Morgan Chase which issued a credit card to Susan Wones at 0 % interest. Then, one month later Mr. Dimon's bank JP Morgan Chase suddenly and without explanation raised the interest rates on Ms. Wones credit card to 23 %.

Last week, Ms. Wones traveled from Denver to Washington DC where she and other upset credit card users were to testify before Congress about how they had been treated by the banks that issued their credit cards.

But when they reached Washington DC , Ms. Wones and the others were told the Republicans would not let them testify unless they first agreed to allow the banks to discuss their personal financial history in any forum at any time. Not willing to have their privacy rights invaded, Susan Wones and the majority of the witnesses chose to not testify.

As a consequence, Americans never heard about how Susan Wones' bank, JP Morgan Chase, had without notice or explanation raised her interest rate on her credit card to usurious levels. Instead they heard the media recount how JP Morgan Chase had bought Bear Stearns investment bank at the urging of the US Fed, a purchase underwritten and guaranteed up to $30 billion by American taxpayers such as Susan Wones.

What happened to Susan Wones and the others who had traveled to Washington DC was a victory for the credit card companies, the banks (JP Morgan Chase in particular), their lobbyists and the Washington DC power structure.

It was, however, a loss for the American people. But it was a loss in a war Americans have been losing since 1913, the year when private bankers took control of a once free nation and its once free markets. The prediction of Thomas Jefferson has come true.

The bankers sold us credit By catering to our dreams

Then they sold us debts

With promised income streams

But then they raised our interest rates

And our debts could not be paid

We found too late ‘twas sex they'd sold

And us the bankers had laid

YESTERDAY TODAY & TOMORROW

Last year, I wrote an article predicting an economic crisis would happen in the summer of 2007. The following is excerpted from Subprime America Infects Asia And Europe posted May 5, 2007 .

http://www.drschoon.com/articles%5CSubprimeAmericaInfectsAsiaandEurope.pdf

… Thailand 's economy went into apoplectic shock and its currency and stock market fell by 50% in 1997 when international currency flows suddenly changed direction. America may soon be in for the same.

And if America falters and falls, the consequences of such will be felt around the world. Today, afternoon tea and scotch flow freely in The City as does dim sum in Hong Kong and Shanghai and sushi in Tokyo around their respective bourses. Soon, however, the risks that have lain dormant beneath globalization's foundation are about to erupt and a reordering of the world's financial geography is about to ensue.

It's spring 2007 and the sun is shining in the US, backyard BBQs are being cleaned in anticipation of summer's use A severe financial crisis, however, is in the offing; a crisis as unexpected as the Golden State Warriors' last minute streak to the NBA playoffs.

An unexpected financial crisis, however, will be much more consequential than Don Nelson's magical resurrection of the Warriors' NBA hopes. There, at least, the Warriors will have a fighting chance. But because most people don't know a financial crisis is in progress, they will have little chance of survival. This summer, America 's subprime CDOs are coming home to roost, and not just to the US .

The financial crisis I predicted happened in August 2007 and is now gaining momentum. Central bankers in Europe , Asia , and America have made available billions of dollars in credit in a failed attempt to restart a stalled and faltering global economy. The central bankers have only succeeding it delaying the coming day of reckoning they themselves set in motion.

Credit leads to debt as well as to expansion and today the expansion has slowed but the debts have compounded. Central banks are the very institution that Thomas Jefferson warned about. Their role in today's problems is misunderstood, an error as fatal as in misdiagnosing a growing cancer.

Americans and indeed the world are looking to central banks to stabilize world markets. But central banks won't and can't because central banks are themselves the destabilizing force that first issued the credit that has now becoming the defaulting debt that can't be traded.

Central banks are the mechanism by which private bankers create the credit that turns into debt, debt that US homeowners, US consumers, and the US government can't afford to repay; and the global banks, pension funds, and insurance companies that bought those debts for their expected income streams are now becoming stuck with IOUs/ sic investments as worthless as today's subprime CDOs.

The international currency flows I referred to in my article Subprime America Infects Asia And Europe will be affected by the inability of US consumers to pay back debts now bundled as investments that are now in the portfolios of banks, pension funds, and insurance companies .

And when international currency flows turn away from America , the spigot of credit which allowed and encouraged Americans to live beyond their means will be turned off. The consequences of such will be felt first in America and then in the world, a world which has come to depend on the credit-driven consumption of the US for its profits.

THE COLLAPSING US ECONOMY AND THE RISING PRICE OF GOLD

One year ago on March 21, 2007 , gold was at $660. Today, the price of gold is $919. Gold has not seen its top nor has the US economy yet seen its bottom. Both gold and the US economy are currently in a correction. The difference is gold's correction will last days and the economy's correction will continue for years.

When the dot.com bubble burst in 2000, in 2001/2002 the Fed cut interest rates in a similar attempt to restart a slowing economy. They succeeded but in so doing created an even greater bubble, the largest residential and commercial property bubble in history.

Now that the property bubble is deflating and the economy again slowing, once again the Fed is lowering interest rates as it attempts to restart the economy. But this time as it pours liquidity and even more credit into world markets, the consequences will be far greater and far more dangerous than even the property bubble it inadvertently set in motion in 2002-2006.

The trick bag of central bankers is almost empty as they relentlessly pursue the only avenue kreditmeisters have at their disposal, issuing more credit. But this time, instead of a property bubble, the kreditmeisters are running the very real risk of igniting the greatest danger of all—hyperinflation, a hyperinflation which will result in the complete destruction of the US dollar—and if gold went to $850 an ounce in 1980 when inflation reached 13.91 %, the price of gold will go through the roof if and when inflation turns into its most feared offspring, hyperinflation

…the United States has experienced high rates of inflation in the past and appears to be running the same type of fiscal policies that engendered hyperinflations in 20 countries over the past century. Laurance Kotlikoff, Federal Reserve Bank Review St Louis July/Aug 2006

RISK ANALYSIS REDUX

The dangers Thomas Jefferson warned about are upon us. Bankers and corporations control America 's finances; the US Treasury is their bank, their credit money is now our debts and, as a consequence, the fate of the US is sealed.

We are but a shadow of the magnificent nation we once were. Our patrimony spent, our liberties reduced to sound bites and echoes of once tangible rights, America stands today on the bankers' gallows of debt, waiting for the bottom to give way as it someday will.

We can do no better than to repeat and reread the words of US President Woodrow Wilson who signed the despicable Federal Reserve Act into law. Those words were uttered and written almost one century ago. His words were true then; they are even truer today.

We have come to be one of the worst ruled, one of the most completely controlled and dominated, governments in the civilized world—no longer a government by free opinion, no longer a government by conviction and the vote of the majority, but a government by the opinion and the duress of small groups of dominant men.. Woodrow Wilson, President of the United States 1913-1921

Today, we are no more able to stop the bankers and corporations in their continuing shake-down of America than the Nazis could be stopped in 1930s Germany . History is being played out in America as it was then in Germany . But times change and America will change in the future as Germany changed in the past.

Tomorrow will bring a better day. But until then, we can only persist and pray [and buy gold] until the bankers and corporations finish destroying and consuming what remains of the once great nation known as America .

Darryl Robert Schoon

www.survivethecrisis.com

www.drschoon.com

About Darryl Robert Schoon

In college, I majored in political science with a focus on East Asia (B.A. University of California at Davis, 1966). My in-depth study of economics did not occur until much later.

In the 1990s, I became curious about the Great Depression and in the course of my study, I realized that most of my preconceptions about money and the economy were just that - preconceptions. I, like most others, did not really understand the nature of money and the economy. Now, I have some insights and answers about these critical matters.

In October 2005, Marshall Thurber, a close friend from law school convened The Positive Deviant Network (the PDN), a group of individuals whom Marshall believed to be "out-of-the-box" thinkers and I was asked to join. The PDN became a major catalyst in my writings on economic issues.

When I discovered others in the PDN shared my concerns about the US economy, I began writing down my thoughts. In March 2007 I presented my findings to the Positive Deviant Network in the form of an in-depth 148- page analysis, " How to Survive the Crisis and Prosper In The Process. "

The reception to my presentation, though controversial, generated a significant amount of interest; and in May 2007, "How To Survive The Crisis And Prosper In The Process" was made available at www.survivethecrisis.com and I began writing articles on economic issues.

The interest in the book and my writings has been gratifying. During its first two months, www.survivethecrisis.com was accessed by over 10,000 viewers from 93 countries. Clearly, we had struck a chord and www.drschoon.com , has been created to address this interest.

Darryl R Schoon Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.