Gold: Who’s Selling Who’s Buying Who’s Lying

Commodities / Gold and Silver 2013 May 08, 2013 - 11:50 AM GMTBy: Darryl_R_Schoon

Although the Pharisees of paper money successfully forced down the price of gold, like those who lobbied Pontius Pilate to crucify Jesus, the consequences of their actions will backfire beyond their wildest imagination.

Although the Pharisees of paper money successfully forced down the price of gold, like those who lobbied Pontius Pilate to crucify Jesus, the consequences of their actions will backfire beyond their wildest imagination.

The decision of the paper money cabal to force down the price of gold is akin to Japan’s decision to attack Pearl Harbor. Although the attack was successful, the eventual consequences were not what Japan had envisioned.

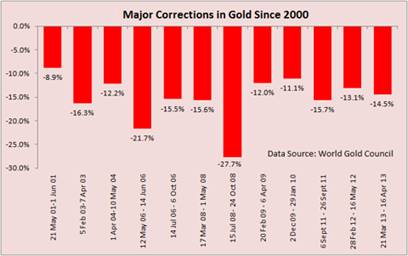

Recently, an article, The Gold Correction: What’s the Big Deal?, at Seeking Alpha posted the following chart. However, measured from its September 2011 high of $1901.35, gold’s fall is 28 %, a drop remarkable similar to its 2008 correction of 27.7 %.

THE 2008 CORRECTION AND/OR MANIPULATION

The 2008 correction of gold occurred during a period of extreme financial and systemic distress. Global markets were in disarray, Wall Street banks were collapsing and trillions of dollars of Fed money was necessary to protect the bonuses of investment bankers whose bad bets had caused the collapse—just the environment when gold would be expected to rise.

Instead, gold fell. In 2008, as today, the same hands were on the scale forcing the price of gold lower. In the fall of 2007, gold had rise from $680 to $1,033, An astounding 51.9 % increase. This is exactly what the paper money cabal feared most, a concomitant rise in the price of gold during a period of extreme financial stress.

If gold quickly rose during a period of heightened investor fear, it would signal to fearful investors that although paper assets were at risk, gold offered not only a safe haven but outsized gains as well; and the investors’ subsequent fear-fueled greed would easily dismiss any resistance the paper money cabal might offer.

To counter the allure of gold in such heightened circumstances, in my article, Gold Buying Opportunity of a Lifetime posted March 18, 2009, I wrote

When gold made its run in the fall of 2007 from $680 to $1,033 in spring 2008, the Swiss National Bank sold 22 tons of gold to cap gold’s rise…One year later (after the collapse of global stock markets in the fall of 2008), gold made another run at $1,000; but this time when gold hit $1,009 on February 20th[2009] , LeMetropole reported central banks sold 220 tons of gold to force gold below $900.

In 2009, the paper money cabal had also pushed gold lease rates into negative territory to prevent gold from rising above $1,000. On March 17, 2009, in his article, Gold Price Manipulation More Blatant, Patrick Heller wrote:

On Friday, March 6, gold lease rates turned negative for the day. What that means is that anyone who wanted to lease gold would actually be paid a fee in addition to getting a free gold loan.

No sane person would choose to lose money loaning physical gold, in addition to the risk of never getting the gold back from the other party. However, if someone (such as the U.S. government) wanted to suppress the price of gold, this is one tactic to try to accomplish that purpose.

I can come to no other conclusion than that a large quantity of physical gold surreptitiously appeared on the market on March 6 with the sole purpose to drive down the price of gold. The quantities were large enough that they almost certainly could not come from private parties. With most of the world's central banks now being net buyers of gold reserves, they would not be the source of this gold. By process of elimination, the suspicion falls upon the U.S. government as the ultimate party responsible for this blatant action to manipulate the price of gold.

Of course, the U.S. government would not want to be identified as the cause of this leasing anomaly. Instead, such manipulation was almost certainly conducted by multiple trading partners of the U.S. government.

This sledge hammer tactic worked at driving the price of gold further away from the $1,000 level - at least temporarily.

Mr. Heller need look no further than Alan Greenspan for confirmation that central banks—in collusion with bullion banks—were, in fact, manipulating gold with lease rates. Eleven years before, on July 24, 1998, before the House Committee on Banking and Financial Services, Fed Chairman Alan Greenspan had testified:

Central banks stand ready to lease gold in increasing quantities should the price rise.

http://en.wikiquote.org/wiki/Alan_Greenspan

Although Greenspan was to fail as an economist he excelled as a politician, and as disingenuous as Alan Greenspan’s tenure was, Greenspan’s testimony as to the readiness of central banks to lease gold in increasing quantities should the price rise is an admission sufficient to quiet those who would still believe otherwise.

Regarding the central bank leasing of gold, in The Gold Market: Seen Through A Glass Darkly, I wrote:

After gold’s explosive ascent in 1980, central bankers began seriously ‘manage’ the price of gold. A lower price of gold would indicate not only an abatement of monetary problems but investors would be less inclined to trade their paper banknotes for the safety of gold when they could more profitably leverage their paper banknotes in the bankers’ paper markets.

Since the early 1980s, supplies of newly mined gold have constantly fallen short of market demand for gold; but notwithstanding supply and demand fundamentals, gold prices nonetheless fell for 20 straight years. In 1980, the average price of gold was $615. By 2001, it was only $271. Clearly, the free market price of gold was being distorted by ‘outside’ forces.

THE REAL QUESTION IS NOT WHETHER THE FED IS MANIPULATING GOLD BUT WHERE THE GOLD IS COMING FROM.

There has been conjecture that gold stolen by Japan from China prior and during WWII is the source of the supply of gold coming onto the market. In 2012, GATA’s Chris Powell discounted that possibility in his post, If U.S. had ‘Yamashita’s Gold’, they’d put it in Cracker Jack boxes.

While I concur with Powell that if the US had access to such gold in 1968, they would have employed it to prevent the collapse of the London Gold Pool. It is my belief, however, that such gold did exist but, in 1968, “Yamashita’s gold”, i.e. China’s stolen gold, was still a tightly held secret of the US government privy to only the top echelons of the CIA and a few others.

More importantly, however, in the 1960s China’s stolen gold, i.e. ‘Yamashita’s gold’, had not yet been laundered into the international banking system. The laundering of the illicit horde of gold was not to happen until the 1980s, the decade when, not coincidentally, American Barrick, a junior oil and gas producer, was to become Barrick Gold.

No less than the esteemed Professor Antal E. Fekete recognized the possibility of gold laundering by Barrick when he questioned Barrick’s inexplicable and self-defeating strategy of unhedged forward selling of gold at prices far below the market.

In his August 2006 article, To Barrick Or To Be Barricked, That Is The Question, Professor Fekete suggested Barricks strategy could, in fact, be an operation to cover up the laundering of gold. The professor wrote:

Is Barrick a front to cover up gold-laundering?

..unless Barrick was a front to cover up gold laundering by governments, in which case unilateral forward selling was not a mistake but a deliberate policy…The suspicion that Barrick is a front to cover up a gigantic gold-laundering operation, presumably on behalf of a government (or governments) that need more time to complete a gold acquisition program in the order of thousands of tons of gold, is hard to escape.

In my book, Light In A Dark Place, I quote from EP Heidner’s Collateral Damage which confirms what Professor Fekete had surmised—but Barrick wasn’t laundering gold to complete a gold acquisition program as believed by Professor Fekete—Barrick was, in fact, laundering China’s stolen gold to bring it into the international banking system.

US Intelligence operations had been siphoning off the gold [China’s stolen gold] for three decades. However in 1986 Vice President George Bush took over the gold from Marcos and the gold was removed to a series of banks, notably Citibank, Chase Manhattan, Hong Kong Shanghai Banking Corporation, UBS and Banker’s Trust, and held in a depository in Kloten, Switzerland.

In 1992, George Bush [former Director of the CIA] served on the Advisory Board of Barrick Gold. The Barrick operation would create billions of dollars of paper gold by creating ‘gold derivatives’ …[and] would become an investment for nearly every gold bullion bank associated with the Marcos gold recovery [China’s stolen gold]. These banks would loan gold to Barrick, which would then sell the borrowed gold as derivatives, with the promise of replacing the borrowed gold with their gold mining operation.

Barrick, which has no mining operations in Europe, used two refineries in Switzerland: MKS Finance S.A. and Argor-Heraeus S.A. – both on the Italian border near Milan, a few hours away from the gold depository in Zurich…The question that Barrick and other banks needed to avoid answering is: what gold was Barrick refining in Switzerland, as they have no mines in that region?

Barrick would become a quiet gold-producing partner for a number of major banks, and its activities became subject to an FBI investigation into gold-price-fixing. The records on this investigation were kept in the FBI office on the 23rd floor of the North Tower which was destroyed by bomb blasts shortly before the Tower collapsed.

p. 11, Collateral Damage: US Covert Operations and the Terrorist Attacks on September 11, 2001, EP Heidner (2008)

CONJECTURE, CONJURING AND CONFIDENCE GAMES

The drop in the price of gold has ignited a frenzy of gold-buying around the world. It is my belief that the gold being sold is not China’s stolen gold, but gold purloined from the central banks of countries still vulnerable to the considerable pressure of Western central banks.

In 2012, India’s central bank, the Royal Bank of India, received a High Court notice to explain gold deposits currently with the Bank of England and the Bank of International Settlements in Basel, Switzerland. India’s central bank is required by law to keep 85% of its gold reserves in India yet 47% of India’s gold is deposited with the Bank of England and the Bank of International Settlements, see http://www.punemirror.in/article/62/2012050420120504025313609120ae2ba/RBI-gets-HC-notice-to-explain-gold-deposits-with-Bank-of-England.html

It is likely that India’s gold has been leased by the Bank of England in order to suppress the price of gold. India is a former crown colony and its imperial shackles have not yet been completely removed.

The international monetary system based on credit and debt is, in truth, a confidence game in which gold was once a critical component. But when ties between paper money and gold were severed in 1971, confidence in the bankers’ paper money began to falter; and, today we are witness to what happens when confidence in a global confidence game begins to evaporate.

In my current youtube video, The Economic Crisis: Then and Now, I discuss the on-going economic collapse. It isn’t over yet. When it is, then and only then, will we be free of the bankers’ dream of eternal debt.

Buy gold, buy silver, have faith.

By Darryl Robert Schoon

www.survivethecrisis.com

www.drschoon.com

blog www.posdev.net

About Darryl Robert Schoon

In college, I majored in political science with a focus on East Asia (B.A. University of California at Davis, 1966). My in-depth study of economics did not occur until much later.

In the 1990s, I became curious about the Great Depression and in the course of my study, I realized that most of my preconceptions about money and the economy were just that - preconceptions. I, like most others, did not really understand the nature of money and the economy. Now, I have some insights and answers about these critical matters.

In October 2005, Marshall Thurber, a close friend from law school convened The Positive Deviant Network (the PDN), a group of individuals whom Marshall believed to be "out-of-the-box" thinkers and I was asked to join. The PDN became a major catalyst in my writings on economic issues.

When I discovered others in the PDN shared my concerns about the US economy, I began writing down my thoughts. In March 2007 I presented my findings to the Positive Deviant Network in the form of an in-depth 148- page analysis, " How to Survive the Crisis and Prosper In The Process. "

The reception to my presentation, though controversial, generated a significant amount of interest; and in May 2007, "How To Survive The Crisis And Prosper In The Process" was made available at www.survivethecrisis.com and I began writing articles on economic issues.

The interest in the book and my writings has been gratifying. During its first two months, www.survivethecrisis.com was accessed by over 10,000 viewers from 93 countries. Clearly, we had struck a chord and www.drschoon.com , has been created to address this interest.

Darryl R Schoon Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.