Stock Market Possible And Probable Outcomes

Stock-Markets / Stock Markets 2013 Jan 17, 2013 - 01:14 PM GMT Socialism is a philosophy of failure, the creed of ignorance, and the gospel of envy; its inherent virtue is the equal sharing of misery…– Winston Churchill

Socialism is a philosophy of failure, the creed of ignorance, and the gospel of envy; its inherent virtue is the equal sharing of misery…– Winston Churchill

Today I want to focus a bit on the not so subtle changes we’re seeing in the United States. Almost forty-seven million Americans are now on food stamps and it’s a common site to see people using them to pay for groceries in supermarkets. As a teenager growing up in the US it was something that you just didn’t see, ever. Now students, senior citizens and the underemployed use them as if it were just part of the every day struggle. Recently I read that for every American that holds a job there are 1.1 persons receiving some sort of government aid. It doesn’t take a genius to figure out that the math just doesn’t add up.

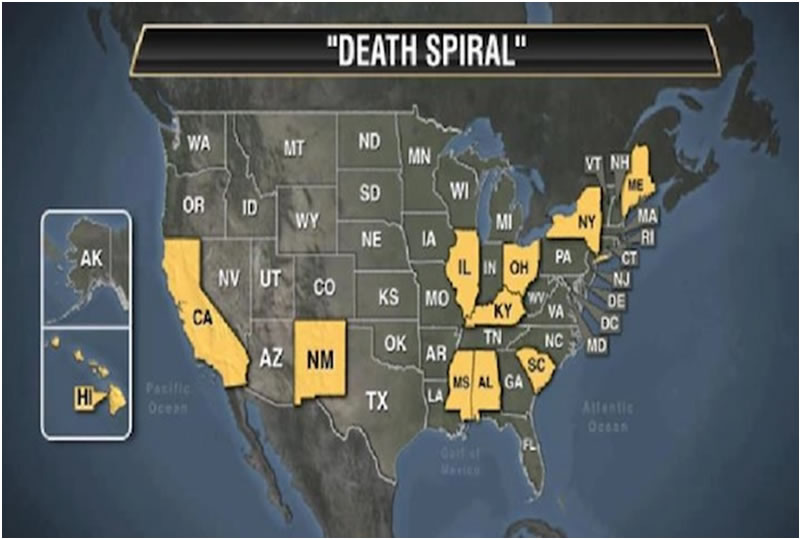

Yesterday a client of mine sent me the following chart appropriately labeled, “Death Spiral”:

The States highlighted in yellow all have more welfare recipients than they do workers. I’m not talking all kinds of aid, just welfare! Notice that the list includes four of the most populous states (California, New York, Illinois and Ohio) and for the life of me I can’t imagine why Michigan is not on this list.

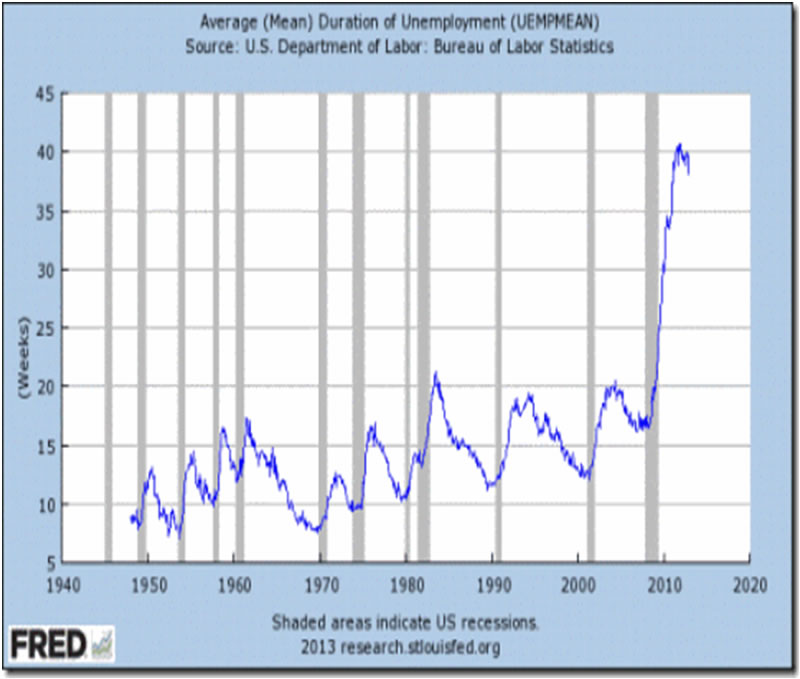

The administration promised change, growth, jobs and new infrastructure, but we haven’t seen any of that. We’ve seen debt and the growth of the welfare society, and we can see evidence of that here:

Source: St Louis Federal Reserve

Note how the duration of benefits have just exploded under the Obama regime. They spend billions and billions of dollars that produce zero growth, and the end result is a society dependent on big brother.

So given the tendency toward more and larger subsidies from government, you have to ask yourself if the government can somehow cut expenditures? Yesterday the President came out and said that he will not discuss the cuts in expenditures until the debt ceiling is eliminated. Additionally he doesn’t want a short-term extension; instead he wants it lifted permanently. Is there really anyone outside of Washington who believes that once the debt ceiling is lifted there will be real cuts in spending? I think not! The only truthful answer is that the welfare society will continue to grow.

Given all of this we need to ask ourselves what the Fed will do, and then how will stocks react to it? The first part of the question invokes the obvious: the Fed will continue to print, and more than likely at an accelerated pace. Instead of cutting QE down from US $85 billion/month, the Fed will sooner or later be forced to increase the monthly stipend. The math is relatively simple: a small increase in taxes plus no real spending cuts and huge deficits mean increases in printing. The part of the question that deals with stock prices is a lot harder to answer.

Right now the Dow is at the tipping point. Yesterday the Dow closed up 27.57 points at 13,534.89 and 77 points below its October 5th closing high. Furthermore the Dow is still 650 points below the all-time closing high established way back in October 2007. Here’s what the big picture looks like in graph form:

On the positive side the Dow continues to trend higher, a trend that goes all the way back to March 2009. One of the first rules in investing is, “Don’t fight the trend!” so that works in the favor of the bulls.

Whenever a trend runs for years it is always in the investor’s best interest to look for warning signs indicating a major change is close at hand. In the previous chart there are two that jump out: volume has been declining since mid-2011 (always a bearish indicator) and the Index is very close to violating a trend line (red diagonal line) that goes back to the 2009 low.

As far as the big picture is concerned these two points aren’t deal breakers, just something to check occasionally. This on the other hand is of real concern:

This is a chart of the Dow Jones Transportation Index and I have highlighted not one but three unconfirmed all-time closing higher highs. The first came in May 2008, the second in July 2011, and the latest one happened yesterday. The Transports rallied 39.15 points to close at 5,639.64, a new all-time closing high. Why is this important? I can find no time in history where either the Dow or the Transports made two or more unconfirmed all-time closing highs over such an extended period of time. Never! Not even once, and that goes back to 1890 and covers two world war, two significant crashes (1907 and 1929), assassinations of presidents, and all the rest.

I classify this as a “distortion” and the cause is produced by the Fed’s conscious decision to extend the bull market in stocks at all costs. You see the Fed is convinced that the average American uses the Dow as a measuring stick for growth and prosperity in the US. Of course governments and institutions have tried to change the course of markets before, but it’s never truly been successful. At best they’ve been able to ‘buy time” over the short run, but at the expense of paying a much higher price over the long run. The real question is whether or not the Fed can be the first to succeed at such an endeavor, and the truth is we just don’t know. A smart man would look at history and step aside (get out of the market) until the verdict is in.

I am of the opinion that the Dow will not confirm the Transports, and we really don’t have long to wait. A secondary confirmation would involve a close above the October 5th closing high while a true confirmation would require the Dow to make a new all-time closing high. I think that’s a bridge too far. Given all the effort, fiat money and time expended by the Fed in order to change the course of the market, a wise man would ask, “What happens if they fail?” I can answer that for you in one word, catastrophe! If they fail the world’s greatest expansion of debt will have a crushing effect, not only on the US, but also on the world’s economy. No one will escape unharmed.

Robert M. Williams

St. Andrews Investments, LLC

Nevada, USA

Copyright © 2013 Robert M. Williams - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.