Closer Look at Gold's Potential 'Cup and Handle' Formation

Commodities / Gold and Silver 2012 Nov 19, 2012 - 12:20 PM GMTBy: Jesse

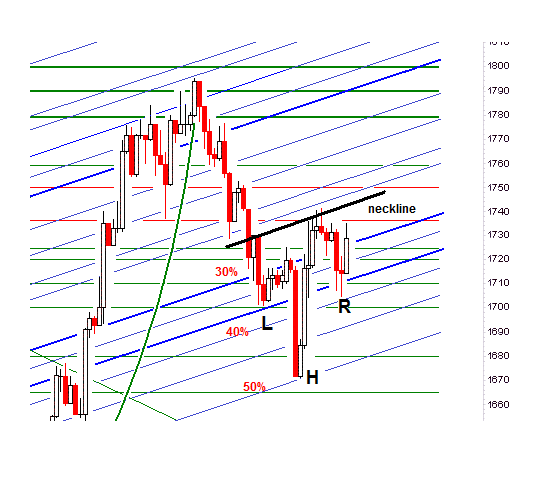

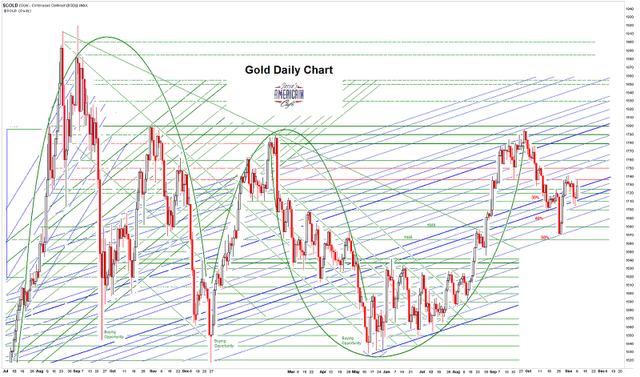

There is an inverse head and shoulder formation within the developing handle of the cup and handle formation.

There is an inverse head and shoulder formation within the developing handle of the cup and handle formation.

The inverse H&S pattern measures to 1810 as a minimum objective. That is also the point at which the handle would be at a breakout to validate the entire cup and handle formation.

I would expect gold to break out and run to that point, with resistance heavier around 1790-1810. There may be some time to actually break out, as the shorts will attempt to hold a strong line there and at the next major objective at 2100 or so, which is the first objective of the cup and handle.

In a major liquidity event, all bets are off of course, as everything gets sold, and some extraordinary deals may be had for the longer term investor, what we call 'buying opportunities' on the charts.

For those who are not comfortable with trading, establishing a strong long term position is the best strategy in a bull market. Some do both, hold a long term core position that is never touched, and also use a smaller amount of capital to 'trade around' the intermediate term swings and dips.

The most important thing is to never panic and lose your entire position while the bull market remains intact, because it is very difficult for most people to summon the will to buy back in. I have seen many who sold out, and who have never gotten back in because they kept waiting for some extreme 'bottom' that never arrives.

They often fall into 'trading their egos' with paper trades on chat boards, seeking company in their misery of having been right, and then losing their way. Their bitterness is best to be avoided since it weakens and distracts.

A wise trader rarely seeks to obtain 'the bottom' or 'the top.' This is a mug's game. An experienced trader waits to find the true trend, and not exhaust their account in pursuit of trading perfection, 'secret knowledge,' pride and 'followers.' The truth is what it is, and it reveals itself to us in its own time.

We are now in a period of 'hysteria' when the unworthy will be blinded by their own pride, and will thrash about in fear and loathing. Lies will abound and the love of many people will grow cold.

When in doubt, look to see if a person's words are crafted in love and caring, or in pride and contempt. This is not certain, of course, since nothing human is without error, but it is a way to avoid the most common of deceptions. Self-deception is the most dangerous, and the cure for that is humility. I have learned that lesson, many times alas.

Always look for that rarest of qualities, genuine love of others, because the great deceivers have none but for themselves.

There will come a time to sell, but I do not think that we are there yet. Is the economic crisis over? Has the financial system been reformed? Is the debt well founded and under strong management? Is there transparency that appeals to our 'common sense?' Is the global currency regime well-ordered and robust? These are some of the signs that we will look for in seeking to find the next plateau.

By Jesse

http://jessescrossroadscafe.blogspot.com

Welcome to Jesse's Café Américain - These are personal observations about the economy and the markets. In plewis

roviding information, we hope this allows you to make your own decisions in an informed manner, even if it is from learning by our mistakes, which are many.

© 2012 Copyright Jesse's Café Américain - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.