U.S. Dollar At Risk? Case for Profiting from Managing Currency Risk

Currencies / US Dollar Jun 11, 2013 - 02:40 PM GMTBy: Axel_Merk

The “cleanest” dirty shirt, the U.S. dollar, is down versus the euro so far this year; and was down last year. Yet, S&P, in upgrading the credit outlook of the U.S., cites U.S. dollar strength. If this is a strong dollar environment, are investors prepared for a weak one? With plenty of dirty laundry in the world, we ponder how investors might be able to profit from actively managing currency risk.

The “cleanest” dirty shirt, the U.S. dollar, is down versus the euro so far this year; and was down last year. Yet, S&P, in upgrading the credit outlook of the U.S., cites U.S. dollar strength. If this is a strong dollar environment, are investors prepared for a weak one? With plenty of dirty laundry in the world, we ponder how investors might be able to profit from actively managing currency risk.

Not managing currency risk may be risky. When holding U.S. dollar cash, if nothing else, one risks the erosion of one’s purchasing power. When adding non-dollar currencies to a portfolio, one clearly adds rather than removes risk when judged in terms of U.S. dollar returns, but it might be a risk worth pursuing. Let us explain:

The “mania of policy makers” might be best expressed in currencies

Investors buying equities in hopes that all the “money printing” (quantitative easing, “QE”) may lift asset prices are taking on a great deal of ‘noise’. We believe asset prices may no longer reflect fundamentals, but instead reflect the next perceived move of policy makers. We believe the currency markets may be a great way to express one’s view of what we call the “mania of policy makers,” as currency movements may provide a far more direct reflection of what policy makers are up to.

Differently put: you may not like what President Obama, German chancellor Merkel, or Japan’s prime minister Abe are up to, but we believe they are rather predictable. The same applies to central banks around the world.

Currencies For Dummies

“Currencies are too complicated!” is about as enshrined in investor’s thinking as the myth that fiat1 currencies are worth more than the paper they are printed on. When we look at the equity space, we see thousands of stocks. Why exactly is the share price of Apple down from its peak despite Apple being a great company? Sure, the pundits have figured it out now, but how many identified the peak? Well, stocks don’t have to be complicated: Abby Joseph Cohen at Goldman Sachs is famous for all too often proclaiming stock prices have the potential to move up 10%, just about no matter where stock prices are.

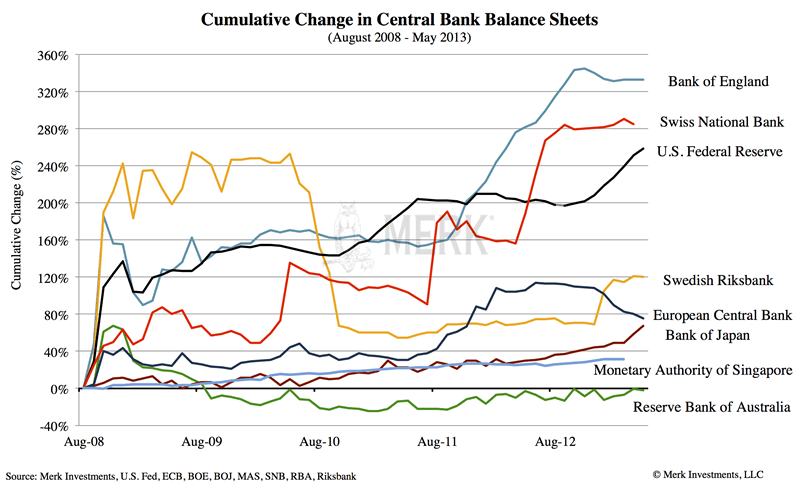

In the currency space, there are 10 major currencies, then a limited number of smaller ones worth following. We think it’s a space that’s much more easily followed. As long-term readers of Merk Insights know, we spend a great deal of time explaining dynamics in the currency space. You don’t have to know the latest and greatest carry trade strategy to make money in currencies, just as one doesn’t need to know all about Fibonacci retracements to make money in equities. However, just like any investments, one does need a coherent framework to look at the market. Our framework happens to be monetary policy, a very fertile base given the active involvement of policy makers. At the risk of over-simplifying, consider this chart depicting growth in central bank balance sheets of select major economies, as a proxy for the amount of money that’s been “printed” (in quotes as no real physical currency is printed, but currency is created by the stroke of a keyboard):

Is it all that surprising that the euro is strong despite trouble in the Eurozone when liquidity is being mopped up? Is it all that surprising that the yen is weakening as the printing presses are ramped up in Japan?

Bonds or Equities? Currencies.

In our discussion with investors, a dominant concern is what may happen to the bond market. Some are concerned about inflation; many are concerned about economic growth: either way, bond prices might be at risk. Yet moving from fixed income to equities likely increases the risk profile of a portfolio. What about investors that are not gung-ho about equities given what might be overvalued levels in the U.S. stock market?

The alternative might be currencies. Like international fixed income, currencies provide non-dollar currency exposure. But unlike bonds, the typical currency investment minimizes interest rate and credit risk. While it’s been profitable in recent years to take on those risks, chasing yields might increasingly become a risky proposition. Some consider currency investing a special case of international fixed income investing, just on the very short end of the yield curve.

Merk Insights

Currencies offer low correlation to traditional asset classes

Most investors have heard currencies may have a low correlation to other asset classes. But what does that mean? There are two basic ways to look at currency investing: directional versus non-directional:

When looking at directional currency investing, think of the U.S. dollar versus a currency, a basket of currencies (such as the dollar index) or a managed basket of currencies (such as a mutual fund). Over longer periods, directional currency investing has historically generated returns that have a rather low correlation to other asset classes, including a negative correlation to bonds. However, directional currency investing is not completely immune to the risk-on / risk-off sort of environments we experienced with some intensity until especially last summer. The good news is that these correlations have been breaking down.

However, currencies also allow investors to design a portfolio that has a low correlation to other asset classes independent of the market environment. We are talking about non-directional currency investing, such as taking a position on the New Zealand dollar versus the Australian dollar. Before you roll your eyes and say “I told you it’s complicated,” consider the following:

- The Australian dollar’s fate is closely linked to the fate of hard commodities; of late, the Aussie has had some challenges.

- The New Zealand dollar’s fate is more closely linked to soft commodities. Most recently, global dairy prices have been on the rise.

Assume now you want to take a position that the Kiwi, as the New Zealand dollar is called, will rise versus the Aussie. While no one can guarantee that you can make money with that sort of trade, it is reasonably certain that the returns generated with this pair will have a very low, if any, correlation to just about anything else in most investors’ portfolios. The power of non-directional currency investing, most commonly found in absolute return types of strategies, is that it may be able to add uncorrelated returns to a portfolio.

Currencies: consistent risk profile

Investors are willing to take risk, but they would like to know what risks they are taking on. The risk profile of currencies is historically more consistent than the risk profile of either stocks or bonds: Equity prices are historically notoriously volatile. Not only are they volatile, but volatility is also all over the place, serving investors everything from “goldilocks” types of markets to gut wrenching roller-coasters during crashes, be they flash or credit-crunch induced. The currency space, in contrast and despite its reputation, is far less volatile. When the euro moves from 1.30 to 1.31, such a move makes the headlines as it affects major economies, but is a rather muted move compared to a typical move in the equity market, where a stock price move from 130 to 131 hardly qualifies as a “mover of the day.”

And, at least historically speaking, when volatility spikes in the currency markets, it does so not only from a lower base, but also does so within a narrower range than either equities or fixed income. The dollar index, for example, typically has an annualized standard deviation of returns in the high single digits, spiking to the low teens in 2008; in contrast, the S&P 500 Index historically has an annualized standard deviation of returns in the twenties, then spiking to the 40 percent range in 2008.

The upside of providing a lower, well-defined risk profile may be more limited downside risk than other asset classes. In recent years, investing in international equities - the most common way to get currency exposure for investors - brought investors more beta rather than alpha. That’s a fancy way of saying that international equity investors got more volatility, but little in the way of true diversification. Why not zoom in on the currency risk, but have that actively managed rather than being a side product? Many international equity managers do not actively manage currency risk: they like it when it works in their favor, and scoff when it detracts from their performance.

Currencies may be well suited for active management

One attribute that may be unique about the currency space is how well it is suited for active management. Many participants in the currency markets are not trying to maximize their profits: think corporate hedgers; think central banks; think tourists using their credit card abroad; or think even many international equity investors neglecting to optimize the currency component of their transactions. All this provides what we believe are market inefficiencies. Lots of speculators are trying to take advantage of these, driving up liquidity, driving down transaction costs. Different from many of these speculators, though:

- Investors do not have to use leverage to invest in currencies.

- One does not need to deploy carry trade or momentum strategies.

Indeed, many of these quant driven strategies have had significant challenges in recent years, not least because when policy makers are active in the markets, no matter how good one’s back testing is, odds are that such back testing cannot account for major policy shifts. Conversely, the types of approaches that have shown promising results include those incorporating significant macro components. In other words: devising an investment strategy that projects anticipated policy changes onto the currency space.

Managing currency risk may be profitable

Ignore currency risk at your own peril. We believe there may be no such thing anymore as a risk-free asset and investors may want to take a diversified approach to something as mundane as cash. Furthermore, managing currency risk may help investors profitably navigate today’s environment.

We are about to publish a white paper providing more in-depth data on this discussion; please make sure you are subscribed to our newsletter to be informed when it becomes available. Also, please join us for a webinar that discusses the currency asset class in more detail: click to join our webinar list; our next Webinar is next Tuesday, June 18.

Manager of the Merk Hard, Asian and Absolute Return Currency Funds, www.merkfunds.com

Rick Reece is a Financial Analyst at Merk Investments and a member of the portfolio management

Axel Merk, President & CIO of Merk Investments, LLC, is an expert on hard money, macro trends and international investing. He is considered an authority on currencies. Axel Merk wrote the book on Sustainable Wealth; order your copy today.

The Merk Absolute Return Currency Fund seeks to generate positive absolute returns by investing in currencies. The Fund is a pure-play on currencies, aiming to profit regardless of the direction of the U.S. dollar or traditional asset classes.

The Merk Asian Currency Fund seeks to profit from a rise in Asian currencies versus the U.S. dollar. The Fund typically invests in a basket of Asian currencies that may include, but are not limited to, the currencies of China, Hong Kong, Japan, India, Indonesia, Malaysia, the Philippines, Singapore, South Korea, Taiwan and Thailand.

The Merk Hard Currency Fund seeks to profit from a rise in hard currencies versus the U.S. dollar. Hard currencies are currencies backed by sound monetary policy; sound monetary policy focuses on price stability.

The Funds may be appropriate for you if you are pursuing a long-term goal with a currency component to your portfolio; are willing to tolerate the risks associated with investments in foreign currencies; or are looking for a way to potentially mitigate downside risk in or profit from a secular bear market. For more information on the Funds and to download a prospectus, please visit www.merkfunds.com.

Investors should consider the investment objectives, risks and charges and expenses of the Merk Funds carefully before investing. This and other information is in the prospectus, a copy of which may be obtained by visiting the Funds' website at www.merkfunds.com or calling 866-MERK FUND. Please read the prospectus carefully before you invest.

The Funds primarily invest in foreign currencies and as such, changes in currency exchange rates will affect the value of what the Funds own and the price of the Funds' shares. Investing in foreign instruments bears a greater risk than investing in domestic instruments for reasons such as volatility of currency exchange rates and, in some cases, limited geographic focus, political and economic instability, and relatively illiquid markets. The Funds are subject to interest rate risk which is the risk that debt securities in the Funds' portfolio will decline in value because of increases in market interest rates. The Funds may also invest in derivative securities which can be volatile and involve various types and degrees of risk. As a non-diversified fund, the Merk Hard Currency Fund will be subject to more investment risk and potential for volatility than a diversified fund because its portfolio may, at times, focus on a limited number of issuers. For a more complete discussion of these and other Fund risks please refer to the Funds' prospectuses.

This report was prepared by Merk Investments LLC, and reflects the current opinion of the authors. It is based upon sources and data believed to be accurate and reliable. Opinions and forward-looking statements expressed are subject to change without notice. This information does not constitute investment advice. Foreside Fund Services, LLC, distributor.

Axel Merk Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.