Intel Paints a Bleak Picture for Desktop PC's

Companies / Tech Stocks Apr 19, 2013 - 10:41 PM GMTPersonal computer (PC) sales are on the decline.

It’s clearly not a surprise whatsoever, as we have seen this trend developing for years following the major push of tablets into the marketplace, according to my stock analysis.

We have seen all of the PC makers report declining sales and the need to re-invent and adapt to the rapidly changing environment for mobile devices.

Intel Corporation (NASDAQ/INTC), which used to be an icon on Wall Street and in Silicon Valley, is succumbing to the mobile wave. And it’s only going to become a technological tsunami that could inevitably devastate the PC sector and drive industry changes in order for survival, based on my stock analysis. (Read “PC Sector Struggling; Time for One Last Goodbye?”)

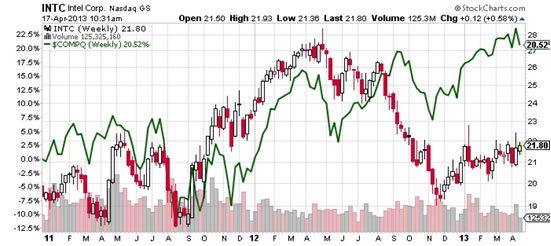

Chart courtesy of www.StockCharts.com

The results released from Intel on Tuesday support my argument.

Let’s take a look (source for all data: “Intel Reports First-Quarter Revenue of $12.6 Billion,” Intel Corporation web site, April 16, 2013):

Revenues from Intel’s once-thriving PC Client Group (PCCG) fell another six percent year-over-year to $8.0 billion in the first quarter, down 6.6% on a sequential basis.

My stock analysis indicates that volume in the notebook segment fell six percent year-over-year in the first quarter, while volume in the PC segment declined seven percent year-over-year.

But what was interesting was the Intel Architecture Group, which comprises the mobile business, including its tablet and smartphone business—areas that I feel will be critical for Intel to expand, based on my stock analysis.

The Intel Architecture Group accounted for a mere 8.5% of total revenues in the first quarter. My stock analysis suggests that what is worrisome is that this key mobile sector saw revenues contract nine percent year-over-year. According to my stock analysis, Intel will need to work on this segment.

Intel knows what is required.

In the company’s press release, Paul Otellini, the company’s president and CEO, said, “Intel performed well in the first quarter and I’m excited about what lies ahead for the company.” He added, “We shipped our next generation PC microprocessors, introduced a new family of products for micro-servers and will ship our new tablet and smartphone microprocessors this quarter.” (Source: Ibid.)

The tablet and smartphone microprocessors are the keys to the future growth of Intel and whether the company can inevitably become a major player in the mobile business.

In my view, the change and improvements will not occur overnight. It will likely take years for Intel to gain any momentum, and even this is not a guarantee, based on my stock analysis.

Over the next few quarters, watch to see if there’s progress in the mobile segment as new products come online; this will foreshadow whether the company is worth a look.

George Leong, B.Comm.

http://www.profitconfidential.com

We publish Profit Confidential daily for our Lombardi Financial customers because we believe many of those reporting today’s financial news simply don’t know what they are telling you! Reporters are trained to tell you the news—not what it can mean for you! What you read in the popular news services, be it the daily newspapers, on the internet or TV, is the news from a “reporter’s opinion.” And there’s the big difference.

With Profit Confidential you are receiving the news with the opinions, commentaries and interpretations of seasoned financial analysts and economists. We analyze the actions of the stock market, precious metals, interest rates, real estate and other investments so we can tell you what we believe today’s financial news will mean for you tomorrow!

© 2013 Copyright Profit Confidential - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.