The Great Graphite Supply Shakeup

Commodities / Metals & Mining Sep 26, 2012 - 02:07 AM GMT Investors who remember the lithium boom (and bust) a few years ago may be twice shy to enter a space with big upside potential tied to electric vehicles. But the parallels between graphite and lithium are superficial, insists Simon Moores, analyst with Industrial Minerals. Graphite, unlike lithium, supplies layers of demand, with reliable end-users in the steel industry. Meanwhile, China's production lull is making way for market entrants. In this exclusive interview with The Critical Metals Report, Moores profiles graphite miners around the world competing for the market's attention.

Investors who remember the lithium boom (and bust) a few years ago may be twice shy to enter a space with big upside potential tied to electric vehicles. But the parallels between graphite and lithium are superficial, insists Simon Moores, analyst with Industrial Minerals. Graphite, unlike lithium, supplies layers of demand, with reliable end-users in the steel industry. Meanwhile, China's production lull is making way for market entrants. In this exclusive interview with The Critical Metals Report, Moores profiles graphite miners around the world competing for the market's attention.

The Critical Metals Report: The graphite market is one commodity sector that is getting increased interest over the past year or two. What's the best way to participate in this market?

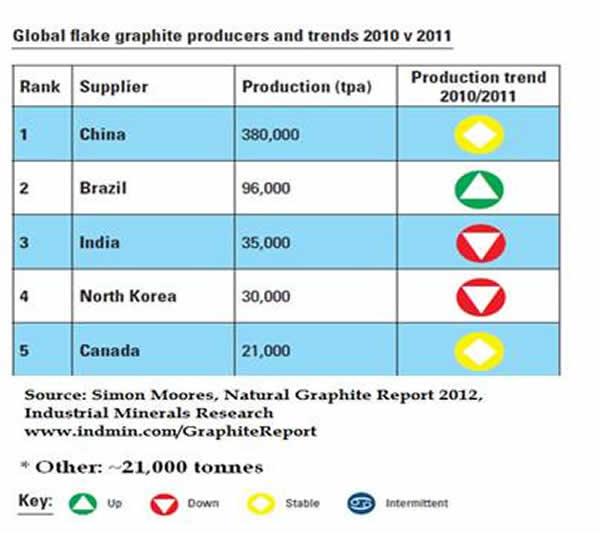

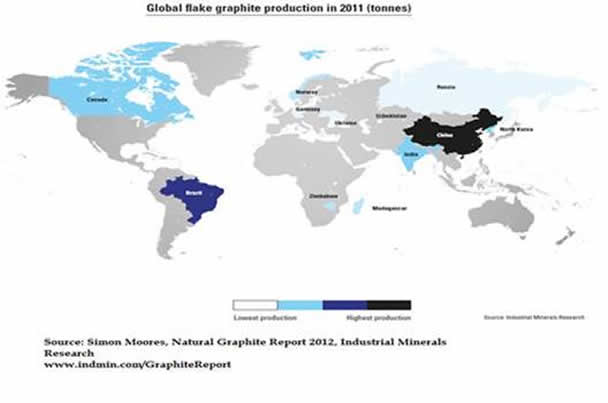

Simon Moores: Because the graphite market is dominated by Chinese companies and private companies, juniors are really the only way to participate directly in this market. The non-Chinese major players, like TIMCAL Graphite & Carbon in Canada, are part of larger minerals companies. So when you invest in Imerys (NK:PA), which is the parent company, you're not investing in an exclusively graphite-focused company. Graphite is only a tiny percentage of its business. Many of the other major non-Chinese companies in the market are private, such as Nacional de Grafite in Brazil, as well as a number of smaller private producers in Zimbabwe, Austria, Russia and Norway. Ultimately, your most direct option is to go for the juniors.

TCMR: Who are the main graphite consumers?

SM: Graphite's current demand is mainly driven by industrial uses, metal production being the most important. Steel is the main driver of the graphite market on two fronts. First is in refractories, which is the biggest end use. Refractories are used to line huge steel kilns and as protective linings in bricks. Graphite is also used as an additive, in what is called a "recarburizer." Steel demand has historically driven the graphite market, accounting for approximately 39% of the market.

TCMR: In your research, you talk about "layers of demand," where there is a base of traditional industrial uses for graphite with new uses incrementally increasing total demand. Tell us more about that.

SM: For the past 100 years, you've seen layers of industrial demand, first for graphite as a lubricant. Then in a post Second World War construction boom, its use as a refractory mineral and recarburizer really took hold. This growth was tied directly to steel in the economies of the U.S. and Western Europe in the 1950s, 1960s and 1970s. In the 1980s and 1990s, industrial demand stepped up in Asia's boom, first in Japan and South Korea, and more recently in China.

Beginning in the 1990s, graphite's diversity was truly seen when you saw batteries taking off as the world required more mobile forms of communication and entertainment with the advent of the Sony Walkman and first mobile phones. Graphite's use as the anode material of choice for all battery technologies saw a new market and fresh demand emerge—a new layer of demand.

Because graphite has so many unique uses and properties, new applications are being created all the time. Graphene is the latest "super material" and the only real chance of commercializing this is by physically stripping flake graphite.

The difference with graphite demand is that one technology does not supersede another. Its incremental demand just builds. On average, graphite demand steps up every 15–20 years, and if the past is anything to go by, we are on the cusp of a new era.

TCMR: What specific new applications could make waves in the graphite market?

SM: The market you're looking at is lithium-ion batteries and anything that uses them. Graphite is already used in all current battery technologies as an anode material. But as we speak, lithium-ion battery technology has the potential to go through the roof, especially with electric vehicle manufacturing. There are a lot of unknowns as to how that market will develop, but it has the potential to grow quickly and in large volumes. Electric vehicles should be the catalyst for explosive growth in graphite demand.

TCMR: With the Chinese the dominant supplier and consumer in the market, is there geopolitical risk associated with Chinese behavior—perhaps something similar to what happened in the rare earth markets?

SM: Definitely. China dictates everything in the current graphite market. In the late 1980s and early 1990s, China came into the market in a big way as an exporter. Producers there undercut many suppliers around the world, and as a result newer, higher-cost mines in Canada and Western Europe were forced to close only a few years after opening. Many of the non-Chinese miners were destroyed overnight. Fast forward two decades, and China has held the potential to restrict graphite exports that the world has come to rely on. The Chinese government doesn't like many things in mining, namely low-value exports and polluting plants and mines. Much of the Chinese graphite sector optimizes these points. It is a much older industry than many realize, and because the space dominated by small- to medium-sized companies' it's hard to regulate. Plus, the wastage of resources is significant on most graphite mines.

China still has some world-leading companies that supply high-quality graphite. But the majority of supply comes from the smaller producers to provincial markets. The concern is that China may not be a reliable and low-cost supplier indefinitely, and that's why you're seeing lots of junior exploration today.

TCMR: What happened to the mines in the 1980s and 1990s? Have any of them been restarted? Are those brownfield exploration targets in some cases?

SM: The only new mine that survived, strangely enough, is TIMCAL in Quebec, Canada, which is one of the biggest outside of China. It produces 20 thousand tons (Kt) per year. It really only survived because Imerys, a major French minerals company, bought it because it is a big buyer of graphite. The company then was known as Stratmin. Otherwise, the rest of producers stopped abruptly. Examples include the Uley mine in Australia, which Mega Graphite Inc. (MEGA) is currently developing, Ontario Graphite Ltd.'s (private) Kearney mine and Flinders Resources' Kringel mine, formerly known as Woxna.

TCMR: Speaking of Australia, do you want to give us an update on Strategic Energy Resources Ltd. (SER:ASX)?

SM: It's gone a bit quiet. It was making good progress at the start of this year, but I think there have been some changes at the corporate level of MEGA Graphite. The last six months have been very quiet for many resource companies, however. Most likely, it is probably a case of the commodity cycle taking a break.

TCMR: Do you see any catalysts coming up for MEGA/Strategic Energy Resources?

SM: Funding is key. The Uley mine has a stockpile of approximately 10 Kt of graphite that the company says is almost ready to go. It needs to be reprocessed however, and building a functioning processing plant is most of the battle. Luckily, getting tonnages to the market is easier for MEGA/Strategic than a lot of companies—the key is getting it accepted by end-users that have been using the same supplier for many years.

Consistency is key for Mega and for all new graphite suppliers. Graphite is a specialist product, not a commodity. Buyers want a consistent product with impurities they can manage. Knowing what to expect when you buy graphite is more important than producing the highest quality and purity.

Ultimately, with the global financial situation the way it is, funding is critical for all these companies. It's been difficult.

TCMR: Are the capital costs high for graphite processing?

SM: It depends what you want to do. Basic processing methods include crushing, grinding, flotation and sizing. Flotation is the most expensive part, depending on the desired level of purity. It's much more expensive to get the float graphite—known as graphite concentrate—above approximately 97%. Generally, it is not worth it because the market accepts 94–97% as the highest quality. Now, if you want to then take it up to the high-purity material that's used in batteries (in the 98–99.99% range), you have to build a new plant. It's a whole different ballgame of mechanical processing and chemical purification. You have to do it all over again with special techniques, which is very expensive. For that reason, companies will shy away from the top end of that market.

TCMR: Would some deposits be more suited for the higher purity or is it really just value-added processing that gets them there?

SM: Ultimately, it's value added. Obviously, the quality of the graphite in the ground significantly aids that, but it comes down to processing. It always has. That's why Western graphite companies like Superior Graphite Co., Asbury Carbons (private) and Graphit Kropfmühl AG (GKR:FKFT) in Germany were able to continue regardless of China's production dominance. These companies are the biggest graphite companies outside of China, but they are not miners. They can add value with proprietary technology and processes.

TCMR: Should investors who want graphite exposure look for the junior mines that are going to feed the supply chain?

SM: Yes, exactly. Look for high-quality deposits in the ground. Look for large-flake or high-grade content but, ultimately, focus on how a company plans to process it and get it to the market. That will make or break a graphite company, and that's why most of the deposits that are listed won't even get beyond a few drill holes. The serious ones will have a business plan from mine to market.

TCMR: Lithium is a recent example of a speculative boom followed by a bust. Is there an analogy between what happened with lithium a couple of years ago and where graphite is today?

SM: Superficially, the investment thesis for both lithium and graphite starts with batteries for electric cars as a catalyst for growth. But when you look a little deeper, there are large differences in the two markets. The fundamental supply structure is very different. Most current graphite comes from a single country—China. With lithium, that's not the case. Supply is fairly stable across several countries—Chile, Argentina, and Australia. The lithium market is dominated by big companies that have supply locked and secured and prices under control. There's very little room for new producers to come in.

But the largest graphite companies aren't graphite miners. The dominant supplier is China, with just under 80% of the market. If the largest companies aren't miners and China is supplying the lion's share of graphite concentrate, even though there are no significant restrictions, there is going to be room for some new suppliers outside of China. Compared to the lithium market, the graphite market has much more opportunity.

You also have to look at the trend in the biggest buyers of graphite, the world's third-largest refractory company—Brazil's Magnesita Refratarios—is seeking to be 100% self sufficient in graphite supply and intends to open a new mine in the next 18 months. This drive stems from its distrust of China. The company has gone on record as saying graphite is not a stable supply chain and reliance on China must be reduced. While I think the graphite supply chain is stable today, I agree with that sentiment going forward.

And that is just the supply side. There is healthy demand for graphite across the many industrial uses as well as the "layers" of demand from evolving technology.

TCMR: Where might some of those new suppliers come from? Are there any geographies that look especially good—maybe Africa or Canada?

SM: Canada has a chance to develop new graphite mines. There are some good projects there. However, there is a unique challenge that Canadian companies face—the companies are bogged down with the stock market, putting out results, trying to woo investors and raise funds. That's the game in Canada, and I understand that. But it concerns me in that it is a distraction to exploration and mine building.

However, if you look outside of Canada, exploration is nowhere near the same level.

But there are a couple of countries that have good potential to become graphite producers. Mozambique is a former producer with some very high-quality graphite resources. The German company Graphit Kropfmühl is active there. Out of the whole of Africa, Madagascar is the country with the brightest prospects. Energizer Resources Inc. (EGZ:TSX.V; ENZR:OTCBB) is the leading company in Madagascar.

TCMR: What are its prospects?

SM: Energizer Resources is about to announce a huge resource in Madagascar. The deposit is at surface, so the mining side is easy. The company is working out the infrastructure, power and water, which will be the project's lynch pin—it's planning to team up with much larger projects nearby, including a big coal mine. The deposit will be more than 100 million tons (Mt), which will be the largest proven resource in the world.

TCMR: Larger than the Chinese deposits?

SM: With the Chinese deposits, it's very difficult to know the size. The Chinese companies don't need to drill to satisfy NI 43-101 or JORC requirements. Instead, they do some sensible drilling and then mine—they explore when they need to.

TCMR: Does Energizer have some catalysts coming up?

SM: The announcement of the resource financing should be the next catalyst. It's already in the leading pack of development companies, but when it comes out with a huge resource on the order of 100 Mt, that will strike a chord with the Canadian investors, who are focused on grade and size.

TCMR: Are there any other Canadian companies that you like?

SM: Northern Graphite Corporation (NGC:TSX.V; NGPHF:OTCQX) and the Bissett Creek project is a very strong prospect. It's the most advanced graphite project out of all of them. Northern has just completed its bankable feasibility study, beating everyone else to the punch. The efforts that the company took in the 2000s, when graphite wasn't on the radar, are now paying off.

Focus Graphite Inc. (FMS:TSX.V) and its Lac Knife project is also a strong prospect. The company is also looking at the technology and processing side more than other companies, which is a positive sign.

One other interesting project in Canada is by Zenyatta Ventures Ltd. (ZEN: TSX.V). I like it because it's vein graphite, and this is the only known deposit of its type outside of Sri Lanka. Vein graphite is much cheaper and easier to mine and process. This could offer the company a significant cost advantage. In Sri Lanka, the graphite is found in lumps that they can hand mine, crush and size. Its purity is so high that no flotation is needed. Skipping this part can save a lot of time and money. The company hasn't promoted the deposit heavily—certainly not as a vein deposit, which it really should. The project marketing has been about trying to compete based on resource size and grade with the rest of the juniors. But it should focus on the purity of graphite in the ground.

TCMR: Do you have any final advice for investors either getting into the space or looking for a little bit of nerve to stay in the space?

SM: My perspective is from the market side. Predicting winners or giving advice on public graphite juniors is a hazardous game because it's not always about the deposit's merits or company's plan. That said, here is how I would analyze the graphite sector as a whole if someone was looking to invest: Look at the fundamentals of the industry. I understand how investors get scared when commodities fall across the board. Money comes out of the market and the investors wait for the moment to go back in. But keep your eyes on fundamental supply and demand dynamics over the next five years. Where is the supply coming from, and is that supply source reliable?

As far as demand, we need to look at what will power the next "industrial revolution" in the West. I believe this is technology and sustainable living/cleaner energy. Investors can see for themselves that batteries are increasing in all walks of life. Five years ago, I carried one mobile phone, but now, when on business, I carry two mobiles, a laptop and an iPad—all battery powered. It makes complete sense that transport is next—and that will be the game changer.

And we must not forget that heavy industry will continue—maybe not at the boom rates of the 2000s, but we will always need buildings and vehicles. This will ensure that refractories remains a major market for graphite.

TCMR: Thanks for your time, it has been interesting and informative.

SM: Very happy to give my thoughts.

Simon Moores has been reporting on, researching and analyzing the non-metallic minerals sector since 2006, when he joined London-based publishing and research house Industrial Minerals. He has specialist knowledge in critical and strategic minerals including graphite, lithium, rare earths and titanium. He led the research and publication of the market study, The Natural Graphite Report 2012: Data, Analysis and Forecast for the Next Five Years. One of the study's key findings was China's dominance of production was significantly higher than previously thought, accounting for 78% of supply. He has chaired conferences and given keynote presentations around the world. He has also been interviewed by international press including London's The Times regarding Chinese control on world graphite production, and The New York Times with regard to rare earths after breaking the story that China blocked exports to Japan in 2009.

Want to read more exclusive Critical Metals Report articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent interviews with industry analysts and commentators and learn more about critical metals companies, visit our Critical Metals Report page.

DISCLOSURE:

1) Alec Gimurtu of The Critical Metals Report conducted this interview. He personally and/or his family own shares of the following companies mentioned in this interview: None.

2) The following companies mentioned in this article are sponsors of The Critical Metals Report: Strategic Energy Resources Ltd., Northern Graphite Corp. and Energizer Resources Inc. Interviews are edited for clarity.

3) Simon Moores: I personally and/or my family own shares of the following companies mentioned in this interview: None. I personally and/or my family are paid by the following companies mentioned in this interview: None. I was not paid by Streetwise Reports for participating in this interview.

Streetwise - The Gold Report is Copyright © 2012 by Streetwise Reports LLC. All rights are reserved. Streetwise Reports LLC hereby grants an unrestricted license to use or disseminate this copyrighted material (i) only in whole (and always including this disclaimer), but (ii) never in part.

The Gold Report does not render general or specific investment advice and does not endorse or recommend the business, products, services or securities of any industry or company mentioned in this report.

From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles on the site, may have a long or short position in securities mentioned and may make purchases and/or sales of those securities in the open market or otherwise.

Streetwise Reports LLC does not guarantee the accuracy or thoroughness of the information reported.

Streetwise Reports LLC receives a fee from companies that are listed on the home page in the In This Issue section. Their sponsor pages may be considered advertising for the purposes of 18 U.S.C. 1734.

Participating companies provide the logos used in The Gold Report. These logos are trademarks and are the property of the individual companies.

101 Second St., Suite 110

Petaluma, CA 94952

Tel.: (707) 981-8999

Fax: (707) 981-8998

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.