George Soros and the Worst Financial Market Crisis in 60 Years

Stock-Markets / Credit Crisis 2008 Mar 12, 2008 - 04:29 AM GMTBy: Clif_Droke

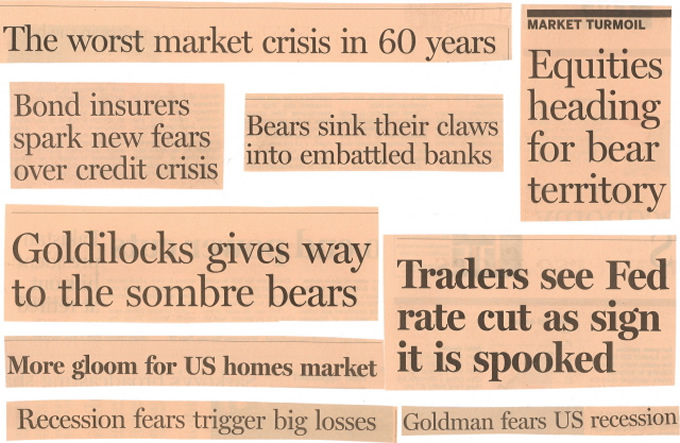

“Blood in the streets” is the central theme of the financial news lately. Barely a day goes by without a barrage of bad news hitting investors like a runaway freight train. In just the past few weeks in the Financial Times newspaper we see the following headlines:

“Blood in the streets” is the central theme of the financial news lately. Barely a day goes by without a barrage of bad news hitting investors like a runaway freight train. In just the past few weeks in the Financial Times newspaper we see the following headlines:

These are a mere sampling of the bearish media sentiment out there right now.

My favorite of these headlines as shown in the above “fear collage” is the one that says, “The worst market crisis in 60 years.” It was written by George Soros of Soros Fund fame. I consider this a key sentiment indicator, for whenever the mainstream financial press trots out the big dogs like Soros, Buffett, et al, to remind us all of the obvious – after the trend has pretty much played out – it's time to start looking in the other direction.

This time is no exception as Soros has told us nothing that virtually everyone has already has been told by the media ad nauseum, namely: the credit expansion got out of hand and resulted in a real estate bust, “market-neutral hedge funds turned out to be not market-neutral and had to be unwound,” credit expansion “must now be followed by a period of contraction,” “Investment banks' commitments to leverage buyouts became liabilities,” “the U.S. Federal Reserve…may no longer be in a position to [avoid a recession],” “If federal funds were lowered beyond a certain point, the dollar would come under renewed pressure and long-term bonds would actually go up in yield,” “a recession in the developed world is now more or less inevitable,” “China, India and some of the oil-producing countries are in a very strong countertrend,” and finally, “The danger is that the resulting political tensions…may disrupt the global economy and plunge the world into recession or worse.” (I like his use of the term “recession or worse.” Kind of remind me of the famous phrase, “We could all be killed…or worse!”)

Well, Mr. Soros, are there any other media-propagated myths and clichés you'd care to throw our way to enlighten us poor peasants? I couldn't help but chuckle after reading this editorial: it's like reading every bearish editorial and article of the past year all rolled up into a single unit. If any of you would like a re-cap of the past year's fears, I highly recommend reading Mr. Soros' editorial. (Who knows, you may even become a convert to the Financial Armageddon Now! cause yourself.)

Of course it would be foolish to suggest that Soros is less than informed on the true state of affairs within the U.S. financial system. One doesn't become a billionaire by being financially inept. What I am suggesting is that Soros is being less than truthful. A poker player doesn't reveal his hand for all to see. A financier doesn't make is billions by telling everyone what he's betting his money on. Poker players are masters of the art of bluffing and so is Soros. If Soros is telling the world that he's taking the bearish bet, you can bet your bottom dollar he has a bullish ace in the hole he's not telling you about. This is how the game is played, my friends.

Fundamental and technical analysts and financial pundits of all stripes are busy wracking their brains trying to analyze the deluge of negative news. Yet the single most reliable method of news analysis is being grossly ignored by almost everyone. The analysis I'm referring to is what I like to call “Granville analysis.” Granville analysis is based on Joe Granville's classic observation, “The obvious is obviously wrong.”

It's so simple to perform Granville analysis that anyone with a modicum of common sense can do it. Here's how it works: simply make a list of all the bearish or super pessimistic news headlines concerning the economic and financial market outlook. Instead of taking these headlines at face value, make a cumulative index and add together all the headlines from the mainstream media that agree with each other. Then apply Granville's Golden Rule to each one. Each time you see a super bearish headline, remind yourself that everyone else already knows and believes this to be true and the value of commonly believed information is exceedingly small. Remember at all times Granville's Golden Rule, “The obvious is obviously wrong.”

Another way of phrasing this observation is found in Laszlo Birinyi's famous “Cyrano Principle,” which states: “If the concerns of the market are as obvious as the nose on your face, the market and monetary policy makers will have an amazing ability to adapt and adjust.”

Next we have the weekend edition of the Financial Times , dateline Jan. 27. The front page proclaims, “The week that shook the world: How the markets went to hell and back.” This immediately brings to mind the same exact terminology used during the last major correction low on August 16, 2007. I remember reading an article in the Times from that correction bottom in August and a New York floor trader was quoted as saying, “It's like the market went screaming into hell, then turned back after it didn't like what it saw.” It would seem then that whenever the use of the highly emotive term “hell” is used in connection with a financial crisis, an internal market low has been reached.

Here are some more headlines from recent editions of the Times to underscore the emotional nature of this panic bottom: “Five days of turmoil and more volatility to come,” “'It felt like the market had fallen off a cliff',” and “Potential for more thrills and spills.”

Several super bearish headline stories have already appeared on the front covers of the major U.S. news magazines. These are the type of stories that appear only once every few years, not just at short-term lows. They mark significant intermediate-to-longer-term lows.

One of the best measures of contrarian sentiment I've seen yet is found in a recent issue of Business Week . It shows page after page of cartoon graphics featuring a bear, implying that we're in a bear market. On page 24 the feature article begins, “How real was the prosperity?” It shows a picture of an over-inflated Uncle Sam character, representing the U.S. economy and stock market, being attacked by an angry bear with his claws bared.

On page 28 the headline reads, “What could cage the bear?” The graphic depicts Uncle Sam trying to push the defiant bear into a cage. On page 32 we are greeted by the headline, “Too big to fail” in reference to the banks. The cartoon shows Uncle Sam trying desperately to keep a bank building from being toppled by the angry bear, who has the upper hand in the struggle.

The headline on page 36 is “Looking for a quick fix” and shows Uncle Sam grappling with the bear. In reference to this question, BW responds “What would Washington's consumer stimulus package buy? Not much more than a little time.”

Last week I received the following e-mail:

“He was just spotted by me on the cover of CBS Marketwatch homepage Fri 523P CST. Will he make to the cover of Time, Newsweek , or Biz Week for Monday?”

The reference was to this growling grizzly shown below. It couldn't have come at a better time (from a contrarian's perspective)!

The reference was to this growling grizzly shown below. It couldn't have come at a better time (from a contrarian's perspective)!

So there you have it, mainstream media sentiment in microcosm. The sentiment couldn't be any more bearish right now. Everyone is talking about recession and more financial turmoil as if it's inevitable. That by itself is an indication that the stock market has already priced in the worst and an interim bottoming process is well underway.

By Clif Droke

www.clifdroke.com

Clif Droke is the editor of the three times weekly Momentum Strategies Report newsletter, published since 1997, which covers U.S. equity markets and various stock sectors, natural resources, money supply and bank credit trends, the dollar and the U.S. economy. The forecasts are made using a unique proprietary blend of analytical methods involving internal momentum and moving average systems, as well as securities lending trends. He is also the author of numerous books, including "How to Read Chart Patterns for Greater Profits." For more information visit www.clifdroke.com

Clif Droke Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.