Santander Warning - How a UK Bank Deposits Freeze Will Happen!

Personal_Finance / Credit Crisis 2013 Apr 03, 2013 - 02:26 AM GMTBy: Nadeem_Walayat

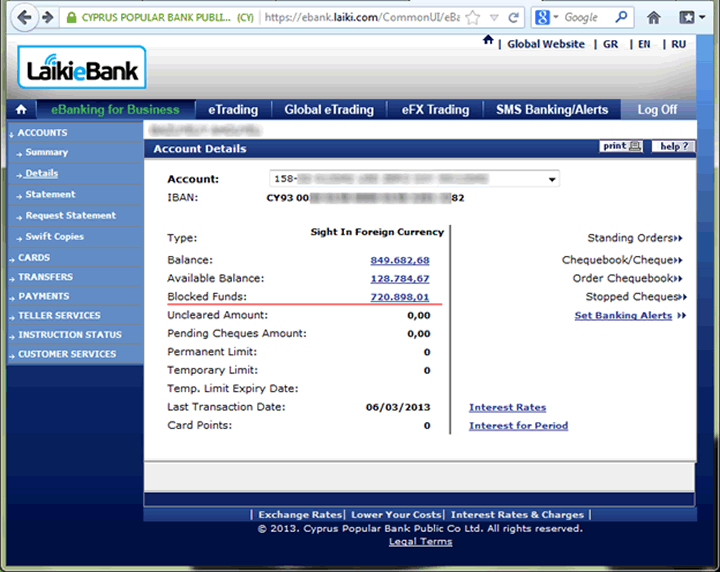

Whilst Cyprus continues to come to terms with it's banking catastrophe that involves the extreme step of outright theft of depositor funds as the following real life example illustrates to what amounts to an 85% theft of this customers bank balance at Laiki Bank actually looks like -

Whilst Cyprus continues to come to terms with it's banking catastrophe that involves the extreme step of outright theft of depositor funds as the following real life example illustrates to what amounts to an 85% theft of this customers bank balance at Laiki Bank actually looks like -

Source - So, What's It Like To Have a Business in Cyprus Right Now?

Writes the account owner:

"Most circulating assets on our business Current Account are blocked. Over 700k of expropriated money will be used to repay country's debt. Probably we will get back about 20% of this amount in 6-7 years.

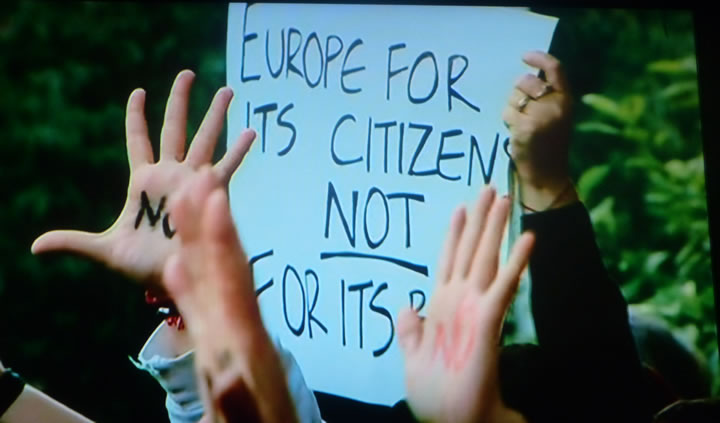

I'm not Russian oligarch, but just European medium size IT business. Thousands of other companies around Cyprus have the same situation.

The business is definitely ruined, all Cypriot workers to be fired. We are moving to small Caribbean country where authorities have more respect to people's assets."

UK Banking Freeze

UK depositors are also at risk of a banking freeze which will manifest itself as -

- Locked out of online access to your bank account without any prior warning.

- Limited to ATM cash withdrawal limits.

- Inability for bank staff to achieve account access for transfer of funds.

That is how a banking freeze will manifest itself not at some future date but this is what customers of Santander may be experiencing right now.

Are Your Deposits Safe in Santander?

The credit ratings agency such as Moody's (for what their worth) rate HSBC, Royal Bank of Canada and JP Morgan at the highest end in terms of credit worthiness, the next tier comprises the likes of Barclays BNP Paribas and Goldman Sachs, the bottom tier includes the likes of RBS, Bank of America, Citigroup, LLoyds HBOS and Santander. Despite credit ratings agencies being several years behind the curve they can still be useful as a good guide towards the relative quality of customer service that one can expect, especially as the lower rated banks will tend to be cash starved and therefore more eager to cling onto to customer deposits / seek government bailouts then other banks.

Santander effectively froze our business bank account (as a legacy account holder following their takeover of Alliance and Leicester) on 22nd March 2013 following an attempt to transfer out a significant sum as part of a Financial Armageddon plan in the wake of the collapse of Cypriot banking system.

However customers first experience of being locked out of their online accounts isn't a message to get in touch for x,y,z reason but rather a highly misleading notice of a planned maintenance that still remains nearly 2 weeks on.

Or what may be perceived as more troubling during subsequent log on attempts is Santander's "Internal Server Error" page, which in the wake of the Cyprus banking crisis is not exactly confidence inducing as it resembles that of one of those dodgy website's that sell you something, take your money and then disappear.

Santander has to date FAILED to provide any written correspondence to notify of account suspension and what needs to be done to reactivate the account. Thus the only way to realise the status of the account is phoning the bank to question the perpetual maintenance page, in response to which I was informed that to regain access to the account I would need to visit a local branch with ID.

The visit to a local branch in Sheffield took place on Thursday 28th of March during which time the staff member informed me that the account was now fully operational and that the transfers that had been suspended a week earlier had now been initiated.

However some 5 days later, these statements have continued to turn out to be untrue as the account remains frozen with no transfers out having been made.

Therefore how can anyone have any faith in a bank when the staff ms-lead customers in the name of clinging onto depositor funds at times of credit crisis extremes?

In summary

- Santander suspended the account on 22nd March 2013 at the height of the Cypriot banking crisis to cling on to funds that were being transferred out with a misleading page that the bank is undergoing maintenance.

- Subsequently telephone banking has failed to have online access restored.

- A branch visit with passport ID has failed to get access restored despite the branch staff ms-informing me at the time that full access had been restored.

- And to date there has been no written correspondence from Santander with regards the status of the account.

If you bank with Santander than it is likely you will continue to have access right up until the point you attempt to transfer a large sum of money out.

So in answering the question can Santander be trusted with your deposits, my answer based on recent experience is NO!

If Spain's banking system collapses (which it could do) then your deposits are at risk in the first instance of being frozen, locked out of funds in what amounts to an extended bank holiday after which funds will likely be subject to capital controls to prevent a run on the bank Cyprus style, in the meantime Santander continues to play games in preventing large transfers out of Santander bank accounts.

Ensure you are subscribed to my always free newsletter to be in receipt of my next in depth analysis which reveals the Bank of England's secret plans to steal your bank deposits as well as the potential for Silver as an investment or not.

Source: http://www.marketoracle.co.uk/Article39770.html

Nadeem Walayat

Copyright © 2005-2013 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 25 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of four ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series.that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 600 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 600 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.