U.S. Labour Force BLS Participation Rate Projections Charting Errors

Economics / Employment Oct 15, 2012 - 07:25 AM GMTBy: Mike_Shedlock

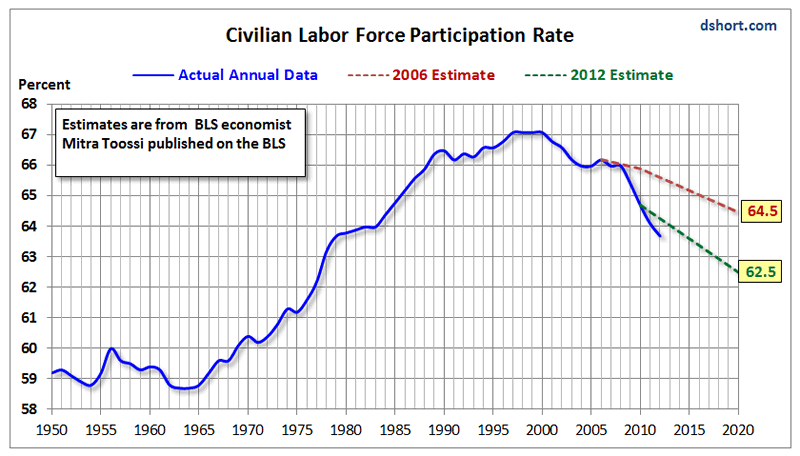

The following graph plots labor force participation rates by BLS economist Mitra Toossi in November 2006 with new projections for the participation rate as of January 2012:

The following graph plots labor force participation rates by BLS economist Mitra Toossi in November 2006 with new projections for the participation rate as of January 2012:

Chart Data

Mitra Toossi in November 2006: A new look at long-term labor force projections to 2050

Mitra Toossi in January 2012: Labor force projections to 2020: a more slowly growing workforce

I asked Doug Short at Advisor Perspectives to plot the difference as a follow-up to my post About That "Expected" Drop In Participation Rate.

As you can see, the participation rate is plunging even faster than the recent January 2012 projections.

| Date | Value | 2006 Estimate |

|---|---|---|

| 1/1/2006 | 66.2 | 66.2 |

| 1/1/2007 | 66.0 | 66.1 |

| 1/1/2008 | 66.0 | 66.1 |

| 1/1/2009 | 65.4 | 66.0 |

| 1/1/2010 | 64.7 | 65.9 |

| 1/1/2011 | 64.1 | 65.8 |

| 1/1/2012 | 63.7 | 65.6 |

76% of Decline In Participation Rate Since 2006 Was Unexpected

The current participation rate is 63.7. In 2006, Toossi estimated the participation rate would be 65.6, a drop of .6 percentage points from 66.2. Instead, the participation rate fell by 2.5 percentage points.

Mathematically, 76% of the decline since 2006 was "unexpected" (1.9 of 2.5).

56% of Decline Since 2000 Was Unexpected

In 2000 the participation rate was 67.1. Using that favorable starting point, Toossi expected a total drop of 1.5 percentage points. The actual drop was 3.4 percentage points.

Even by the most favorable method, only 44% of the total decline in the participation rate was expected by the BLS.

Thus, no matter how one slices or dices the data, there is no realistic way to say the decline in the participation rate was expected. Not even half of it was, by the most liberal interpretation.

Regardless, now that we have BLS projections for labor force and participation rates, there are some interesting things we can do with those projections (such as figure out how many jobs it will take to reduce the unemployment rate to 5%, hold it steady, etc.)

I hope to have an interactive graph of that idea shortly.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2012 Mike Shedlock, All Rights Reserved.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.