Expect Stronger U.S. Dollar, More Volatility Heading into September

Currencies / US Dollar Aug 23, 2012 - 09:40 AM GMTBy: Elliot_H_Gue

Recent economic data unambiguously shows that the European Union (EU) has slipped into a recession, with little sign that a turnaround will occur soon. In fact, with most European countries facing additional rounds of fiscal austerity, the EU economy is poised to get worse before it eventually finds its footing.

Recent economic data unambiguously shows that the European Union (EU) has slipped into a recession, with little sign that a turnaround will occur soon. In fact, with most European countries facing additional rounds of fiscal austerity, the EU economy is poised to get worse before it eventually finds its footing.

The EU sovereign credit markets have improved slightly in recent weeks but remain under pressure. The European Central Bank (ECB) has talked down yields on Spanish and Italian government bonds by hinting that it will begin buying the debt of these two countries to force down yields at some point this year. However, the size and form of ECB support still remains unclear and borrowing costs remain elevated for both nations.

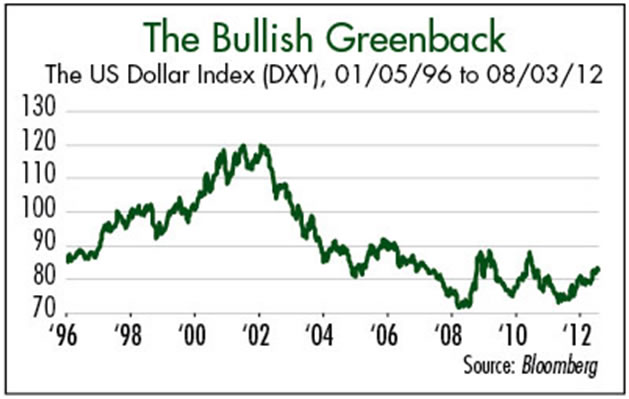

Amid all this gloom, at least one ray of light shines for Europe: a steadily weakening currency (see “The Bullish Greenback”).

The US Dollar Index (DSY) is a measure of the dollar’s value against a basket of foreign currencies; the euro is far and away the largest component of the index. Some investors may remember that soon after the euro first became a paper currency in 2001, it traded for less than $0.80 per euro.

Of course, for most of the decade that followed, the dollar steadily weakened, pushing the Dollar Index from its 2001 highs near 120 to recent lows in the low 70s. Protecting portfolios from the weak dollar became a popular investment theme.

The dollar now appears to have bottomed and is moving upwards, largely because of the continual weakening of the euro. This trend gives rise to numerous investment implications.

First, investors should not be overly concerned that a strengthening greenback will push down commodity prices. To be sure, a weak currency does tend to push up prices because most globally traded commodities are priced in dollars. However, the media typically overplay the significance of currency movements in commodity markets and underplay the role of supply and demand.

Case in point: crude oil and grain markets have been strong in recent weeks, even as the dollar has strengthened.

Second, the decline in the euro appears to reflect a growing belief that the ECB will further loosen monetary conditions and purchase troubled sovereign debt, to stimulate European economies and dampen borrowing costs for Italy and Spain.

Europe will benefit from the weaker currency because it makes the region’s exports cheaper in foreign currency terms. In addition, a weaker euro makes the region a more attractive destination for tourists and European companies become more interesting as takeover targets by foreign buyers. Expect more downside out of the euro.

Meanwhile, across the pond in the US, second-quarter earnings season is nearly over and continues to look lackluster. While close to three-quarters of companies in the S&P 500 have beaten consensus earnings estimates for the quarter, just under 60 percent have disappointed expectations for revenues.

Companies can boost their earnings per share using multiple levers, including cost-cutting or buying back stock. These measures can be positive for stocks but are limited—ultimately companies need actual growth in sales to power their businesses.

A slump in revenues reflects the slowdown in the global economy this year and forward guidance from many major companies suggests that the weakness continues. I continue to expect short-term weakness in stocks, as the notoriously volatile September-October trading environment approaches.

For more on Linn Energy and two other picks, check out my free report, The Top Growth Stocks To Own Now.

Mr. Gue is also editor of The Energy Strategist, helping subscribers profit from oil and gas as well as leading-edge technologies like LNG, CNG, natural gas liquids and uranium stocks.

He has worked and lived in Europe for five years, where he completed a Master’s degree in Finance from the University of London, the highest-rated program in that field in the U.K. He also received his Bachelor’s of Science in Economics and Management degree from the University of London, graduating among the top 3 percent of his class. Mr. Gue was the first American student to ever complete a full degree at that business school.

© 2012 Copyright Elliott H. Gue - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Elliott H. Gue Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.