QE3, SPR Release and Gasoline Prices

Commodities / Crude Oil Sep 27, 2012 - 03:28 AM GMTBy: EconMatters

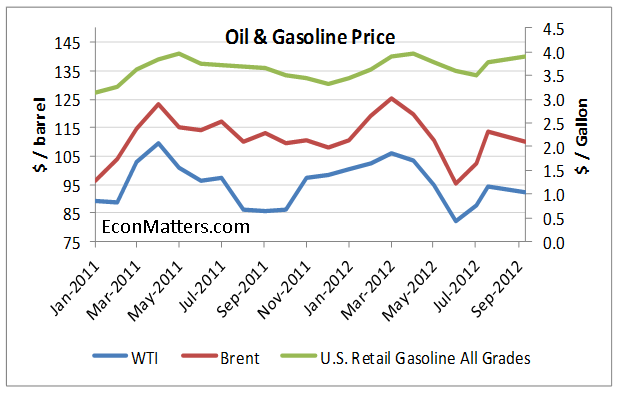

With crude oil accounting for 65% of the price of gasoline, there's typically a high correlation between the price of oil and gasoline. However, there's been a disconnect between the two for the most part of this year. The main reason for the disconnect is the divergence of supply market fundamentals.

With crude oil accounting for 65% of the price of gasoline, there's typically a high correlation between the price of oil and gasoline. However, there's been a disconnect between the two for the most part of this year. The main reason for the disconnect is the divergence of supply market fundamentals.

Chart data source: US EIA

As the two charts below illustrate, while domestic crude oil supply remains way above the 5-year average, the gasoline supply is actually a lot tighter by historical norm, primarily due to some domestic unscheduled refinery accidents/outages, refinery closures in the Atlantic Basin leading to an increase in gasoline exports from the US.

To make things worse, on top of the already tight domestic gasoline supply, Fed picked a nice “political” timing to launch its infinite QE3. On September 13, 2012, Helicopter Ben has pledged an open-ended $40 billion a month MBS bond purchasing program, while holding the fed funds rate near zero at least through mid-2015.

The likely eventual consequence of this unlimited money printing operation – Dollar debase and the artificial price inflation of almost everything from commodities (including Oil and Gasoline) to stocks, and consumers end up paying the price.

For now, Brent dropped 4.5% last week, while U.S. WTI crude also lost 6.2%. Oil has been held down primarily by slowing global economic growth and the dismal demand outlook.

Meanwhile, the national average gasoline price also saw a nickel a gallon decrease from a week ago, according to the AAA automobile club. Nevertheless, the current national average --$3.805 a gallon for regular gasoline -- is still 8% above a year ago level and fairly close to where they were in 2008 before the financial crisis.

Gasoline has always been a hot topic during any election year. In fact, interesting exchanges have already taken place between White House, G7, and the IEA regarding a potential SPR (strategic petroleum reserves), with a clear divide between the oil industry experts (IEA) and politicians (White House, G7, et al). IEA’s position was that oil markets were currently well supplied and there was no reason to release SPR.

With Obama’s re-election on the line, and to counter the potential effect of artificial price inflation by QE3, an SPR release attempting to bring down oil and gasoline prices would be the politically correct move by the White House.

As predicted in our previous post, domestic crude oil inventory could continue to build even from the current high level. From a global supply standpoint, Saudi Arabia reportedly has pledged to pump around 10 million barrels of crude a day in a bid to cut the price of Brent crude to around $100/bbl. These factors should further weaken the justification of an IEA-coordinated oil release like the one from last year.

However, even if there’s an SPR release--unilateral by the U.S. or not--it will unlikely have as significant impact as people might expect on gasoline prices due to the diverging supply fundamentals discussed here. Think it could be a good idea to consider a strategic gasoline reserve as well?

By EconMatters

The theory of quantum mechanics and Einstein’s theory of relativity (E=mc2) have taught us that matter (yin) and energy (yang) are inter-related and interdependent. This interconnectness of all things is the essense of the concept “yin-yang”, and Einstein’s fundamental equation: matter equals energy. The same theories may be applied to equities and commodity markets.

All things within the markets and macro-economy undergo constant change and transformation, and everything is interconnected. That’s why here at Economic Forecasts & Opinions, we focus on identifying the fundamental theories of cause and effect in the markets to help you achieve a great continuum of portfolio yin-yang equilibrium.

That's why, with a team of analysts, we at EconMatters focus on identifying the fundamental theories of cause and effect in the financial markets that matters to your portfolio.

© 2012 Copyright EconMatters - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.