“Gold From The ATM” In Turkey As Gold Deposits Surge In Turkish Banks

Commodities / Gold and Silver 2012 Nov 26, 2012 - 06:46 AM GMTBy: GoldCore

Today’s AM fix was USD 1,747.25, EUR 1,347.56, and GBP 1,090.87 per ounce.

Today’s AM fix was USD 1,747.25, EUR 1,347.56, and GBP 1,090.87 per ounce.

Friday’s AM fix was USD 1,734.75, EUR 1,345.39, and GBP 1,088.37 per ounce.

Silver is trading at $34.12/oz, €26.43/oz and £21.40/oz. Platinum is trading at $1,616.00/oz, palladium at $660.50/oz and rhodium at $1,060/oz.

Gold rose $21.80 or 1.26% in New York on Friday and closed at $1,751.20. Silver hit a high of $34.16 and finished with a gain of 2.19%. Gold was up 2.28% for the week and silver soared 5.61% for the week.

Gold edged down on a Monday as speculators took their profits as prices rallied on thin volumes on Friday to their highest in a month on technical buying. A strong fall in the greenback triggered rapid gains in commodities and options-related buying on Friday.

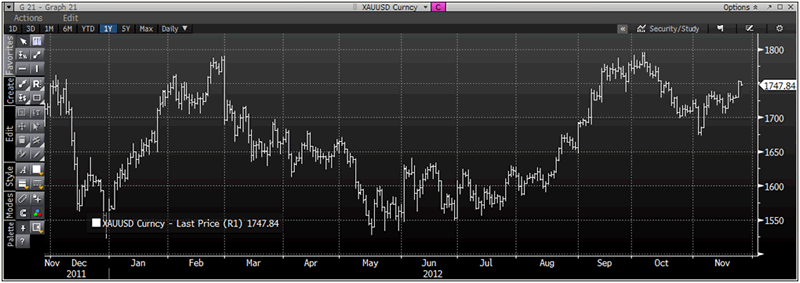

XAU/USD 1 Year – (Bloomberg)

Tonight US Congress will meet to attempt to devise a plan to avert the US fiscal cliff which will throw the US into a spiral of tax hikes and budgetary cuts that will lead the US economy deeper into a recession this January.

Another short term ‘resolution’ will almost certainly be achieved which will allow the US to keep spending like a broke drunken sailor and which will again store up far greater fiscal and monetary problems. The scale of these deep rooted structural challenges is so great that they are likely to affect the US sooner rather than later.

The euro racked up a seven month high against the yen and is holding near a one month high against the US dollar as the meetings amongst Greek creditors continue and hope to reach an outcome today.

Greece’s goal is reducing the 190% debt to GDP ratio to a more manageable 120% in eight to ten years. The dilemma is that the IMF and eurozone finance ministers want to cease payments until a new deal is agreed because they have no guarantee that the financing won’t continue indefinitely.

Can Greek debt become manageable without creditors writing off some of the loans? France and Italy would vote to reduce interest repayments on already granted loans while other countries like Germany would not.

A consensus was reached when German central bank governor Jens Weidmann suggested that Greece could "earn" a reduction in debt it owes to euro zone governments in a few years if it diligently implements all the agreed reforms. The European Commission also supports this view.

Global investment demand for gold remains robust with the amount in exchange-traded products backed by the metal rising 0.1% to 2,606.3 metric tons.

Meanwhile reports of the death of the Indian gold buyer have again been greatly exaggerated as India's net gold import for domestic consumption is likely to be about 800 tonnes this year following a pick-up in demand during the festive season, according to the World Gold Council (WGC).

Last year, the net import for domestic consumption was 969 tonnes. This is a significant fall but not surprising considering the sharply rising price. It shows that the Indian cultural attachment to gold will continue and India may be becoming acclimatised to higher gold prices.

This week US economic data for Tuesday include Durable Orders, the Case-Shiller 20-city Index, Consumer Confidence, and the FHFA Housing Price Index. On Wednesday, New Home Sales and the Fed’s Beige Book are published. On Thursday, Initial Jobless Claims, GDP, and Pending Home Sales can be viewed. Friday’s data is Personal Income and Spending, Core PCE Prices, and Chicago PMI.

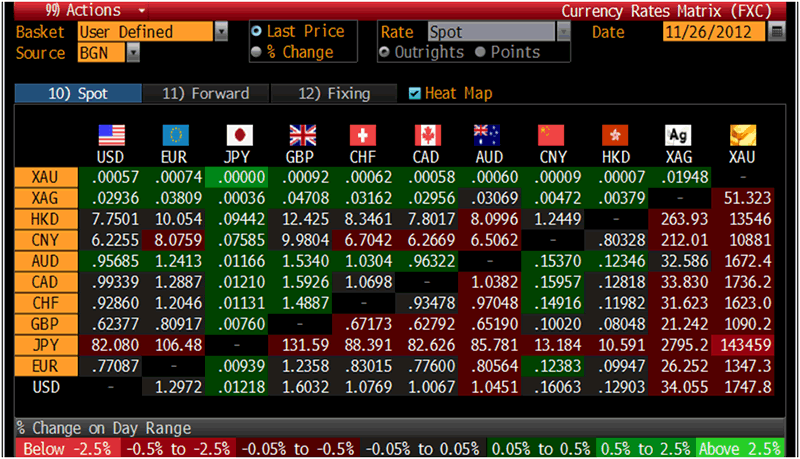

Cross Currency Table – (Bloomberg)

Gold deposits in Turkey have grown from 3.1 billion liras to 16 billion liras in the past year, Bloomberg reported on news reported in the daily Turkish newspaper Aksam which cited Denizbank AS gold banking group manager Cem Turgut Gelgor.

According to the Turkish bank Denizbank, one of the largest in Turkey, it collected 1.5 tons of gold in 7 months.

Deposits have increased from 500 kg to over 6 tons or over 192,000 ounces (worth some €260 million) over an unspecified period.

Kuveyt Turk Katilim Bankasi AS has added 3.8 tons of gold, Aksam quotes Kuveyt Turk product development group manager Mustafa Dereci as saying. Dereci said that Kuveyt Turk is providing new products such as “gold from the ATM.”

The World Gold Council estimates that there are around 5,000 tons of gold remaining outside the financial system, gold which the Turkish people have prudently accumulated over the years as a store of wealth to protect from currency depreciation and debasement.

Gold jewellery producer and wholesaler Karakas Atlantis Kiymetli Madenler AS is “working to bring unregistered gold into the system,” Chairman Kamil Karakas says in e-mailed statement today reported on by Bloomberg.

The gold wholesaler is meeting regularly with jewelers and banks in effort to draw unregistered gold assets into financial system.

Separately Turkey is aiming to position itself as a leading player in the gold jewellery and bullion industry by also becoming one of the leading gold and precious metal refining countries in the world.

Turkey is at a level to compete with international gold refining centers like Germany and Switzerland, Istanbul Gold Exchange deputy chairman Osman Sarac said today according to Dunya newspaper.

Turkey imports scrap gold mostly from Germany and the United Arab Emirates, the gold is turned into standard bullion coins and bars in Turkish refineries and exported.

Turkey imported 114.8 tons of gold by Nov. 14 this year, of which 46.6 tons was scrap, according to Istanbul Gold Exchange data.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.