Central Banks Attack on Aggregate Demand

Economics / Economic Stimulus Sep 07, 2012 - 12:58 PM GMTBy: Andy_Sutton

We are now at least somewhat clear on one central bank’s plans for the economies under control. Save a significant reversal, the European Central Bank (ECB) is going to ‘nuclear’. That is to say the bank will engage on a program of bond buying in the Eurozone that is unlimited in scope, duration, and magnitude. A thoroughly anemic August jobs report has now applied even more pressure on the USFed to act when it meets next week. While the markets will undoubtedly cheer any indication of further monetization or a formal announcement itself with a flurry of high-frequency trading activity, this is nothing for Mr. and Mrs. Main Street to get too excited about. Why? The idea that money is being pumped into the economy sounds pretty good especially if some of it lands in your lap, right? Once again, things are not always what they seem and this is another prime example.

We are now at least somewhat clear on one central bank’s plans for the economies under control. Save a significant reversal, the European Central Bank (ECB) is going to ‘nuclear’. That is to say the bank will engage on a program of bond buying in the Eurozone that is unlimited in scope, duration, and magnitude. A thoroughly anemic August jobs report has now applied even more pressure on the USFed to act when it meets next week. While the markets will undoubtedly cheer any indication of further monetization or a formal announcement itself with a flurry of high-frequency trading activity, this is nothing for Mr. and Mrs. Main Street to get too excited about. Why? The idea that money is being pumped into the economy sounds pretty good especially if some of it lands in your lap, right? Once again, things are not always what they seem and this is another prime example.

In truth, the federal reserve on this side of the Atlantic, much like its ECB counterpart on the other side, has been waging an all-out war on aggregate demand. But that is counter-intuitive, isn’t it? Doesn’t the fed want to increase demand to promote economic growth? Not exactly.

Hiding Inflation is Becoming Harder and Harder

One of the pillars that any fiat currency rests upon is confidence. The economic agents that use such a currency have to believe several things, one of which is that the currency is an adequate store of wealth. Now in America we’ve been propagandized pretty heavily over the past 5 or 6 decades into believing that inflation is necessary for economic growth (a myth) and that deflation is an evil force that must be defeated at all costs.

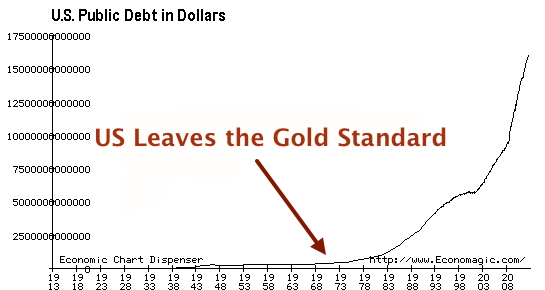

There are a couple of problems with this approach and the first is that there are several mathematical functions that describe the various aspects of a fiat monetary cycle, most of these are parabolic in nature. For quite a long time everything is ok, but when things start going bad, they go bad quickly and with increasing magnitude. The US Public debt is a great example of such a situation.

Looking at the above chart, there was a very long period of time where the public debt wasn’t an issue at all. For those who don’t think a gold standard creates monetary discipline, notice the arrow that indicates when America officially departed the gold standard in 1971. Note also what happened with the public debt after that. Continuing, it is obvious that the doublings of the public debt are on the increase while the time to do so is on the decrease. The lame position that the debt is the responsibility of one political group or another is nonsense, and is merely intended to create confusion among the voting proletariat. The debt has steadily been increasing. And don’t forget that this is only the cost of the mistakes of the past. The mistakes of the present and future aren’t even accounted for on this chart, yet they’re still there.

Managing this type of situation requires a lot of inflation and ever-increasing amounts of it. Now we’re back to the confidence factor again. If the CPI is going up by 10% a year, people are going to quickly lose faith in the currency. Obviously the current calculation of the CPI is a joke, but the larger the disconnect between the government numbers and reality, the more people are falling off the wagon and losing confidence in the currency anyway. The continuation of a fiat regime cannot be perpetuated with misinformation and propaganda alone. Enter aggregate demand.

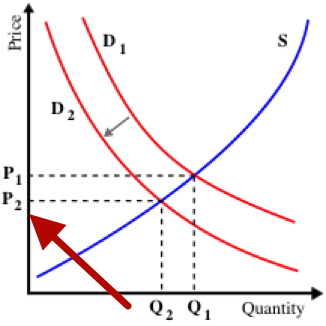

Let’s assume that the chart above represents the supply and demand for the total of all goods produced (or imported) into the United States. The Supply is represented by S, and the initial demand is represented by D1. A contraction in aggregate demand in economic terms is little more than a demand shift to the left as portrayed above by D2. Note that this shift results in both less products purchased (Q2) and at a lower overall price level (P2). While this tactic cannot totally cover up a massive inflation, every little bit helps and might buy the monetary regime a few extra months or even years.

A series of more extreme economic dislocations called price controls was used in the early 1970s and was an abysmal failure. The attack on aggregate demand will, in the end, fail to adequately cover up the massive amounts of inflation being released into the system by global monetary authorities; however, it will certainly delay the inevitable. This is a classic example of kicking the can down the road.

How is this attack accomplished? This is where it becomes intriguing, to say the least. Certainly the above depiction of the demand shift is rather clear, but how does one go about accomplishing this shift in an economic system where its actors are accustomed to an ever-increasing standard of living and the subsequent consumption activities associated with such a mentality? We’ll look at two methods being used over the past couple of years.

Allow the Actors to Choke on Debt

There have most assuredly been thousands if not tens of thousands of articles written regarding the inequality of bailing out banks and multinational corporations at the expense of Main Street. These instances have been so obscene in several cases that employees of one large bank were issued weapons and carrying permits because of the fear of backlash.

Meanwhile, back at the ranch, the average American is choking on their debt. Whether it is in the form of an underwater mortgage, student loans, credit card debt, car payments, or some other type of debt, it seems that almost everyone has some.

There is a point certain at which even the most foolhardy of economic actors will decide that they just can’t take on any more debt. They’ve already used Visa to pay off the MasterCard and are now coming to the realization that they just can’t do it anymore – or at least not like they were before.

Let’s say for a minute that the big Wall Street megabanks would have been allowed to fail and that all the money wasted allowing banks to continue their existence had been used to wipe out the debts of Main Street. The inflation created would still be the same. However, with 300 million Americans relieved of their debt, the shackles on consumption would have been removed. Understand I am not advocating the bailout of folks who made poor financial decisions, but am using this merely as an illustration. People certainly would have felt a lot better about continuing to increase consumption if their debts were gone, much in the same way banks had no problems continuing their risky behavior once the American taxpayer was put on the hook for the consequences of that risky behavior.

This is also why the government announced that there would be no more cash stimulus payments directly to the public after the 2010 checks were sent. The people used the money to pay off debts instead of spending it. The government didn’t mind the quick bump in consumption, but improving the balance sheets of the public (which as said before would have stimulated demand moving forward) was not on the list. While the idea of giving money to people is kind of contradictory to what is being presented here, remember it was like firing a water pistol at a forest fire in terms of its total effect and 2010 was a pretty important election cycle. Never put it past ANY government to think of its own survival before that of its constituents.

Make-Work Jobs Erode Confidence

When the stimulus plans were announced, it was decided that America’s infrastructure needed an overhaul, which was and is certainly true. Our bridges and roads desperately needed attention. So the government embraced a ‘New Deal’ mentality and decided to borrow what ended up being several trillion dollars to send armies of workers in helmets out across the country and fix the bridges and roads. This activity is still going on today.

There are a couple of problems with this approach, however. The first is that there is no savings account from which to draw the funds to pay for all of this. The money had to be borrowed either from foreigners, or the federal reserve, which is really the same thing. The money was spent on these infrastructure projects, but the projects have no way of creating cash flows with which to pay for themselves unless the roads, etc. were tolled, which would just pull money from other areas of the economy anyway. The second problem is that as the projects are completed, the workers are furloughed because there isn’t enough other work to keep them on a gang. I have talked to numerous construction workers who have essentially had their pay cut because they work 2 weeks then are off a week and other such arrangements. They remain employed, but they’re not making nearly as much as they were before.

Also, when you hear about the fact that roughly half of the jobs that are being ‘created’ pay $13/hour or less, it becomes apparent that the public’s confidence is being eroded slowly but surely. Despite all types of reporting methodology shenanigans, people are waking up to the reality that we’re just muddling along, waiting for the other shoe to drop.

Instead, consider what would have happened had the government spent the stimulus money on factories to employ American workers producing products that we would consume domestically, thereby reducing our reliance on foreigners. I realize that there are many outstanding issues surrounding this type of a move, but just look at it from a confidence standpoint. Factories pay for themselves, and then create profit, capital, and investment that can be allocated to freeing up other areas of the economy.

Despite some of the headwind associated with taking this approach such as trade restrictions and agreements as well as China’s nuclear option regarding our consumption of their products and their willingness to hold onto our bonds, this type of a maneuver would have acted as a light at the end of the tunnel.

A Possible Secondary Motive

There is a potential second motive for the attack on aggregate demand and it is a strategic one. Back in 2010, Duane Chandler and I talked on our Spin Cycle podcast about the idea that governments and central banks would act in concert on a global level to throttle economies due to the realization that the world had passed the point of peak oil (or peak cheap oil at a minimum) and were simply trying to position the well-connected, who still have possession of reserves, to have pricing power in the coming era of dwindling crude oil production.

Nothing has really happened to refute this potential second motive since we did that series of broadcasts over two years ago. Oil prices have fluctuated for sure, but demand growth has gone negative, especially here in the US, and we’re still nowhere near close to our pre-recession consumption levels seen in 2006.

There are those who may believe this is the primary objective behind the attack on aggregate demand and that hiding inflation is just a side benefit. Time will tell. What is important for the average American to take from this piece is that you’re on your own. The government is unwilling (and largely unable) to help. American austerity is not far off and even a quick glimpse across the Atlantic will show that it can be very unpleasant. The time to embrace austerity at a personal level is now, not when it is foisted upon us by a desperate political establishment.

By Andy Sutton

http://www.my2centsonline.com

Andy Sutton holds a MBA with Honors in Economics from Moravian College and is a member of Omicron Delta Epsilon International Honor Society in Economics. His firm, Sutton & Associates, LLC currently provides financial planning services to a growing book of clients using a conservative approach aimed at accumulating high quality, income producing assets while providing protection against a falling dollar. For more information visit www.suttonfinance.net

Andy Sutton Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.