Commerzbank Forecasts New Record Euro Gold Price By Year End

Commodities / Gold and Silver 2012 Nov 19, 2012 - 07:53 AM GMTBy: GoldCore

Today’s AM fix was USD 1,723.25, EUR 1,349.66, and GBP 1,083.67 per ounce.

Today’s AM fix was USD 1,723.25, EUR 1,349.66, and GBP 1,083.67 per ounce.

Friday’s AM fix was USD 1,710.00, EUR 1,342.76, and GBP 1,077.91 per ounce.

Silver is trading at $32.70/oz, €25.72/oz and £20.65/oz. Platinum is trading at $1,567.50/oz, palladium at $633.30/oz and rhodium at $1,080/oz.

Gold fell $2.10 or 1.10% in New York on Friday and closed at $1,711.90. Silver fell to a low of $32.057 and finished with a loss of 1.01%.

Gold rose on Monday as the dollar fell and oil prices rose as the Israeli Palestinian conflict escalates and the US fiscal cliff discussions support the yellow metal.

Gold ETF funds climbed to a record high of 75.421 million ounces on November 16thshowing how institutional demand for the ETF remains robust as ever.

US Commodities Futures Trading Commission said that speculators increased long bets in US gold bullion ending the week of November 13th. US silver contracts also rose from the prior week.

US economic highlights today include US Existing Home Sales for Oct & NAHB Housing Market Index (1500 GMT). Tuesday’s data are Housing Starts and Building Permits, and on Wednesday Initial Jobless Claims, Michigan Sentiment, and Leading Economic Indicators.

Commerzbank AG released research that said gold is set to rally to break through the “psychological” resistance of $1,786 or 1,400 euros.

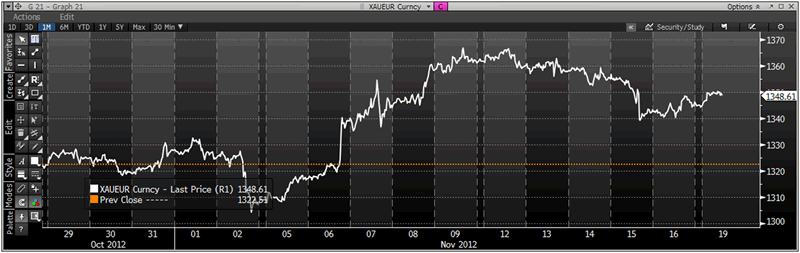

XAU/EUR 1 Month – (Bloomberg)

The yellow metal soared 4.9% in euros in one week from the 11 week low set November 2nd and has since fallen 1.3%. The rebound from the November dip means prices should recover to reach the all-time euro high set last month, before rising to the point-and-figure target at 1,395 euros, said the bank’s research. Point and figure charts estimate trends in prices without showing time.

Gold may then reach a Fibonacci level of about 1,421, the 61.8% extension of the May-to-October rally, projected from the November low, Commerzbank wrote in its report on November 13th which was picked up by Bloomberg. Fibonacci analysis is based on the theory that prices climb or drop by certain percentages after reaching a high or low.

“What we are seeing is a correction lower, nothing more,” Axel Rudolph, a technical analyst at Commerzbank in London, said by e-mail Nov. 16, referring to the drop since November 9th. Rudolph remains bullish as long as prices hold above the November low at about 1,303 euros. Technical analysts study charts of trading patterns and prices to predict changes in a security, commodity, currency or index.

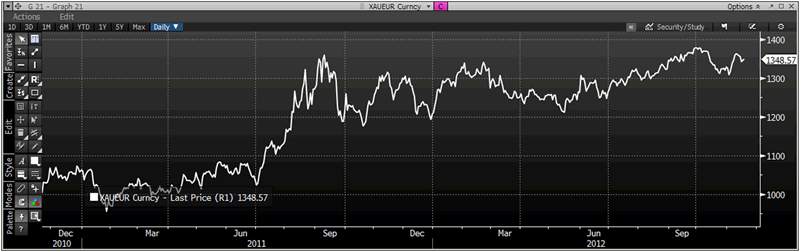

XAU/EUR 2 Year – (Bloomberg)

Bullion in dollars is heading for a 12th consecutive annual gain as central banks from the US, Europe and Asia utilized quantitative easing to protect fragile financial and economic systems. Gold reached new records in Swiss francs, rupees and rand since September, a year after setting a high in dollars.

Gold’s significant consolidation of the last 15 months between €1,200 and €1,400 has been very healthy and sets the market up for strong gains again in the coming months.

Interestingly, when gold broke above the resistance at €1,100/oz seen in 2010 and 2011, it quickly rose to a new record high of nearly €1,400/oz. This was a gain of over 27% in just over 2 months.

Once resistance of €1,400/oz is broken we could see similar price gains and a 25% increase from these levels would result in gold at over €1,750/oz.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.