Russia: The Sleeping Giant of Gold Producing Countries

Commodities / Gold and Silver 2013 May 25, 2013 - 03:55 PM GMT “The more gold a country has, the more sovereignty it will have if there’s a cataclysm with the dollar, the euro, the pound or any other reserve currency.” — Evgeny Fedorov, Russian lawmaker, United Russia Party

“The more gold a country has, the more sovereignty it will have if there’s a cataclysm with the dollar, the euro, the pound or any other reserve currency.” — Evgeny Fedorov, Russian lawmaker, United Russia Party

As it stands today, the top seven global gold producers, according to the U.S. Geological Survey, are:

1. China (370 Metric Tonnes)

2. Australia (250 MT)

3. United States (230 MT)

4. Russia (205 MT)

5. South Africa (170 MT)

6. Peru (165 MT)

7. Canada (102 MT)

When you take-in this table, it inspires little beyond a shrug until you consider the monetary policies, and the policies toward gold, in the countries listed. China, for example, is the world’s biggest producer of gold, but its production is essentially sequestered, i.e., it stays in the country and forms part of its monetary reserves. The same is true with Russia. Thus 21% (575 tonnes) of the world’s gold production in 2012 did not see the light of day on international markets.

In addition among the countries that still make their gold production available to world markets, four of the top seven are in long-term decline — the United States, South Africa, Australia and Canada, some would say precipitously. Three enjoy rising production — China, Russia and Peru. Among the declining states, South Africa suffered the worst cutbacks, down 52% from production in 2000. U.S. production is down 39% over the same period; Canada is down 38% and Australia, 24%.

So what does this mean with respect to the long-term, overall supply-demand picture?

Obviously there is substantially less gold actually reaching the market today than there was 12 years ago, and by a wide margin when you consider the tonnage sequestered as mentioned above. In 2000, none of the gold production was sequestered by nation states to build monetary reserves (at least none that we know of), now, a significant portion is going into reserves in what might be considered a trend, or the first baby steps, toward a 21st century version of a gold reserve standard. (Think where South Africa would be as a nation state today if it had kept even one-third of its production as a monetary reserve.) The world of gold from a supply perspective has changed remarkably over the past dozen years.

Given the problem of money printing on a global basis, the trend of rising official sector gold reserves is likely to continue as more and more emerging countries see it in their best interest to diversify their monetary reserves. I wouldn’t be surprised to learn at some point down the road that Peru, for example, decided it might be in its best interest to retain production.

—————-

Russia’s gold production is an important piece of the overall supply puzzle in terms of both production and reserves. Few people know (or remember) that in 1980, Russia was the second largest global gold producer at 21% of the total global output (258 metric tonnes) South Africa was number one at 55% of the total global output (675 metric tonnes). With respect to future gold production, Russia is a sleeping giant that could leap-frog the United States and Australia soon.

Reuters quotes Sergei Kashuba, head of the Russian Gold Industrialists’ Union as saying, “If gold prices remain at a high level, gold output in Russia will continue to grow by 4-5 percent per year, which will allow it to become the third largest producer in the world in 2015.”

After the collapse of the old Soviet Union in late 1991, gold production plummeted. In 1995, Russia produced only 133 metric tonnes — 5.9% of the global total output. South Africa, still number one in 1995, produced 524 metric tonnes. Overall production globally more than doubled between 1980 and the present from 1220 MT in 1980 to about 2700 MT today. The United States (with its vast deposits in Nevada), Australia, Peru and Indonesia were primarily responsible for the increases in overall production.

Now Russian gold production is on the mend, and building its gold reserves is part of the Putin government’s attempt to shield Russia from a potential currency war between the yen, yuan, dollar and euro — the first volleys for which we have seen over the past few months. Keep in mind too that in terms of known reserves Russia reports 5000 metric tonnes. It ranks third behind Australia (7400 MT) and South Africa (6000 MT). The United States reports 3000 MT.

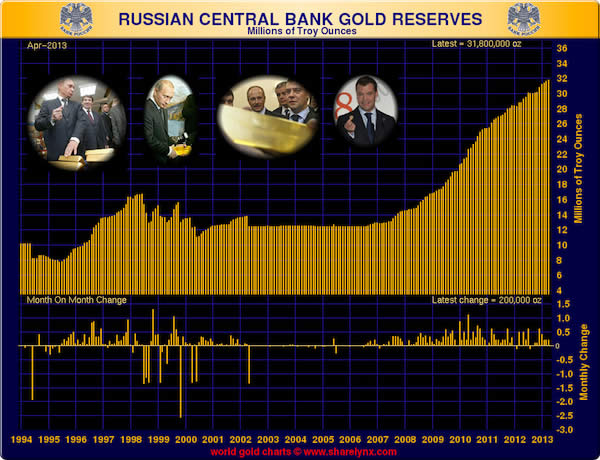

Here’s an interesting graph from my old friend Nick Laird over at Sharelynx that shows the effects of Russia’s gold strategy on its reserve position and buttresses the Evgeny Federov quote at the top of this post:

If you like this kind of in-depth commentary, you will probably like our newsletter. It’s free, arrives by e-mail link, and you can opt out at any time.

By Michael J. Kosares

Michael J. Kosares , founder and president

USAGOLD - Centennial Precious Metals, Denver

Michael Kosares has over 30 years experience in the gold business, and is the author of The ABCs of Gold Investing: How to Protect and Build Your Wealth with Gold, and numerous magazine and internet articles and essays. He is frequently interviewed in the financial press and is well-known for his on-going commentary on the gold market and its economic, political and financial underpinnings.

Disclaimer: Opinions expressed in commentary e do not constitute an offer to buy or sell, or the solicitation of an offer to buy or sell any precious metals product, nor should they be viewed in any way as investment advice or advice to buy, sell or hold. Centennial Precious Metals, Inc. recommends the purchase of physical precious metals for asset preservation purposes, not speculation. Utilization of these opinions for speculative purposes is neither suggested nor advised. Commentary is strictly for educational purposes, and as such USAGOLD - Centennial Precious Metals does not warrant or guarantee the accuracy, timeliness or completeness of the information found here.

Michael J. Kosares Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.