Is Panic Selling Marking Bear Market Bottom In Gold and Silver Miners?

Commodities / Gold and Silver Stocks 2013 Apr 06, 2013 - 12:49 PM GMTBy: Jeb_Handwerger

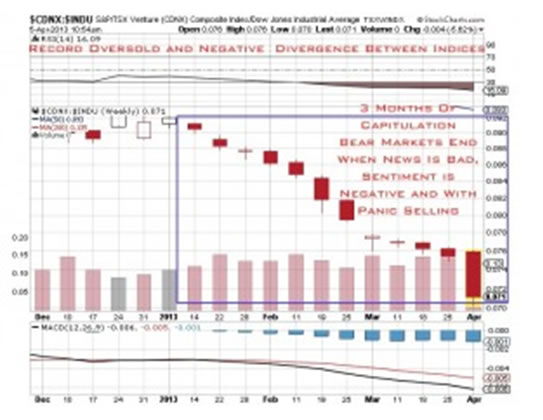

One of the ways to look for a bear market low is to look for panic selling and capitulation after an extended downtrend. Since 2013 began the Venture has had 3 months of losses compared to the Dow Industrials.

One of the ways to look for a bear market low is to look for panic selling and capitulation after an extended downtrend. Since 2013 began the Venture has had 3 months of losses compared to the Dow Industrials.

This may be a record consecutive decline as money seeks out income in large cap dividends rather than growth in smaller speculative issues. Remember that just as parabolic rises forecast major tops, cascading waterfalls, capitulation and panic selling usually marks major bear market bottoms. Value investors try to buy near a major low and look for panic selling where fundamentals and balance sheets are disregarded. This may be exactly what is occurring in the junior mining investment arena.

The resource area may be in the midst of a three month capitulation and major rotation. Old, tired players are trying to sell at any price making room for the next fresh group of value investors and entrepreneurs picking up discounted assets.

This sort of parabolic downward move historically represents bear market bottoms as the shorts cover and value investors step in. Extremely powerful upward moves can follow as shorts cover and fresh new buying comes in. Short term investors may be mistakenly selling their wealth in the earth assets at pennies on the dollar to chase the sectors actively supported by Central Banks such as housing and financials. These sectors may be risky, overbought and could easily correct.

I believe long term resource investors should exercise caution selling into this panic after a 2+ year decline as this panic capitulation may mark the bear cycle low and become a major reversal area. Smart capital may soon enter the wealth in the earth sector to hedge against inflationary risks as mining equity valuations hit record lows while large cap equities move into parabolic territory.

Despite the record printing of fiat currency that was thrown at the toxic U.S. housing market and financial sector, mining equities and commodities have been beaten down. These easy money policies not affecting commodities defies all reason and logic in the short term. Remember it is a goal for governments to disguise inflation from the masses. As I have always reminded you the markets will do whatever it can to misdirect and confuse the amateur investor in the short term.

There is a major disconnect between the markets and the real economy. The Dow is hitting record highs, yet the job market is weak. Many investors were concerned that the Fed would have to exit from quantitative easing. This recent jobs report will delay any hawkish move and will continue to support printing dollars to attempt to boost the economy. Quantitative Easing will continue for some time benefitting precious metals and commodity prices.

Gold and silver may bounce off important support levels.

Banks, housing and the US equity markets are soaring despite an extremely high unemployment rate. This will force the Fed to continue quantitative easing. Silver may even outperform gold to the upside as it has been basing longer and may be a more affordable alternative to struggling middle class wage earners who are looking to hedge against further currency devaluations and potential bank confiscations.

Eventually, capital will flow into precious metals especially silver which is holding key technical support and is demonstrating increasing momentum. No one has wanted to buy silver and mining equities for over two years now, but that may change soon as governments continue to promote inflation through easy money policies. This year may mark the turning point for silver and the miners which represent deep discounts to value investors.

Short sighted investors chasing momentum and the investment crowd are bidding up Dow dividend stocks. This craze is nothing new.

In the late 1990s, there was a big boom in dividend stocks. Billions of dollars went into this area as investors believed they were a safe haven and they could never lose. This continued rapidly until the price of the Dow dividend stocks moved too high and the dividends became minuscule compared to other growth opportunities. Eventually, investors rotated into the speculative stocks. This may happen again as history may not repeat but it tends to mimic.

The more sectors or investment approaches become popular, the less chance of being successful. Therefore, I look for what is not popular at the moment to 99% of the population and look for areas where I see supply-demand imbalances, which could spark the next rally. Remember 2011 and 2012's worst performers could be 2013 and 2014's best performers.

You have to buy when there's blood in the streets and real value. That's when you have to step in and pick up the bargains. One should fight the crowd when you see value and learn to wait. To paraphrase Jesse Livermore, "Money is not made in the buying or selling, but in the waiting."

Many investors are chasing the latest bandwagon dividend Dow stocks hitting new highs, rather than doing their homework and finding discounted opportunities which are trading close to liquidation levels. A wise value investor could pick up companies now at cheap prices, wait and sell them when the return to favor.

Savvy investors will take advantage of these depressed prices. To paraphrase Gerald Loeb, "The worst way to combat inflation is to buy something at an inflated price."

Look at discounted opportunities in the resource sector, study the fundamentals and invest in bargains. Stay away from chasing sectors that are overbought with questionable fundamentals.

Amateur investors usually chase what is rising or popular, while the pros look to acquire undervalued assets. The public is usually misdirected into the latest fad which may be just about to crash. Be careful of analysts who recommend stocks at 70 times earnings like Amazon and ignores companies that are trading at record low discounts like Barrick at 6 times earnings.

Subscribe to my free newsletter to get up to the minute updates on rare earths, uranium, gold and silver.

By Jeb Handwerger

Disclosure: Author owns no stocks mentioned.

© 2013 Copyright Jeb Handwerger - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Jeb Handwerger Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.