Why Many Newsletter Writers Will Steer You The Wrong Way

InvestorEducation / Stock Markets 2013 Feb 08, 2013 - 10:56 AM GMTBy: GrowthStockWire

Brian Hunt writes: It's time for traders to take caution... the "dirty secret of the investment advisory business" is flashing a warning sign.

Brian Hunt writes: It's time for traders to take caution... the "dirty secret of the investment advisory business" is flashing a warning sign.

This dirty secret helped traders make big, low-risk gains by going long stocks in June. And it's a timeless piece of wisdom that will always help lead you to great trading opportunities. The "dirty secret" is simple...

Most of the folks writing investment newsletters aren't particularly good at their jobs. And rather than listening to the average investment-newsletter "guru," you're better off taping the Wall Street Journal's stock table to the wall, throwing darts at it, and buying the stocks you hit...

There's a good reason why this is the case. It's the same reason most baseball players don't make the All-Star team. It's the same reason most new businesses fail. It's because most people in ANY professional field are average or below average at their jobs. That's just how the world works.

Armed with this knowledge, we urged readers of DailyWealth Trader to "go long" stocks in June. Investment newsletter writers were at extreme levels of bearishness... which made us bullish.

Our call to go long was well-timed. The benchmark S&P 500 Index bottomed in June... and staged a big 10% rally into September. Newsletter writers in general also became bearish in November. We urged readers to go long back then as well. The S&P 500 has rallied 11% off its November lows.

These days, investment-newsletter writers aren't super-bearish... they're getting super-bullish. The Hulbert Financial Digest is a service that tracks the investment newsletter industry. According to its newsletter sentiment index, newsletter writers are reaching extreme levels of optimism.

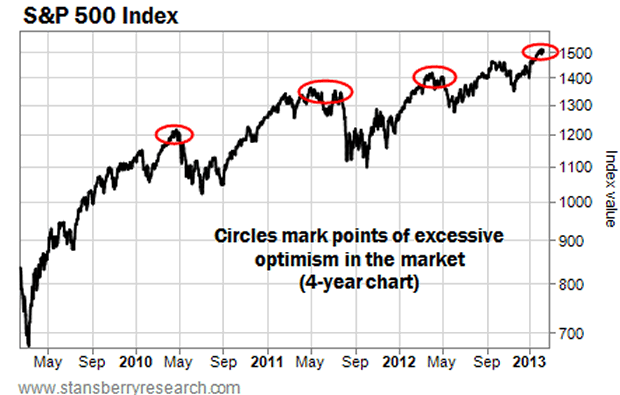

Newsletter writers are as susceptible to mindless crowd-following instincts as the next guy. So the recent 8% surge in stocks has the group as bullish as it has been only a handful of times over the past four years. Each time similar levels were reached, stocks suffered sharp corrections (like in early 2010, mid-2011, and mid-2012).

Keep in mind... Readings of excessive optimism aren't a "slam dunk" indicator that mean stocks will plummet tomorrow. Periods of excessive optimism and rising stock prices can turn into long periods of excessive optimism and rising stock prices. But these readings are always concerning to contrarian traders.

For us, they are warning signs that say we should trade cautiously. This means tightening trailing stops... and making sure any new long positions are in assets that have not enjoyed huge rallies and are thus, vulnerable to a sharp market decline. Also remember that these readings are more of a short-term trading concern than a longer-term investment concern.

In summary, it was a good idea to go long stocks back in June and November. These were periods of pessimism. Stocks rallied hard both times. But right now, we have a far different story. We've entered a period of high optimism. Even measures of individual investor sentiment (like the American Association of Individual Investors poll) are showing high levels of optimism.

That's why it makes sense to reread yesterday's essay from Jeff... and make sure any position you take is still in the "cheap and unloved" bin.

Regards,

Brian Hunt

http://www.growthstockwire.com

The Growth Stock Wire is a free daily e-letter that provides readers with a pre-market briefing on the most profitable opportunities in the global stock, currency, and commodity markets. Written by veteran trader Jeff Clark, and featuring expert guest commentaries, Growth Stock Wire is delivered to your inbox each weekday morning before the markets open.

Customer Service: 1-888-261-2693 – Copyright 2009 Stansberry & Associates Investment Research. All Rights Reserved. Protected by copyright laws of the United States and international treaties. This e-letter may only be used pursuant to the subscription agreement and any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), in whole or in part, is strictly prohibited without the express written permission of Stansberry & Associates Investment Research, LLC. 1217 Saint Paul Street, Baltimore MD 21202

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Growth Stock Wire Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.