Vatican's Next GodFather - What's More Important To You, Italy or the Dow?

Politics / Italy Mar 11, 2013 - 08:02 PM GMTBy: Raul_I_Meijer

During the Italian election weekend two weeks ago, I watched all three Godfather films on a local station. Very convenient, since they can teach you quite a bit about Italy, even if you've seen them a dozen times already in the past. The abdication of the pope sort of rounded off the history lesson, and I was thinking: OK, now I'm good to go.

During the Italian election weekend two weeks ago, I watched all three Godfather films on a local station. Very convenient, since they can teach you quite a bit about Italy, even if you've seen them a dozen times already in the past. The abdication of the pope sort of rounded off the history lesson, and I was thinking: OK, now I'm good to go.

After the results came in and Beppe Grillo and the Five Star movement (M5S) became the single biggest "party", I was going to simply repost my February 10 article Beppe Grillo Wants To Give Italy Democracy, in which I wrote about my meeting with Beppe and the ideas we talked about which I took away from that. He had won big, but it was clear that most people still had no idea who he is.

But after reading through the lazy sloppy "journalism" in the international press in the days following the elections, it was obvious that wouldn't have been sufficient anymore. Hardly anyone seems to know who Beppe Grillo is, and more importantly, they don't seem to care. In their minds, because everybody else does it, they are fine calling him a clown, a dictator and (Italian paper Gazetta Del Sud) a "foul-mouthed rabble rouser". Much easier, because it doesn't require any research.

At the very least, whether you work for a major international news organization or a national paper, if you want to stay on the safe side, since deep down you know you haven't done your homework, "populist" looks like an acceptable sort of name-calling. Now, one of the definitions of populist is someone who opposes elites, which certainly applies to Grillo, but these days you can't use the term without implying someone who appeals to the base instincts of the IQ challenged part of the population. And that definitely does not apply. If only because in Italy, Berlusconi's got that demographic covered.

The name of the game seems to be that Grillo is bad news because he "unnerves" markets and investors. For one thing, he himself would be only too happy with that. Not because he wants mayhem, but because he thinks that what there is now is not working. Grillo's first and main objective is to rid Italy of the corruption it has been suffering from for ages (which is why the Godfather series is enlightening), so if you want to understand or perhaps even judge him you will first need to look at that whole chapter. And yes, it's true, he sees the entire political system in Rome as an integral part of that corruption, and so it will have to go. As he put it:

"Who makes up a criminal conspiracy? If you go and look, [you'll find] they are made up of bankers, politicians, judges and, just perhaps, once in a while, a criminal."

What is happening in Italy as a consequence of its relationship with the EU and the Eurozone is in Grillo's eyes also the result of the corrupt system (since it's all been agreed to by the career politicians who sit in parliament, for all sides of the spectrum). Therefore, he questions the benefits for the Italian people of the existing situation. That's all. And that's enough for both Brussels and Rome to vilify him. Nobody is supposed to question the glory of Europe and the Euro, and hardly anyone does, certainly not the press, presumably because nobody wants to unnerve the markets. But if you ask me, if anything needs to be questioned, it's that one-dimensional religion that says the Euro is the only way to achieve fulfillment.

Grillo, who's been given the anti-Euro label by the press, puts it this way in a Time Magazine interview:

Do you think Italy should leave the euro?

I've never said I want to be in or out of the euro. I said I want correct information. I want a Plan B for survival for the next 10 years. And then, with a referendum we decide. The costs and benefits, let’s know what are they are. But first you need to inform.

If you just hint that you want to leave the euro, you're crazy. There’s no dialogue. Just hint, and you’re a demagogue, you’re crazy, you want to drag Italy to default, you’re irresponsible. Just because you say, let’s think about this, what would really happen?

For the Europhiles, the Merkel Monti Draghi Van Rompuy clan, there is no Plan B. Or perhaps I should say it's the plan whose name shall not be mentioned. And that's untenable; you can do that sort of thing as long as you throw enough bling at people, but when you start taking it away from them, they'll come looking for answers and explanations. There simply comes a point when unnerving the people will trump unnerving the markets.

First, let's get up to date with Italy's economy, to get a better idea of the backdrop against which the Five Stars have risen. On Friday, Fitch downgraded Italian debt. President Napolitano has until March 15, the new parliament, to start pressuring for a new government. Since he's about to resign, he can't call new elections. Beppe Grillo has called for his long term supporter, Nobel literature laureate Dario Fo, to be appointed the new president.

Grillo has rejected calls to close a deal with Bersani's existing left wing coalition, as he always said he would. Napolitano could try to get a new technocrat government in place (Corrado Passera, Monti's industry minister is named as a new PM), or he could call on Bersani and Berlusconi to work together. Ironically, the main reason for Italy to have a government would be to make sure the Troika austerity demands keep being met, and if that doesn't work, to file for a new bailout. Whichever choice Napolitano makes, it appears certain it will be short-lived.

"Italy is a nation of tricksters. Yesterday I was in Rome. I got on a bus and stamped my ticket: 'Click. Clack.' The driver turned round and said: 'What the *****'s that noise?!'"

The Italian economy contracted 2.4% in 2012, almost twice as much as Spain. Italy's public debt is €2 trillion, or $2.6 trillion, predicted to rise to 130% of GDP this year, the highest level in 100 years. Also in 2012, more than 360,000 Italian businesses folded as a result of what business lobbying group Confindustria labeled a "credit crunch": on the one hand banks refuse loans, on the other Monti's tax increases and spending cuts squeeze like a vice. Italy’s official unemployment rate hit a 11.7% record in January, the government said last week, with youth unemployment rising to 38.7%. And that's just the macro numbers; the real story lies beneath the surface. Like here:

More than 65% of Italian families struggling

More than 65% of Italian families cannot make it to the end of the month with their current salaries, a report by the Bank of Italy said on Tuesday. The alarm launched by the country's central bank said that those hardest hit are young families and renters whose monthly income is not sufficient to cover living expenses.

Also, in Italy a huge number of young adults live with their parents, like for instance over 70% of men and 50% of women between 25 and 29 years old, and more than half between 18 and 34, lived "at home" in 2010. While part of that is due to stronger family bonds than in other countries, it's much more importantly an indication of just how poorly the economy is doing. In comparison, in France just 10% of the same age group live with their parents.

Of course you can glaze over these numbers, they're just more of the same. Where it gets interesting is when you try to see what's comings next. The Italian economy is bad and getting worse, and the only answer the troika has ever had is double or nothing, in other words: more austerity, more cuts and higher taxes. And that will have to stop somewhere; it should certainly not come as a surprise that Italians vote for someone who says it can be done differently.

It seems clear that no matter what government is tinkered together, Italy will have new elections relatively soon, perhaps late this year. But even before then, Beppe Grillo will demand changes. He will demand a clean-up of parliament, prosecution of the corrupt part of society, and a clean and clear vote of the people in issues like the Euro.

More ominously for the Italian and European status quo, he will launch a nationwide discussion about what to do with the 130% of GDP, $2.6 trillion debt. He's made clear that in his (accountant) mind, restructuring and default should be on the agenda, in correlation with large scale nationalization of the banking industry. That is the time bomb that has started ticking in Europe when the election results came in. The idea is simply what I've said earlier about Greece: if you know you're going to be miserable whatever you do, you might as well make sure it's your own misery, and under your own control.

At this point it's hard to say what's more likely, Grillo being murdered and renditioned or more Grillo's raising their heads in other European countries. The more time he gets, the more he will get done. And others will see that and try to copy it. And he's right, the internet does open a whole new set of democratic opportunities. That may be perceived as more urgent in Italy's corruption-rotten state, but why would Spain, Greece and Portugal not follow? Because they have no angry comedians?

The EU meanwhile needs to deal with Cyprus, a hard nut to crack, since Dutch, German and Finnish taxpayers must be forced to bail out Russian oligarchs who have billions in funds stashed in bankrupt Cypriot banks. What's been below the surface thus far is that Brussels has a next case to contend with: Slovenia's government fell last week over economic issues, and it's a - small - Eurozone country. Bulgaria's government is also gone, but they're "only" EU, not Eurozone.

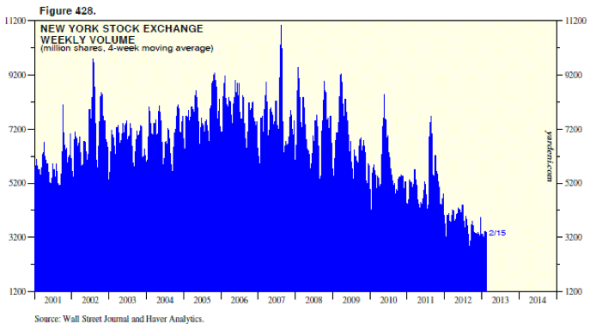

Nothing like a perfect storm to unnerve financial markets. Which brings me to the Dow. Which is setting records. And I find that peculiar: while pundits try to make us believe these records stem from an economic recovery stateside, when I look at this graph, part of a presentation by Jim Boswell, I just don't see it:

As is obvious from this graph, trading volume on the NYSE is so low it feels like some kind of singularity is upon us. It’s down at least 50% from the average of the preceding years, and last year doesn’t even have a temporary peak anymore. But prices set records? Really? What other assets are there for which prices go up as trade goes down? Well, yeah, scarcity can do that perhaps, but that's not the case here. It all looks very volatile to me. It's easier to prop up prices at low volumes, but they can fall much faster too when whoever it is that still remains in the market goes away. Because he's found out to hold mainly zombie money, for instance.

So to answer the question what's more important to you: I sure wouldn't pick the Dow. That records thing could be over tomorrow. Beppe Grillo's new democracy, though, has a long way to go. The more the owning class tries to squeeze, the more the debt slaves will demand a vote. They don't even need to gather in streets and squares anymore, they have representation in parliament. From that same Time interview:

Are you afraid that if you don’t succeed, the same energy that pushed you up could push up darker forces?

If we fail, [Italy] is headed for violence in the streets. But if we crumble, then they come. Everything started in Italy. Fascism was born here. The banks were born here. We invented debt. The mafia, us too. Everything started here. If violence doesn’t start here, it’s because of the movement. If we fail, we’re headed for violence in the street. Half the population can’t take it anymore.

I think he may just be right. That movements like this are the only remaining chance at solving this peacefully. That alone should be worth a lot more than keeping a contraption like the Eurozone together. The problem is, it's not the ruling religion. Anyone know any German comedians? Do they even have any?

Life has become a show at which we are the audience – and have to buy a ticket. Beppe Grillo

By Raul Ilargi Meijer

Website: http://theautomaticearth.com (provides unique analysis of economics, finance, politics and social dynamics in the context of Complexity Theory)

© 2013 Copyright Raul I Meijer - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Raul Ilargi Meijer Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.