Gold and the HUI Gold Bugs Stocks Index Update

Commodities / Gold and Silver Stocks 2013 Jan 12, 2013 - 08:11 AM GMTBy: Vin_Maru

In spite of the recent down turn in the price of gold and silver, we still remain bullish on precious metals and its equities. Regardless of its paper manipulated price (if you believe this is currently happening), history has shown us that gold is money (not fiat currencies) and it is no one else's liabilities. When it comes to gold, as always we suggest owning the physical metals outright fully paid for and stored safely where only you have access to it. If you have a significant holding in the physical, it may be wise to diversify your gold internationally in order to minimize country and political risk by reading Getting Your Gold out of Dodge (GYGOOD). Gold seems to be gaining strong support under $1650 which should most likely hold, so now is a great time to be adding to physical holdings.

In spite of the recent down turn in the price of gold and silver, we still remain bullish on precious metals and its equities. Regardless of its paper manipulated price (if you believe this is currently happening), history has shown us that gold is money (not fiat currencies) and it is no one else's liabilities. When it comes to gold, as always we suggest owning the physical metals outright fully paid for and stored safely where only you have access to it. If you have a significant holding in the physical, it may be wise to diversify your gold internationally in order to minimize country and political risk by reading Getting Your Gold out of Dodge (GYGOOD). Gold seems to be gaining strong support under $1650 which should most likely hold, so now is a great time to be adding to physical holdings.

We could be at transition period in this bull market where the paper gold price dictatorship comes into question and the democratic free market physical price will start ruling the golden kingdom. The dictatorship by Western central planners over the gold price is ready to be challenged and we may come to a point in history where only votes based on actual physical holdings will be counted. There will be no hanging chads counted on this financial election ballet, its either you own the gold legally and outright, or you have paper promises for imaginary gold (similar to government bond and fiat money) where the question around ownership will arise. Trust us; you don't want to be one holding paper receipts in questionable gold backed investments engineered by most western financial institutions. Ask yourself, can you trust the source of gold dictatorship to protect your financial assets, especially when it comes to your gold holdings?

HUI and the Gold Miners

When it comes to owning the gold miners, we actually believe we hit the bottom of the market this past summer and then most recently this December. Back in the summer we suggested adding to positions and selling into a September rally for trading positions and then look to add back position in the November/December time frame.

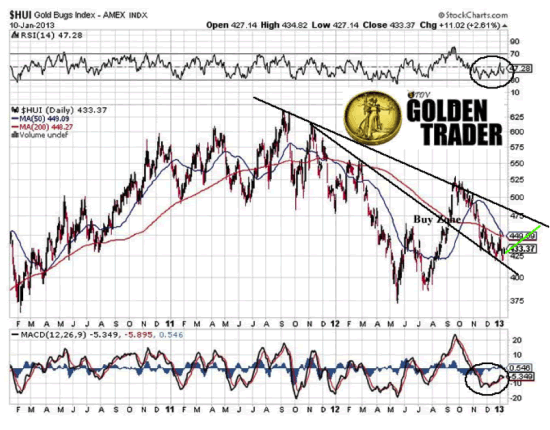

Looking at the HUI chart below, it seems this past December low finished off the correction that started in October. If this does turn out to be the lows, then I see some really positive signs in the charts. Since the beginning of December, the RSI, and MACD have been turning up after being in negative territory and they both look like they have room and momentum on their side to move higher. This means the HUI has a good chance at starting an intermediate uptrend which should last at least a month to two and go towards an initial target of 475 before taking a pause.

What is most encouraging is seeing HUI start to make a new trend upward from May 2012 in a series of higher highs and higher lows, this is a positive development especially if the December lows of 425 hold. What would be more encouraging would be to see the HUI start a new uptrend right now, go to 475 and then blow past it to test the resistance seen at 525 in September. If the gold miners do catch a strong bid and can get past the 525 hurdle that is in front of us, then we can be confident that we really do have a strong rally in the miners and that the uptrend will continue to make higher highs and higher lows moving forward. Eventually it may blow past the old highs of 625 which may come sometime towards the end of this year, but most likely in early 2014.

If you plan on trading these markets, pay attention to the above mentioned numbers on the HUI for places to lighten up on positions and then buy back in on any pull backs in a series of higher highs and higher lows. If we are right on this pattern and uptrend, then the next wave up should take out the September high of 525 and more likely run to 575 (hopefully by spring) before we see a significant correction going into the summer doldrums maybe back towards the 450-475 level. Then I suspect we could see a strong yearend rally that goes well into the early part of 2014 and at that time I expect the HUI to be back close to all time highs. This is what I see happening technically on the charts and hopefully the fundamentals will allow this to play out over the coming year and a half; of course this is based on normal market activity and no market manipulations. This is the strategy we have been planning for TDV Golden Trader subscriber and how to play this new uptrend that could be emerging over the next year.

If you enjoyed reading this article and are interested in protecting your wealth with precious metals, you can receive our free blog by visiting TDV Golden Trader. Also learn how you can purchase and protect your gold holdings by getting a copy of our special report Getting Your Gold out of Dodge or protecting the stock investments you currently own with Bullet Proof Shares.

© 2012 Copyright Vin Maru- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Vin Maru Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.