Many Key Resources Have No Security of Supply

Commodities / Resources Investing Feb 03, 2013 - 07:22 AM GMTBy: Richard_Mills

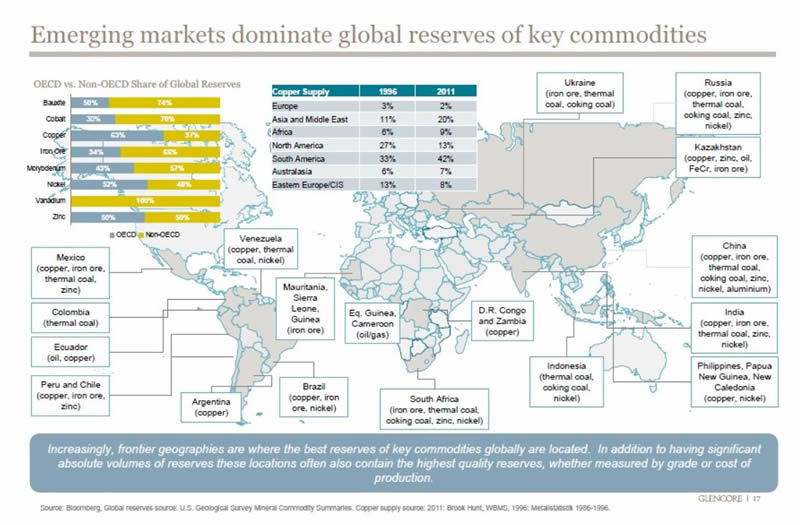

The truth, in regards to the world's mineral resources, is that we in the western developed countries are not in control of supply. The map below was posted on reddit.com. While interesting it does not reveal the enormity facing the western world in regards to Security of Supply for many of our key minerals.

The truth, in regards to the world's mineral resources, is that we in the western developed countries are not in control of supply. The map below was posted on reddit.com. While interesting it does not reveal the enormity facing the western world in regards to Security of Supply for many of our key minerals.

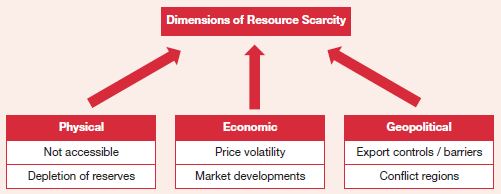

"The spectre of resource insecurity has come back with a vengeance.The world is undergoing a period of intensified resource stress, driven in part by the scale and speed of demand growth from emerging economies and a decade of tight commodity markets. Poorly designed and short-sighted policies are also making things worse, not better. Whether or not resources are actually running out, the outlook is one of supply disruptions, volatile prices, accelerated environmental degradation and rising political tensions over resource access." Chatham House, Resources Futures

There are many serious concerns in regards to global resource extraction that we need to consider:

- Resource nationalism/Country risk, political instability of supplier

- A looming skills shortage

- Competition with Chinese mining investment, smaller areas open for exploration

- Low hanging fruit - the high quality large deposits have already been found, lower economic attractiveness of new projects, cost inflation

- Supply bottlenecks for much needed and scarce equipment

- The manipulation of supplies ie speculation and concentrated ownership of LME stocks

- Rising capex/opex, lack of financing options, capital project execution

- Lack of innovation and technological advancements

- Declining open pit production, ongoing operational issues

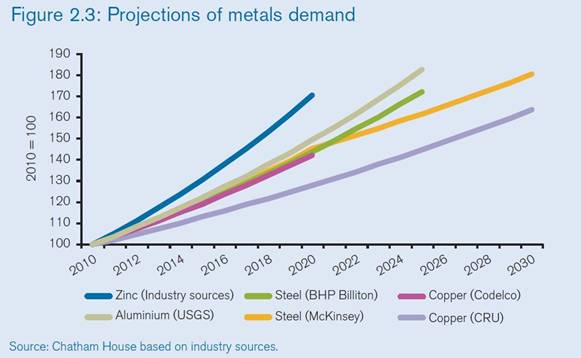

- Lack of recognition for population growth, growing middle class w/disposable incomes and urbanization as on-going demand growth factors

- Environmental group and labor risks, mining unrest - lack of a social license to operate, incredibly difficult and lengthy permitting processes

- Climate change, accidents and natural disasters

- Lack of infrastructure or poor infrastructure access, attacks on supply infrastructure

- Price and currency volatility

- Fraud and corruption

Let's take a hard look at Costs, some examples of growing Resource Nationalism and Civil Unrest Directed Towards Mining and lastly Population Growth & Urbanization.

Costs

Mining is an extremely capital intensive business for two reasons. Firstly mining has a large, up front layout of construction capital called Capex - the costs associated with the development and construction of open-pit and underground mines. There are often other company built infrastructure assets like roads, railways, bridges, power generating stations and seaports to facilitate extraction and shipping of ore and concentrate. Secondly there is a continuously rising Opex, or operational expenditures. These are the day to day costs of operation; rubber tires, wages, fuel, camp costs for employees etc.

Copper mining has become an especially capital intensive industry - the average capital intensity for a new copper mine in 2000 was between US$4,000 - 5,000 to build the capacity to produce a tonne of copper, now capital intensity is north of $10,000/t, on average, for new projects.

The same trends are also evident for new nickel mines, where capital intensity has gone through the roof:

- Capital costs on a per pound basis escalating rapidly over the last decade

- The discrepancy between the initial per pound capital cost of nickel projects, and the ultimate construction costs, are over 50 percent

- Economies of scale have not been reflected by lower unit capital costs - large projects have similar or even higher capital intensity

Global nickel supply is increasingly going to come from laterite nickel deposits, and the high-pressure acid leach (H-Pal) plants to treat the ore require much bigger investments - there is often significant cost and technical challenges associated with laterite projects.

We are now looking at north of $35/lb capital intensity as we move into these very large ferronickel and H-Pal projects that are requiring many billions of dollars to build.

Capex costs are escalating because:

- Declining ore grades and more complex metallurgy means a much larger relative scale of required mining and milling operations

- A growing proportion of mining projects are in remote areas of developing economies where there's little to no existing infrastructure

Chile is the world's top copper producer but the country as a whole is woefully short of power. The country's power generation capacity currently stands at 17,000 megawatts. It is estimated that the country will need at least 30,000 megawatts of power by 2020 to keep up with the demand, the increased demand coming primarily from mining projects. Unfortunately the government only plans to add 8,000 megawatts between now and 2020 and there is serious opposition to these plans from environmental groups who have, so far, been wildly successful by suspending several key projects and more than $22 billion worth of power investment. The Chilean Supreme Court recently struck down the planned 2,100-megawatt, $5 billion Castilla thermoelectric power plant project, citing environmental concerns.

Codelco, the Chilean state owned copper company, and the world's largest copper miner with 20% of global copper reserves, said that their 2012 first half copper production fell 6.4% because of lower grades mined. Codelco's direct cash costs increased 27% year-on-year mostly because of paying higher prices for electricity from the drought stricken SIC grid.

Many copper mining companies are having to go back to the drawing board in regards to their economic studies trying to lower their cost of production.

With the lower grades of ores now being mined energy becomes more and more of a factor when considering economics. The cost of energy is climbing, the amount used is climbing but the returns from energy expended is declining. Eventually the quantity of resources used in the extraction process will be 100% of what is produced.

The bottom line? It is becoming increasingly expensive to bring new mines on line and run them.

Resource Nationalism

"Resource nationalism retains the number one risk ranking as governments seek to transfer even more value from the mining and metals sector. Many governments around the world have now gone beyond taxation in seeking a greater take from the sector, with a wave of requirements introduced such as mandated beneficiation, export levies and limits on foreign ownership.

There is no doubt projects around the world have been deferred and delayed, and in some cases investment withdrawn altogether, because of the degraded risk/reward equation. The uncertainty and destruction of value caused by sudden changes in policy by the governments of resource-rich nations cannot be understated. Mining and metals companies looking to preserve value are actively negotiating value trade-offs with less politically sensitive policies than resource nationalism. As this risk continues to grow in significance, we don't expect a slowing in this trend." Ernest & Young, Business Risks Facing Mining and Metals 2012

Xstrata Plc's plans to create a $5.9 billion copper-gold project in the Philippines has been halted because of a mining reform bill.

Barrick Gold Corp. has lowered its copper production outlook for 2013 due to permitting delays at its Jabal Sayid project in Saudi Arabia.

Zambia is Africa's largest copper producer (and wants to directly market its copper), in second place is the DRC. The copper-belt which straddles Zambia's and the Democratic Republic of the Congo's borders is being tied up for internal development by the two countries. The DRC and Zambia are amending their mining codes to enable the government to raise taxes and implement a 35-percent minimum ownership threshold for state shareholding in projects.

Approximately 48% of the world's 2007 mined cobalt was a byproduct of nickel mining from sulfide and laterite deposits. An additional 37% was produced as a byproduct of copper operations, mainly in the Democratic Republic of the Congo (DRC) and Zambia. The remaining 15% of cobalt mining came from primary producers.

There are very, very few primary cobalt deposits in the world today.

The Congo's staggering economic potential (the DRC contains five percent of the world's copper and 50 percent of its cobalt) is matched only by its poverty and corrupt mismanagement.

Vale's New Caledonia (Goro) nickel mine is many years behind schedule. The Goro nickel project in New Caledonia has become the bad boy poster child for the assortment of problems associated with HPAL technology. Minority partners Sumitomo and Mitsui have reduced their participation in the project.

Vale's Onca Puma project, a ferronickel producer, has been completely shutdown. Vale has said that a return to production is not yet scheduled.

Xstrata's nickel mine, Koniambo - In 2007 capex was set at US$3.8b, in August of 2011 it was revised upwards to US$5b. According to Xstrata the increased cost was because of increased labor costs from competition from the oil and gas sectors for a limited labor pool on a remote island. First pour was slated in the second half of 2012, there has been no news from the company.

"Recent years have witnessed a significant increase in both labor disputes and regulatory burden in the resources sector across the world. The ongoing mining sector unrest in South Africa, marked by widespread wildcat action and shocking levels of violence, suggests that these pressures continue to mount and that previous policy responses may prove insufficient. Moreover, there is a risk that the disorder seen in South Africa may presage a new, even more contentious phase of global resource exploitation characterized by a higher incidence of resource nationalism in both developing and developed economies." Iain Mills, South Africa Mining Unrest: A New Era of Resource Nationalism?

In September Anglo-American closed its 17,000 tonne per year Loma de Niquel mine (a ferronickel producer in Venezuela) because of disputes over mining concessions.

Panama recently repealed part of its mining code allowing investments from foreign governments.

Australia has imposed a 30 percent tax on mining profits.

While Bolivia has a number of operating mines they have nationalized exploration projects in the country.

Indonesia (the world's top exporter of nickel ore) enacted an export tax system, effective May 6, 2012, under which a 20% export tax is levied on 14 raw ores of Indonesian origin, including nickel. This is the first step by Indonesia towards a full ban on the export of minerals that is scheduled to begin in 2014. The Indonesian government has also approved a law capping foreign investment in mining projects at 49 percent. Foreign investors are to divest at least 20 percent of their shares by the fifth year of production, and gradually reduce their interest over the next five years to the required 49 percent.

In Canada the province of Quebec raised its tax rate on mining duties in 2010 and the PQ government has indicated that they plan to further increase this and impose a 5% mining royalty.

Mongolia is pushing to renegotiate its stake in the massive Oyu Tolgoi copper-gold project to 50 per cent from the current 34 per cent. The current agreement states Mongolia's interest can be raised to 50 per cent only after 30 years from the agreement taking effect.

Civil Unrest Directed Towards Mining

At least 15 mining projects in Peru (world's second largest copper producer) have been delayed with their start dates set-back for up to two years because of social unrest, mining investment in the country is expected to fall 33% in 2013 because of the unrest. Five protesters were killed at Newmont Mining's Conga mine in July of 2012.

A column of 1,500 strikers, many bearing machetes, confronted a small group of riot police at Anglo American Platinum's Bathopele shaft in the "platinum belt" near Rustenburg, 100 km (60 miles) northwest of Johannesburg. This was a repeat of a march undertaken just days before at Lonmin's neighboring Marikana mine, where police shot dead 34, the infamous Marikana Massacre, striking miners on August 16, 2012.

Bolivian officials report an Indian was killed and six people were injured in a clash with police. This happened in a remote area of the country where locals seized five people working for a Canadian company planning to mine for silver.

In November, 2012 the military-backed government of President Thein Sein sent armed police to disperse six small camps of protesters occupying sites around a copper mine at Letpadaung, near the town of Monywa in northwestern Burma. Police used water cannon and tear gas to forcibly remove the protesters.

First Nations protesters blockaded the road to the largest new mine development in Manitoba, Canada. Work was disrupted at HudBay Minerals' Lalor mine site, about 680 kilometres north of Winnipeg.

Two men were killed and dozens more injured in connection with a police crackdown on dissent over mining and hydroelectric developments in Panama.

Dominican Republic - In October, 2012 the La Vega provincial court ordered the suspension of Xstrata subsidiary, Xstrata Nickel Falcondo's Loma Miranda project. The project is opposed by locals and NGOs, protests against the Pueblo Viejo project have led to violence.

Two men are dead (security guards) and another nine were injured during a confrontation over a silver mine in Guatemala.

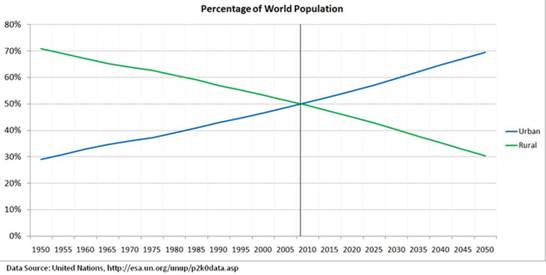

Urbanization & Population Growth

By 2025, nearly 2.5 billion Asians will live in cities, accounting for almost 54 percent of the world's urban population. India and China alone will account for more than 62 percent of Asian urban population growth and 40 percent of global urban population growth from 2005 to 2025.

"That emerging markets should play host to an increasing proportion of the world's largest mining companies should not perhaps be so surprising since these countries host a large proportion of the world's undeveloped resources and are the fastest growing mineral markets. The bank, Citi, has estimated that between 2004 and 2010, the EV (enterprise value4) of the global mining industry increased from $500 billion to $2,100 billion, with emerging markets increasing their share of the total from 16 percent to 39 percent." David Humphreys, Transatlantic Mining Corporations in the Age of Resource Nationalism

China

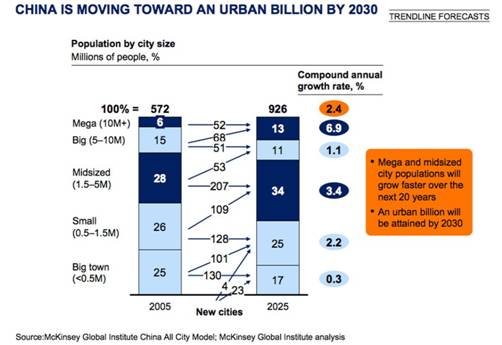

China had 172 million urban residents in 1978 when Deng Xiaoping started his economic reform program. By 2006 there were 577 million Chinese urbanites. In January of 2012 there were 680 million urban Chinese - 51.27 percent of the population.

China has set a goal of 65 percent urbanization by 2050. China's current urbanization rate of 46 percent is much lower than the average level of 85 percent in developed countries and is lower than the world average of 55 percent.

By 2025 China's urban population is expected to rise to 926 million. By 2030 that number will increase to a billion.

China's urban residents saw their average per capita disposable income increase 9.6 percent in 2012 after being adjusted for inflation. The growth was 1.2 percentage points more than that of 2011, bringing average income to 24,565 yuan (3,912 U.S. dollars). Rural residents' average per capita net income climbed 10.7 percent in real terms to 7,917 yuan last year, 0.7 percentage points lower than the growth of 2011.

BCG Consulting's November 2010 Report: "Big Prizes in Small Places: China's Rapidly Multiplying Pockets of Growth" says China is expected to become the world's second largest consumer market by 2015 and by 2020 China's consumer consumption nation-wide will amount to 22 percent of total global consumption, behind only the U.S. at 35 percent. The expected transition from an investment led economy to a more consumer focused model will bring about continued growth. The McKinsey Global Institute projects China's middle class will increase from 43% of the population to 76% by 2025.

"The shift from investment to increasing consumption overall - and as a share of GDP - is very important to sustainable growth in the long-term. China has maxed out on the input model." Diana Farrell Director, McKinsey Global Institute

India

India has 1.2 billion people and the second largest urban system in the world - almost one in three Indians now lives in areas classified as urban.

A report done by the McKinsey Global Institute called India Urban Awakening predicts that 40% of the population will live in cities by 2030. By that time, Asia's third largest economy would have 68 cities with populations over one million, up from 42 today, 12 cities are expected to cross the 2.5 million mark by 2015.

The 2011 census data showed, for the first time, that the increase in population in India is more in urban areas, at 91 million, than in rural areas at 90.4 million.

India will be a country of 53.3 million middle-class households (267 million people) by 2015-16. The McKinsey Global Institute projects that India's middle class will grow to 583 million people (113.8 million households) over the next two decades - at the same time, the country will advance from the world's 12th largest consumer market to the fifth largest.

The Indian middle class constitutes about 15% of the population today, up from 5.7% in 2001-02, and by 2025-26, they will account for 37.2% of the population.

India is young, per the 2011 census, more than 50% of India's population is below the age of 25 and more than 65% below the age of 35. It is expected that, in 2020, the average age of an Indian will be 29 years, compared to 37 for China and the US, 45 for Western Europe and 48 for Japan.

Africa

Africa has been the second-fastest-growing region in the world over the past 10 years, with average annual growth of 5.1 per cent.

According to The Economist, between 2000 and 2010, six of the world's ten fastest growing economies were in Sub-Saharan Africa. The only BRIC (Brazil, Russia, India and China) country to make the top ten was China which came in second behind Angola - the fastest growing country in the world.

The International Monetary Fund (IMF) says Africa will own seven out of the top ten places for fastest growing economies between now and 2015.

Africans, on a per capita basis, are richer than Indians and a full dozen African states have higher gross national income per capita than China.

A lot of this growth is driven by a blossoming domestic market - the largest domestic market outside India and China. In the last four years private consumption of goods and services has accounted for two thirds of Africa's GDP growth.

Today Africa has 14% of the world's population and by 2050 one in every four people on the planet will be African - by 2027 Africa will have more people than does China or India.

Rates of urbanization in Africa are the highest in the world - during the next 25 years the urban population will be growing almost twice as fast as the general population and will have increased by more than half a billion from 1990 levels.

By 2020, Africa will have 11 mega-cities with five million inhabitants or more and almost 3000 cities with populations of more than 20,000, an increase of almost 300% from 1990.

"Poverty is also on the retreat. A new consuming class has taken its place: since 2000, 31 million African households have joined the world's consuming class. At the point when household incomes exceed $5,000, measured at purchasing power parity, consumers begin to direct more than half their income to things other than food and shelter. The continent now has around 90 million people who fit this definition. That figure is projected to reach 128 million by 2020.

Indeed, contrary to conventional wisdom, the majority of Africa's growth has come from domestic spending and non-commodity sectors, rather than the resources boom.

By 2035, Africa's labour force will be bigger than that of any individual country in the world, which offers the continent a chance to reap a demographic dividend, using its young and growing workers to boost economic growth." 10 things you didn't know about Africa's economy, independent.co.uk

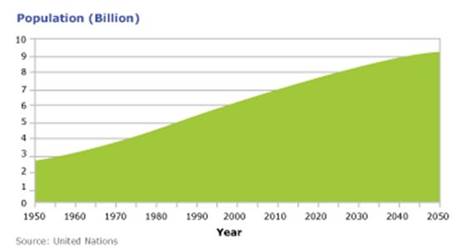

Population Growth

Since 1950, the world's population has gone from 2.5 billion people to over seven billion today. Over 75 million people a year are added to this number, the world's population is expected to exceed 9 billion by 2050 and reach 10.1 billion by the end of the century - according to the United Nations.

Conclusion

Access to raw materials at competitive prices has become essential to the functioning of all industrialized economies.

PricewaterhouseCoopers, Resource Scarcity

Accessing a sustainable, and secure, supply of raw materials is going to become the number one priority for all countries. Increasingly we are going to see countries ensuring their own industries have first rights of access to internally produced commodities and they will look for such privileged access from other countries.

Numerous countries are taking steps to safeguard their own supply by:

- Stopping or slowing the export of natural resources

- Shutting down traditional supply markets

- Buying companies for their deposits

- Project finance tied to off take agreements

Increasingly we will see falling average grades being mined, mines becoming deeper, more remote and come with increased political and nationalization risk.

The supply of most commodities is going to tighten. This undeniable fact should be on everyone's radar screen. Is it on yours?

If not, it should be.

By Richard (Rick) Mills

If you're interested in learning more about the junior resource and bio-med sectors please come and visit us at www.aheadoftheherd.com

Site membership is free. No credit card or personal information is asked for.

Richard is host of Aheadoftheherd.com and invests in the junior resource sector.

His articles have been published on over 400 websites, including:

Wall Street Journal, Market Oracle, SafeHaven , USAToday, National Post, Stockhouse, Lewrockwell, Pinnacledigest, Uranium Miner, Beforeitsnews, SeekingAlpha, MontrealGazette, Casey Research, 24hgold, Vancouver Sun, CBSnews, SilverBearCafe, Infomine, Huffington Post, Mineweb, 321Gold, Kitco, Gold-Eagle, The Gold/Energy Reports, Calgary Herald, Resource Investor, Mining.com, Forbes, FNArena, Uraniumseek, Financial Sense, Goldseek, Dallasnews, Vantagewire, Resourceclips and the Association of Mining Analysts.

Copyright © 2013 Richard (Rick) Mills - All Rights Reserved

Legal Notice / Disclaimer: This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified; Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

Richard (Rick) Mills Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.