U.S. Mint Runs Out American Eagle Gold Coin; Smells of Shortage of Physical Gold

Commodities / Gold and Silver 2013 Apr 24, 2013 - 03:41 PM GMTBy: Mike_Shedlock

Demand for gold coins has surged following the record price plunge in gold last week. Demand is so high that the U.S. Mint Runs Out of Smallest American Eagle Gold Coin.

Demand for gold coins has surged following the record price plunge in gold last week. Demand is so high that the U.S. Mint Runs Out of Smallest American Eagle Gold Coin.

The U.S. Mint ran out its smallest American Eagle gold coin after demand surged following the biggest drop in futures prices in 33 years.

Sales of the coins weighing a 10th of an ounce were suspended after demand more than doubled in 2013 from a year earlier, the Mint said today in a statement. Total sales of American Eagles in April have almost tripled from a month earlier, according to Mint data on the website.

On April 15, gold futures in New York plunged 9.3 percent, the most since 1980. Retail sales and jewelry demand soared in India, the world’s top buyer, and China, the second-biggest. Coin sales also surged in Australia.

The Mint also sells 22-karat American Eagle coins of 1 ounce, half an ounce and a quarter of an ounce.

The U.S. Mint suspended sales of silver coins in January for more than a week because of lack of inventory. Sales of the coins jumped to a record that month.

Bullish or Bearish?

It's possible to make a bullish or bearish argument out of this shortage. The bullish argument is simple: demand is strong. The bearish argument is small investors are a contrarian indicator just as they were with silver in January.

I am not taking a short-term stance one way or another, so don't ask. I do like my chances longer-term as I explained at the Wine Country Conference. See Mike “Mish” Shedlock: A Brief Lesson in History.

Shortage of Physical Gold?

Some writers have spun this story into the message there is a shortage of physical gold. No there isn't. There is a temporary shortage of certain coins, no more no less.

Divergence Between Physical Gold and Paper Gold?

Other writers have noticed the price premium on small denomination coins and concluded there is some sort of "divergence between physical gold and paper gold".

Once again, that's nonsense. Premiums on small denomination coins is not the same a general premium on physical gold itself.

How do I know?

Easy: If I went to buy or sell at GoldMoney (and GoldMoney only deals in physical metals with allocated, audited storage), I would pay the same small markup as before, based on the current futures price.

Here is another way to tell. Go buy or sell a one ounce bar and see how much it costs or how much you can get. Here's a hint: your selling price will not fetch $1900 as it once did, nor would it cost you over $1900 to buy.

Smackdown by Naked Shorts?

Many claim blatant manipulation by naked shorts. Mercy! Under this theory, shorts piled on to the tune of 163,000 gold futures. Really?

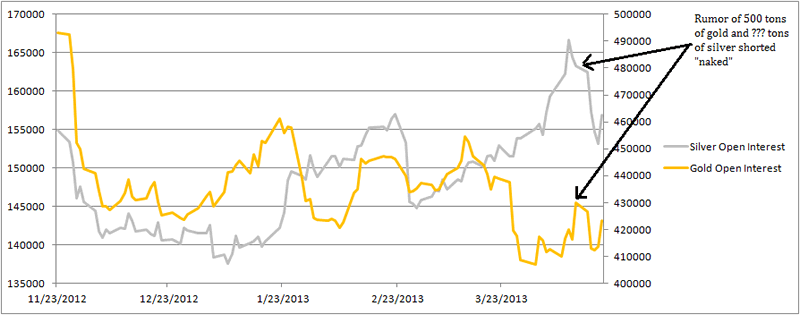

Keith Weiner tackles that theory for the Acting Man Blog in The Last Contango. Here is the pertinent chart.

Weiner asks "If someone had sold 163,000 futures to cause the price to drop, then wouldn’t the open interest [in futures] have risen? If Santa went down chimneys, wouldn’t there be soot on his red and white uniform?"

The answer to both questions is of course "yes". Instead, the chart shows a 16,000 open interest drop in gold futures and a 12,000 drop in silver futures.

Ignore the Hype in Both Directions

Bulls blame every drop on manipulation and frequently tout preposterous price targets. Bears cite jewelry demand and other nonsense as if it's important (and it isn't).

It is best to ignore the hype and silliness on both sides.

Fundamentally, what has changed? I suggest nothing

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2013 Mike Shedlock, All Rights Reserved.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.