Gold Reaches 155,180 Yen/oz - New Record In Japanese Yen

Commodities / Gold and Silver 2013 Feb 04, 2013 - 03:03 PM GMTBy: GoldCore

Today’s AM fix was USD 1,664.25, EUR 1,224.52, and GBP 1,057.47 per ounce.

Today’s AM fix was USD 1,664.25, EUR 1,224.52, and GBP 1,057.47 per ounce.

Friday’s AM fix was USD 1,665.00, EUR 1,217.99, and GBP 1,052.46 per ounce.

Silver is trading at $31.57/oz, €23.37/oz and £20.17/oz. Platinum is trading at $1,701.00/oz, palladium at $754.00/oz and rhodium at $1,200/oz.

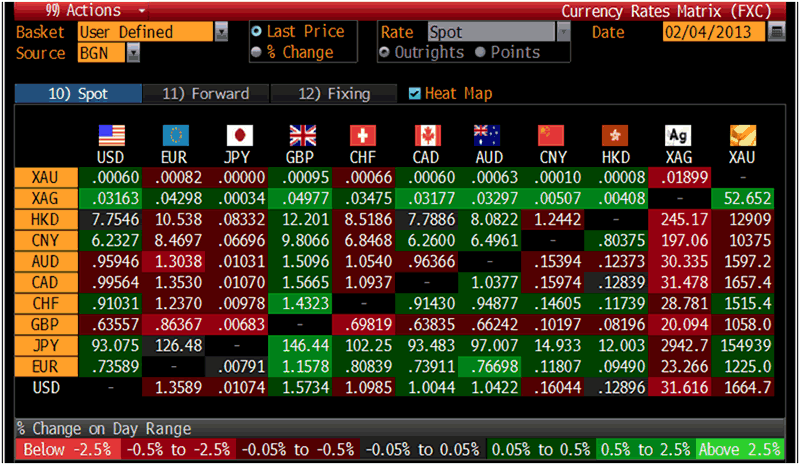

Cross Currency Table – (Bloomberg)

Gold rose $3.00 or 0.18% in New York Friday and closed at $1,667.80/oz. Silver surged to a high of $32.14 and finished with a gain of 1.18%.

Gold advanced 0.54% for the week, while silver was up 1.99%.

Gold rose initially on Monday prior to seeing determined selling. Gold was unable to break its narrow trading range despite rising after the poor GDP number last week.

While sentiment towards gold remains lukewarm due to recent tepid price action and confusing, mixed economic data, platinum rose to a 4 month high ($1,705.25) and palladium soared to its highest since September 2011 ($759.75) primarily due to concerns about supply especially from South Africa.

The run up in platinum and palladium is also due to U.S. auto sales reporting that January topped estimates, as car buyers returned to U.S. showrooms.

This week’s U.S. economic highlights include Factory Orders at 1500 GMT today, ISM Services on Tuesday, Initial Jobless Claims, Productivity, Unit Labor Costs, and Consumer Credit on Thursday, and the Trade Balance and Wholesale Inventories on Friday.

The Eurozone Sentiment and PPI are also released today and currency and gold traders will be paying close attention to the ECB's monthly policy statement on Thursday for any attempt by the ECB to weaken the euro as currency wars heat up.

The Chinese week long holiday for the Lunar New Year starts on Saturday and therefore physical buying will continue this week and lend support prior to becoming quiet next week.

Holdings of SPDR Gold Trust, remained unchanged for its 4th session at 1,328.092 tonnes

The benchmark gold on Tokyo Commodity Exchange (TOCOM) hit a record high of 5,000 yen a gram, driven by a weak yen and the continuation of the Bank of Japan’s loose monetary policy.

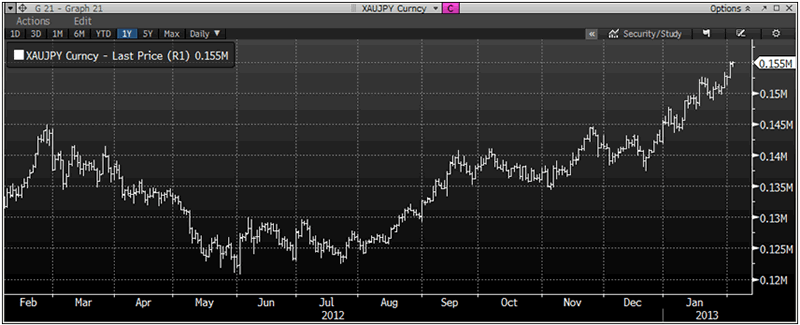

XAU/JPY, 1 Year – (Bloomberg)

Gold bullion for delivery in December climbed as high as 1.2% to 5,000 yen per gram on the TOCOM. In ounce terms, the yen fell to 155,180/oz against gold, its lowest level since 1980.

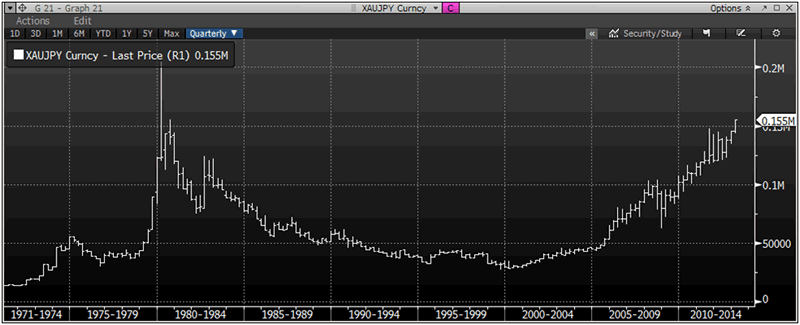

According to the data on Bloomberg, the all-time record high for gold priced in yen was 204,850 yen on January 21, 1980.

Thus, yen gold remains 33% below the record intraday nominal high from 1980. Given the Japanese determination to devalue the yen to escape deflation, the record nominal high will almost certainly be reached in the coming months.

Platinum also climbed 2.7% to 5,130 yen per gram for the same month, the highest level for the most-active contract since May of 2010.

The yen was 92.97 per dollar on Feb. 1st its, the lowest ratio since May 2010. The Japanese yen dropped 2.1% last week its 12thweek of losses in a row.

Despite Japanese Finance Minister Taro Aso claiming that “the objectives from the current government are not intended to weaken the yen” – that is exactly what is happening.

XAU/JPY, Quarterly, 1971-Today – (Bloomberg)

A cheaper yen boosts Japanese exporters. It helps increase the earnings abroad when they are funnelled back into yen, plus it lowers the price abroad of goods that are made in Japan and exported. The country’s strong auto and electronics sector benefitting from the cheap yen are outperforming the benchmark index.

The yen fell by more than 20% against gold in 2012 and analysts are concerned that Prime Minister Abe and his new government’s determination to stoke inflation, devalue the currency and promote growth could lead to further falls in 2013.

Competitive currency devaluations are set to continue and currency wars deepen and such beggar thy neighbour monetary policies will lead to debased currencies, inflation and the real risk of an international monetary crisis

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.