Buying Gold On Dip - Russia, Kazakhstan, Azerbaijan, Kyrgyz Republic, Turkey

Commodities / Gold and Silver 2013 Jun 25, 2013 - 01:55 PM GMTBy: GoldCore

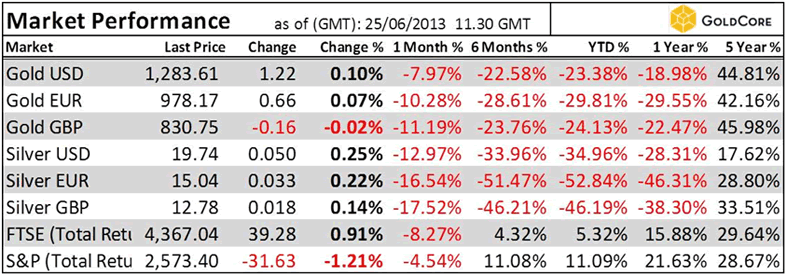

Today’s AM fix was USD 1,285.00, EUR 979.42 and GBP 831.88 per ounce.

Today’s AM fix was USD 1,285.00, EUR 979.42 and GBP 831.88 per ounce.

Yesterday’s AM fix was USD 1,283.25, EUR 978.98 and GBP 836.21 per ounce.

Gold fell $11.70 or 0.90% yesterday and closed at $1,282.30/oz. Silver slid to a low of $19.453 and finished down 2.14%.

Gold is marginally higher today in most currencies. Market participants continue to assess whether the gold price is vulnerable to more falls or is close to bottoming.

Recent market turmoil and sharp declines in stock and bond markets may have exacerbated gold’s recent weakness as margin calls led to forced selling of a market that was already under pressure.

Central bank reserve diversification should support gold at these very depressed levels.

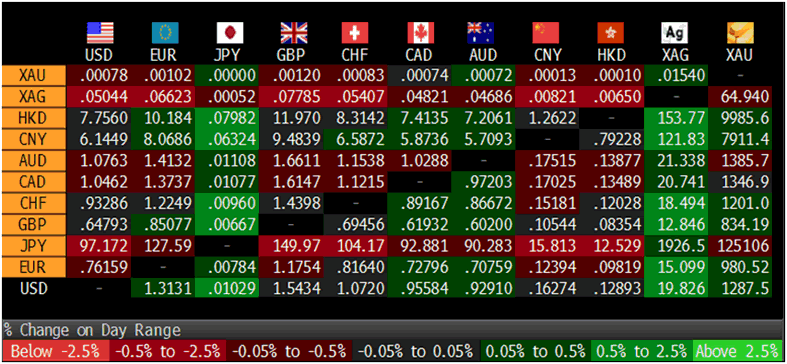

Cross Currency Table – (Bloomberg)

The smart money continues to realise the importance of an allocation to gold for diversification purposes and to see gold’s long term bull market as intact.

Gold’s bull market is intact and prices will reach a new high as declines in bonds and equities boost demand and investors seek insurance against economic and political risk, according to Schroder Investment Management Ltd.

“Gold’s bull market is intact and prices will reach a new high as declines in bonds and equities boost demand and investors seek insurance against economic and political risk” Schroder Investment Management Ltd. Told Bloomberg in an interview.

Macroeconomic, geopolitical and monetary uncertainty led to continuing central bank diversification into gold in May. Recent price falls are not deterring many creditor nation central banks from allocating some of their foreign exchange reserves into gold.

Russia, Kazakhstan, Azerbaijan, Kyrgyz Republic and Turkey all increased their gold reserves in May.

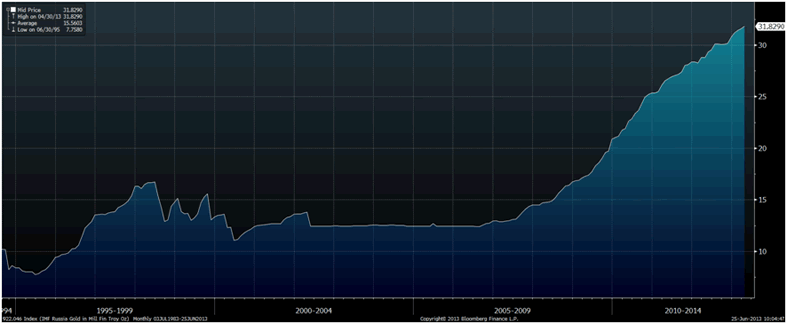

IMF Russia Gold in Mill Fin Troy Oz – (Bloomberg)

Russia and Kazakhstan expanded their gold reserves for an eighth straight month in May, buying the metal to diversify assets due to increasing political, economic and monetary uncertainty.

Russian holdings, the seventh-largest by country, climbed 6.2 metric tons to 996.2 tons, taking gains this year to 4% after expanding by 8.5% in 2012, International Monetary Fund data show.

In ounce terms, Russia raised gold holdings to 32.027 million ounces in May from 31.829 million ounces in April.

Gold Support & Resistance Chart – (GoldCore)

Kazakhstan’s gold reserves grew 4 tons to 129.5 tons, taking the increase to 12% this year after a 41% expansion in 2012. In ounce terms, Kazakhstan expanded holdings to 4.163 million ounces in May from 4.036 million ounces in April.

Turkey’s holdings rose 18.2 tons to 445.3 tons in May, increasing for an 11th month as it accepted gold in its reserve requirements from commercial banks. In ounce terms, Turkey increased gold holdings to 14.32 million ounces in May from 13.73 million in April.

Azerbaijan and Kyrgyz Republic were among nations that bought bullion in May, while Brunei and Nepal added gold in April.

Mexico cut its gold reserves marginally for a 13th month while Czech Republic also reduced holdings marginally.

Czech Republic cut holdings to 0.355 million ounces in May from 0.366 million ounces in April. Mexico cut holdings to 3.986 million ounces in May from 3.989 million in April.

The People’s Bank of China does not declare their gold reserves to the IMF and is likely to be quietly accumulating gold reserves which is another important strong plank of support for gold.

This central bank demand is set to continue as macroeconomic, geopolitical and monetary uncertainty is here to stay and indeed may escalate substantially in the coming months as we move into the next phase of the global debt crisis.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.